2023 Revenue Plunge Confirms 2022 Surge Was a Fluke

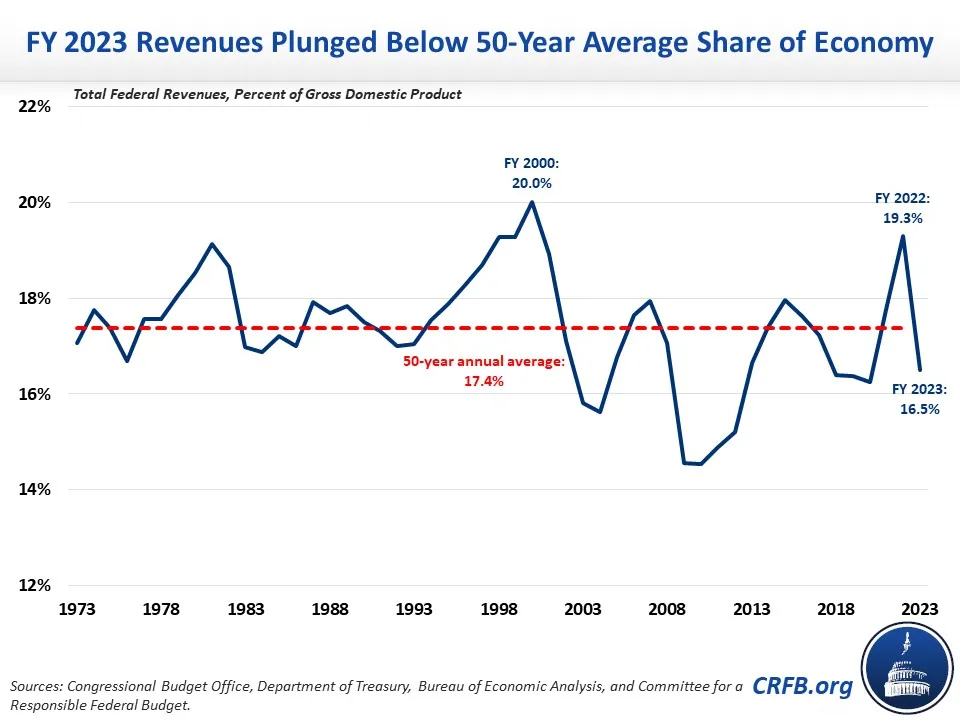

After surging to 19.3 percent of Gross Domestic Product (GDP) in Fiscal Year (FY) 2022, revenue in 2023 plummeted to 16.5 percent of GDP, according to new Treasury data. With revenue collections now below their historic average, it is clear that last year’s one-time revenue surge was a fluke.

Not only did revenue as a share of GDP fall from FY 2022 levels, but revenue also fell in real (inflation-adjusted) and even nominal terms. After reaching 19.3 percent of GDP in 2022 – one of the highest levels as a share of GDP on record – 2023 receipts plunged to just 16.5 percent of GDP. In nominal terms, revenue fell by nearly $460 billion, dropping from $4.90 trillion to $4.44 trillion. In other words, revenue fell 9 percent in nominal terms and 15 percent relative to output.

For the most part, the drop in revenue represents a normalization relative to FY 2022. As we’ve noted previously, FY 2022 revenue was bolstered by unusually high capital gains realizations in tax year 2021 attributable to ballooning asset values and a spike in taxable income as a result of surging inflation in 2021 and 2022. That revenue surge disappeared, unsurprisingly, as the stock market normalized and tax code provisions were indexed (on a lag) for inflation.

Several other factors likely reduced FY 2023 revenue levels even below their steady state. These include delayed tax payments from California and other areas of the country affected by natural disasters, the lack of Federal Reserve remittances due to the significant losses the Fed is facing in light of high interest rates, and a huge uptick in take-up for the Employee Retention Tax Credit – some or much of which may prove fraudulent.

