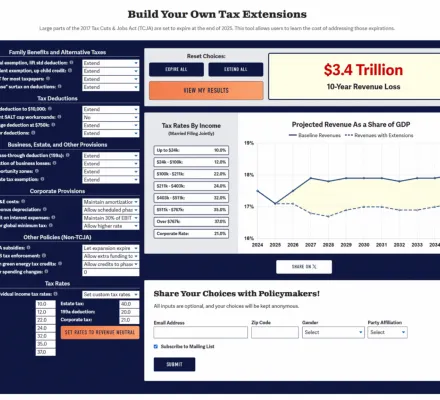

Interactives

Project Spotlight

US Budget Watch 2024

US Budget Watch 2024 is a project designed to educate the public on the fiscal impact of presidential candidates’ proposals...

Trust Fund Solutions

Some of our most important federal programs are financed through dedicated revenue sources and managed through federal trust...

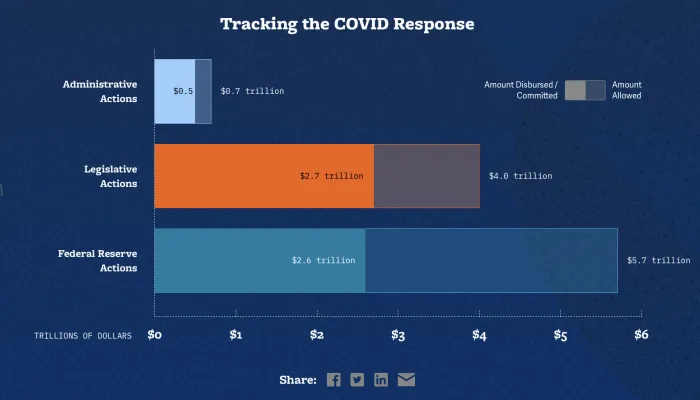

COVID Money Tracker

Explore the data and track the trillions of dollars of federal spending, tax cuts, loans, grants, and subsidies authorized...

Health Savers Initiative

The Health Savers Initiative is a collaborative project of the Committee for a Responsible Federal Budget, Arnold Ventures...

FixUS Initiative

FixUS seeks to better understand the root causes of our nation’s growing divisions and deteriorating political system, to...

Our Mission

The Committee for a Responsible Federal Budget is a nonpartisan, non-profit organization committed to educating the public on issues with significant fiscal policy impact.