Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

Upcoming Congressional Fiscal Policy Deadlines

Updated 4/8/2024: The Congressional Budget Office issued a report on Friday, April 5, estimating that sequestration will not be required for FY 2024...

Student Debt Cancellation Resources Page

Overview Student debt cancellation has gained attention in recent years as a policy proposal to address rising student debt levels in the United...

Event Recap – When the TCJA Expires: A Tax Policy Summit

On March 28, the Committee for a Responsible Federal Budget hosted When the TCJA Expires: A Tax Policy Summit, an event focusing on the large parts of...

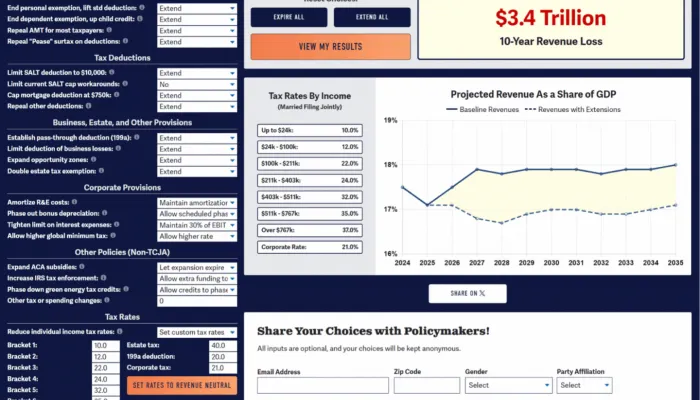

New Interactive Tool: Build Your Own Tax Extensions

With large parts of the 2017 Tax Cuts and Jobs Act (TCJA) set to expire after 2025, policymakers will soon face important choices about the future of...

Spending Cuts in the President's FY 2025 Budget

The President's Fiscal Year (FY) 2025 budget calls for $3.3 trillion of net deficit reduction through 2034, with $6.5 trillion of gross revenue and...

Maya MacGuineas on CNBC's "Squawk Box"

Committee for a Responsible Federal Budget president Maya MacGuineas recently joined CNBC's "Squawk Box" to discuss findings from the Congressional...

CBO Releases March 2024 Long-Term Budget Outlook

The Congressional Budget Office (CBO) just released its March 2024 Long-Term Budget Outlook that projects the nation's fiscal and economic future over...

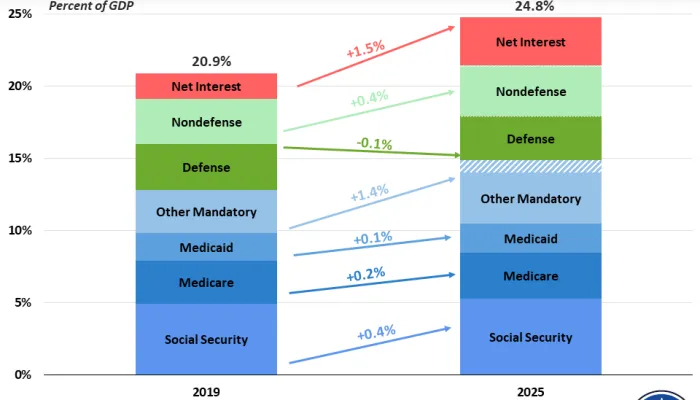

Comparing Spending Levels in the President’s 2025 Budget

President Biden proposes spending nearly $7.3 trillion in Fiscal Year (FY) 2025, or 24.8 percent of Gross Domestic Product (GDP), under his latest...

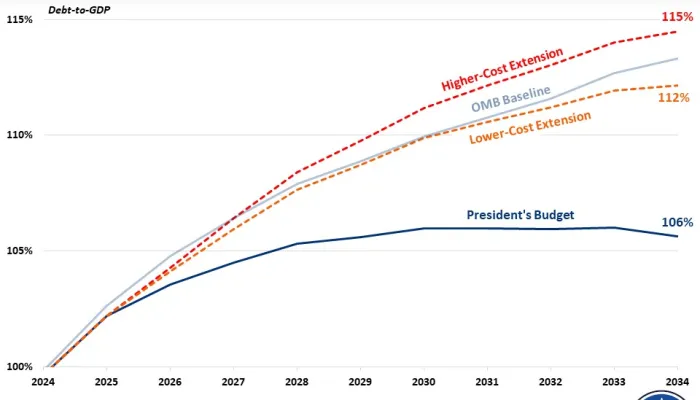

Tax Extensions Wipe Away the President’s Budget Savings

The President’s Fiscal Year (FY) 2025 budget proposal calls for $3.3 trillion of net deficit reduction through 2034. However, these savings could...

Health Care Proposals in the President’s Fiscal Year 2025 Budget

For more about these proposals, listen to Josh Gordon , CRFB’s Director of Health Policy, on the podcast: Facing the Future . The President's Fiscal...

CBO Says IRS Cuts Would Be Costly

Rescinding $20 billion of Internal Revenue Service (IRS) funding would ultimately add over $30 billion to the deficit, including $24 billion through...

An Overview of the President's FY 2025 Budget

The Biden Administration just released its Fiscal Year (FY) 2025 budget proposal, outlining some of the President's tax and spending priorities for...