Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

New Poll Finds Widespread Support for Creation of a Bipartisan Fiscal Commission

A recent poll released by the Peter G. Peterson Foundation shows that a strong majority of Americans are increasingly concerned with the national debt...

CBO: Social Security is Ten Years from Insolvency

The Congressional Budget Office (CBO) recently published detailed long-term projections for Social Security that project the financial outlook for the...

Event Recap: The Fiscal Outlook After the Debt Limit Deal

The bipartisan Fiscal Responsibility Act (FRA), signed into law in May, is the largest deficit reduction legislation enacted in nearly a dozen years...

Asa Hutchinson's Proposal to Reduce the Federal Civilian Workforce by 10 Percent

Republican presidential candidate Asa Hutchinson recently proposed shrinking the size of the federal civilian workforce, which we estimate could save...

CBO Releases June 2023 Long-Term Budget Outlook

The Congressional Budget Office (CBO) just released its June 2023 Long-Term Budget Outlook that projects the nation's fiscal future over the next...

Rep. Grothman Introduces Bill to Enforce FY 2026-2029 Spending Caps

Representative Glenn Grothman (R-WI) recently introduced the Enforce the Caps Act in the House, along with nearly a dozen co-sponsors. The legislation...

Maya MacGuineas on Bloomberg's "Balance of Power"

Committee president Maya MacGuineas recently joined Bloomberg's "Balance of Power" to discuss the latest Long-Term Budget Outlook from the...

Marc Goldwein: Pulling Levers to Prevent Cuts to Social Security Benefits

Marc Goldwein is senior vice president and senior policy director of the Committee for a Responsible Federal Budget. He was recently featured in a...

The Post-FRA Fiscal Outlook

The nation's fiscal outlook has improved slightly since the last Congressional Budget Office (CBO) baseline in May, thanks to the $1.5 trillion of ten...

John Kasich and Leon Panetta: The Fiscal Responsibility Act is Only a First Step Toward Truly Responsible Spending and Debt Reduction

John Kasich and Leon Panetta are former Members of Congress and a Director and Co-Chair, respectively, of the Committee for a Responsible Federal...

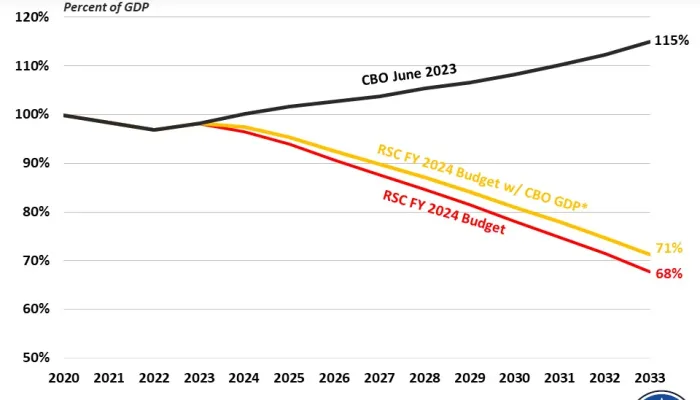

RSC Releases FY 2024 Budget Proposal

The Republican Study Committee (RSC) recently released its annual budget proposal for Fiscal Year (FY) 2024, covering the upcoming fiscal year and the...

Congress is Trying to Have it Both Ways with Telehealth

6/26/23 Update: The Congressional Budget Office released a cost estimate of the legislation allowing telehealth to be covered pre-deductible in HDHPs...