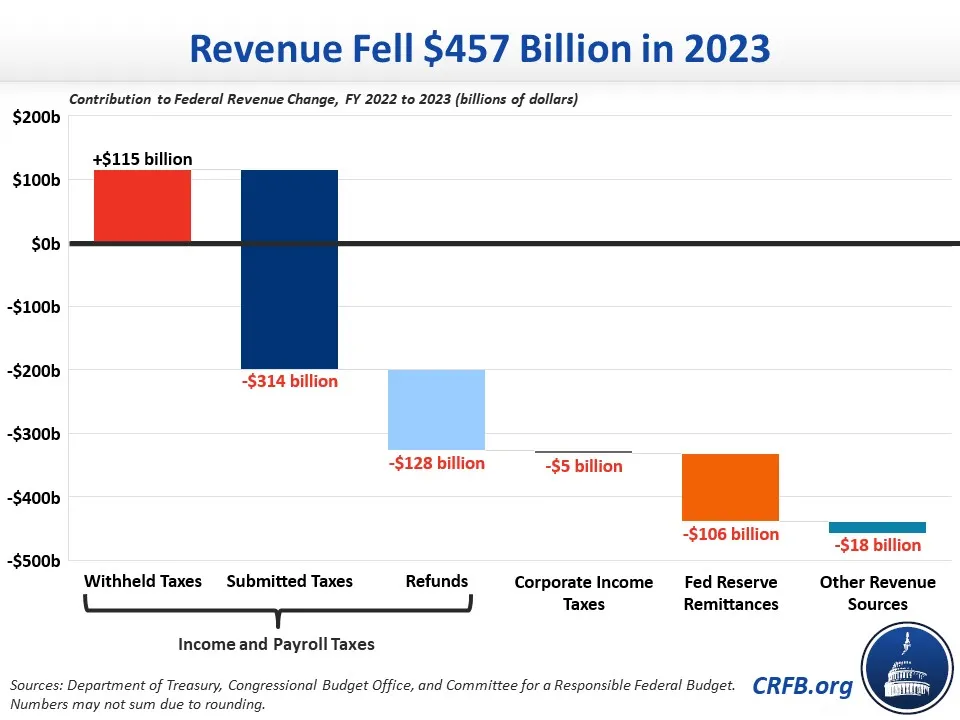

In nominal dollars, most of revenue drop in FY 2023 can be explained by lower taxes owed for tax year 2022 as compared to tax year 2021. Of the $457 billion decline in revenue between FY 2022 and 2023, over two-thirds ($314 billion) can be attributed to a collapse in submitted (nonwithheld) tax payments made in April and throughout the year. Higher income tax refunds explain another quarter ($128 billion) of the revenue loss.

Remaining revenue losses – including $106 billion in lower Federal Reserve remittances and $24 billion in lower corporate income tax revenue and other sources – were largely offset by a $115 billion increase in nominal revenue collections from withheld individual income and payroll taxes.

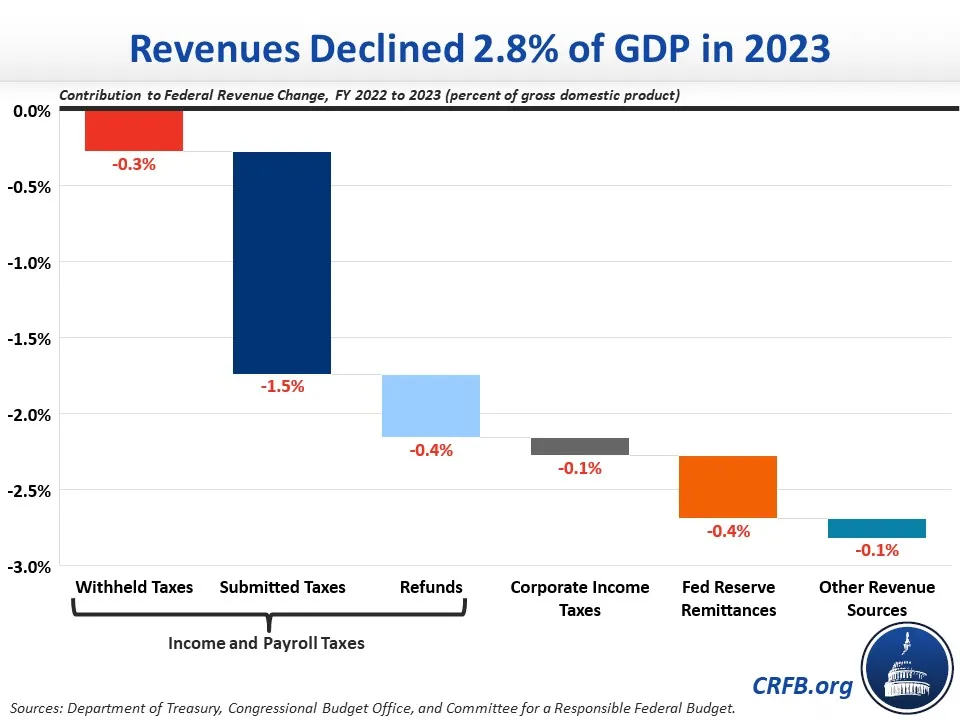

As a share of the economy, lower submitted tax payments (1.5 percent of GDP) explain half of the 2.8 percent of GDP revenue decline. The rest of the decline can be explained by higher tax refunds (0.4 percent of GDP), the lack of Federal Reserve remittances (0.4 percent of GDP), lower withheld individual income and payroll taxes (0.3 percent of GDP), lower corporate tax collections (0.1 percent of GDP), and lower collection from other revenue sources. No significant source of revenue was larger as a share of the economy in 2023 than in 2022.

Although revenue may pick up some in FY 2024, the low revenue collections last fiscal year should put to bed the idea that the economic policies put forward by either this or the previous administration led to a sustained increase in revenue collections. The fact that revenue was so low in the face of 3.6 percent unemployment over the past fiscal year and strong nominal economic growth is of particular concern.

This weak revenue collection further affirms the need for action to bring revenue and spending more closely in line. Lawmakers should consider establishing a fiscal commission to negotiate a plan to reduce deficits and put the debt on a more sustainable path.