Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

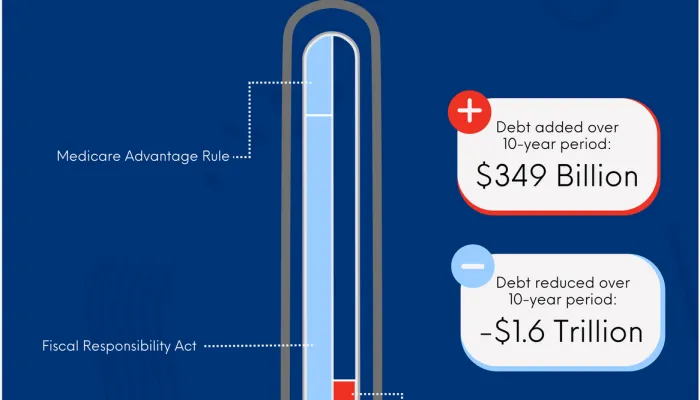

Introducing the CRFB Debt Thermometer

Fiscal policy has profound consequences on the economic health and national security of the country. Yet little is done to track the effects of...

2023 Revenue Plunge Confirms 2022 Surge Was a Fluke

After surging to 19.3 percent of Gross Domestic Product (GDP) in Fiscal Year (FY) 2022, revenue in 2023 plummeted to 16.5 percent of GDP, according to...

2023 Interest Costs Reach $659 Billion

According to final data from the Treasury Department, net interest costs reached $659 billion (2.5 percent of GDP) in fiscal year 2023, a $184 billion...

What’s in the White House’s $106 Billion Supplemental Request?

The Biden Administration submitted to Congress an emergency supplemental funding request last week totaling nearly $106 billion. The request includes...

IRS Estimates a $625 Billion Tax Gap

The Internal Revenue Service (IRS) recently released a new analysis of the “ tax gap” – the difference between taxes owed to the federal government...

2023 Deficit Hit $1.7 Trillion

The U.S. Department of the Treasury released its final Monthly Treasury Statement for Fiscal Year (FY) 2023, showing a $1.7 trillion deficit for the...

House Site-Neutral Policy Should Save More

House leadership recently introduced the Lower Costs, More Transparency Act, that unifies multiple legislative proposals from the Energy and Commerce...

IRS Rescission Would Worsen Deficits

Rescinding $25 billion of IRS funding would result in the loss of $49 billion in revenue and increase deficits by $24 billion over ten years...

NDAA Includes $150 Billion Deficit-Increasing Program

The Senate-passed National Defense Authorization Act for Fiscal Year (FY) 2024 (NDAA) would increase the deficit by $153 billion over a decade...

Interest Rates Remain Near Record Highs

Interest rates continue to surge, hitting new post-financial crisis records. Over the past month, yields on the ten-year Treasury note have risen more...

Tim Scott's Proposal for Cutting Spending, Cutting Government, and Cutting Taxes

GOP presidential candidate and Senator Tim Scott (R-SC) recently unveiled a comprehensive economic plan, titled “ Build. Don’t Borrow." The plan is...

Revised Projections from CBO, OMB, & Fed Give Hope of “Soft Landing”

Recent economic forecasts from the Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the Federal Reserve (Fed) present...