Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

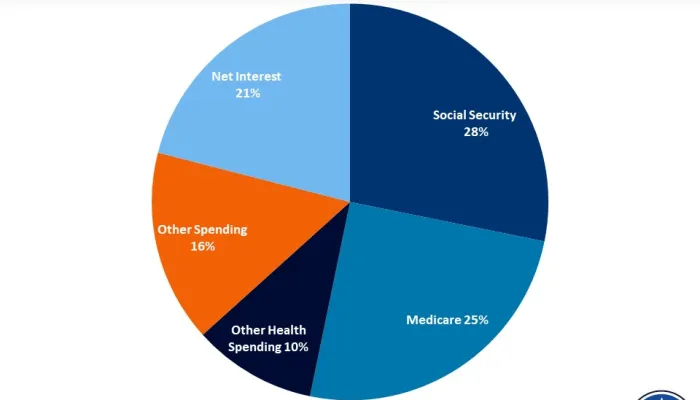

84 Percent of Spending Growth Will Come from Health, Social Security, and Interest

Budget deficits are projected to grow from $1.7 trillion in Fiscal Year (FY) 2023 to $2.6 trillion by 2034 according to the Congressional Budget...

Fiscal Commission Act: Just the FAQs

The House Budget Committee recently reported the Fiscal Commission Act (FCA), sponsored by Reps. Bill Huizenga (R-MI) and Scott Peters (D-CA) on a...

What's in the Senate-Passed National Security Supplemental?

Earlier this week, the Senate passed the National Security Act that combines aid to Ukraine and Israel with other defense-related priorities. Based on...

Maya MacGuineas Discusses CBO Projections on C-SPAN

Committee for a Responsible Federal Budget President Maya MacGuineas recently joined C-SPAN's "Washington Journal" to discuss new projections from the...

What Would It Take To Fix the Debt?

It would take about $8 trillion of ten-year savings to stabilize debt as a share of the economy and about $15 trillion to balance the budget under the...

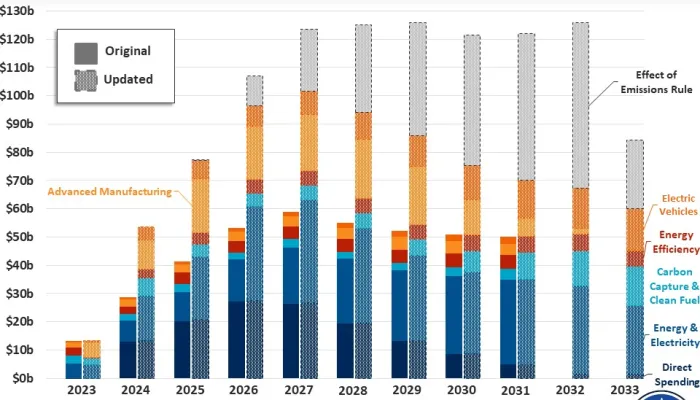

IRA Energy Provisions Cost Could Double With New Emissions Rule

Last April, the Environmental Protection Agency (EPA) proposed a new rule for stricter vehicle emissions standards starting in model year (MY) 2027...

Mike Murphy: A bipartisan fiscal commission could help lawmakers address our looming debt issues

Mike Murphy is senior vice president and chief of staff at the Committee for a Responsible Federal Budget. He recently wrote an opinion piece for The...

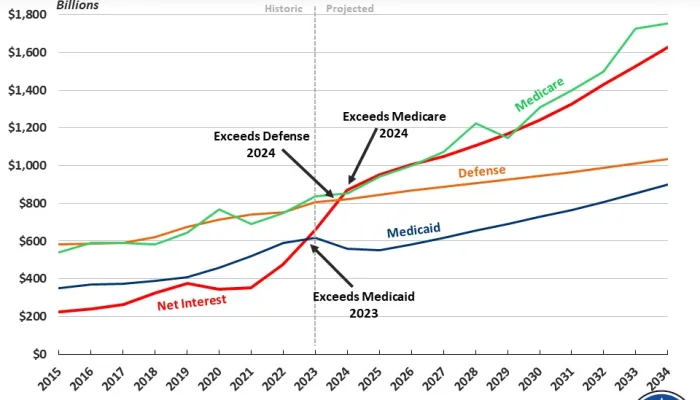

Interest Costs Will Leapfrog Medicare and Defense This Year

Interest on the debt is the fastest growing part of the budget. Net interest payments will exceed both defense and Medicare spending this year, in...

The Deficit Was $1.8 Trillion Over the Past Year

The federal budget deficit totaled $1.8 trillion over the past 12 months, up $70 billion from Fiscal Year (FY) 2023, or 4.2 percent. The 12-month...

CBO Releases February 2024 Budget and Economic Outlook

The Congressional Budget Office (CBO) just released its February 2024 Budget and Economic Outlook, its first full ten-year baseline and economic...

Senate Set to Consider $118 Billion National Security & Border Package

The Senate is set this week to consider the National Security and Supplemental Appropriations Act that combines aid to Ukraine and Israel with border...

Maya MacGuineas: Social Security is in trouble. Most candidates won’t admit it.

Maya MacGuineas is president of the Committee for a Responsible Federal Budget and head of the Campaign to Fix the Debt. She recently wrote an opinion...