Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

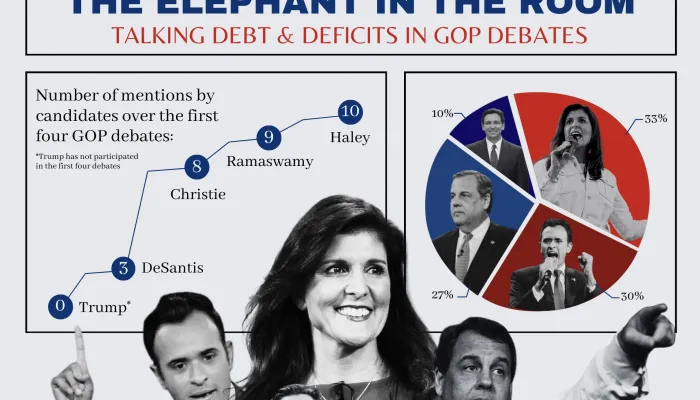

Talking Debt and Deficits in the GOP Debates

In the first four Presidential primary debates, the GOP candidates have mentioned the deficit or debt a combined 35 times, with former United Nations...

Payroll Taxes Fall Short of Paying for Social Security and Medicare

In a recent New York Times opinion piece which keyed off a recent analysis from Karen Smith and Committee for a Responsible Federal Budget board...

Marc Goldwein and Chris Towner: Social Security Can’t Grow Its Way Out of Trouble

Marc Goldwein is senior vice president and senior policy director of the Committee for a Responsible Federal Budget. Chris Towner is policy director...

Lawmakers Are Mulling Up to $2.3 Trillion in Borrowing

So far, this year, lawmakers have enacted $1.3 trillion of ten-year debt reduction (see our debt thermometer) – the most since 2011. But policies...

Lower Costs, More Transparency Act Passes House

The House of Representatives passed the Lower Costs, More Transparency Act yesterday with a large bipartisan majority. Within the legislation is an...

A Breakdown of Foreign Aid Obligations

With policymakers considering supplemental appropriations for Ukraine, Israel, and other foreign policy needs, many are wondering how much of the...

Can Social Security Be Saved by Selling America’s Oil & Gas Reserves?

In a town hall hosted by Fox News, former President Donald Trump suggested that America’s fiscal problems – and specifically Social Security’s looming...

CBO Scores National Security and Border Bill at $113 Billion

The Senate will soon consider a bill combining President Biden's national security supplemental funding request with border security measures. The...

Vivek Ramaswamy's Proposal to Increase Defense Spending

Vivek Ramaswamy, businessman and current GOP presidential candidate, has proposed increasing spending on national defense to at least 4 percent of...

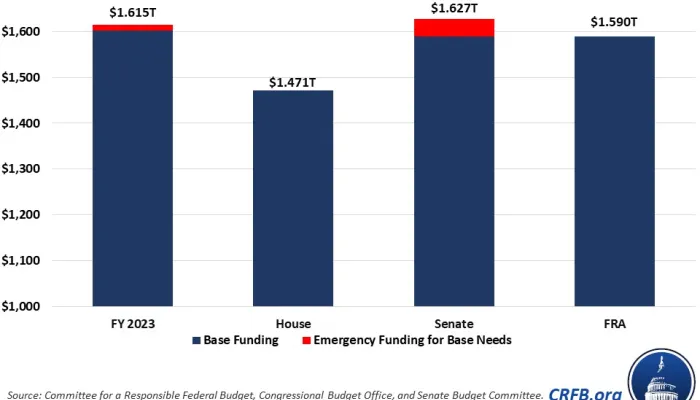

Comparing 2024 Appropriations Levels

With the passage of the second continuing resolution (CR) for Fiscal Year (FY) 2024, Congress should turn to passing full-year appropriations bills...

Five Revenue-Raising Loophole Closures Policymakers Should Consider

George Callas of Arnold Ventures, who previously served as a senior tax counsel in the U.S. House of Representatives – both for the Ways and Means...

Year-End Tax Deal Could Cost Over $800 Billion if Made Permanent

UPDATE (January 2024): We have published an updated analysis of this tax deal. You can find the updated analysis here . According to press reports...