Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

Maya MacGuineas: Finally, a Serious Idea to Address the National Debt

Maya MacGuineas is president of the Committee for a Responsible Federal Budget and head of the Campaign to Fix the Debt. She recently wrote an opinion...

More Deficit-Increasing Tax Cuts from the Ways & Means Committee

Tomorrow, the House Ways and Means Committee is scheduled to mark up two bills to expand Health Savings Accounts (HSAs). The bills will reduce revenue...

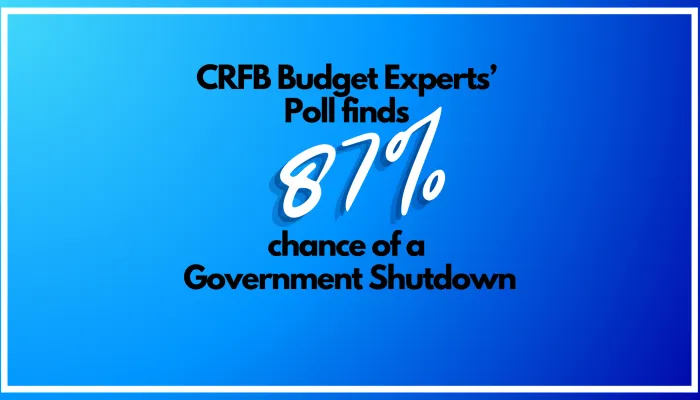

87% Chance of Shutdown, Per CRFB Budget Experts' Poll

The odds of a government shutdown, per the unscientific CRFB Budget Experts' Poll, have shot up to 87 percent (after dropping one expert's prediction...

Kent Conrad and Rob Portman: It isn’t hopeless. We can fix our debt and deficit problems.

Kent Conrad is a former senator, former Chairman of the Senate Budget Committee, and a director of the Committee for a Responsible Federal Budget. Rob...

The High Cost of Borrowing at Low Rates

Federal interest spending is on track to nearly double between 2020 and 2023 and projected to double again by 2032, due to rising interest rates and a...

An Overview of the House FY 2024 Budget Resolution

The House Budget Committee has released and marked up its Fiscal Year (FY) 2024 budget resolution, a framework that purports to put the budget on a...

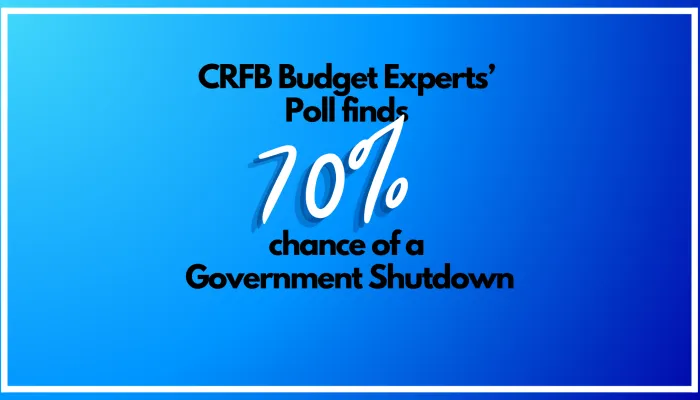

CRFB Budget Experts' Poll: 70% Chance of Shutdown

In our second round of unscientific polling of budget experts, they now place the chance of a government shutdown in October at 70 percent – up from...

2023 Budget Bash Reception: Celebrating Our Commitment to Fiscal Responsibility

On Wednesday, September 13, the Committee for a Responsible Federal Budget hosted our annual reception at the Observatory at America's Square. The...

Marc Goldwein Joins C-SPAN to Discuss U.S. Deficit and Federal Spending

Committe for a Responsible Federal Budget Senior Vice President and Senior Policy Director Marc Goldwein recently joined C-SPAN's "Washington Journal"...

Social Security Reform Can Boost Incomes, Grow the Economy

According to recent estimates from the Congressional Budget Office (CBO), restoring Social Security solvency through blunt changes could ultimately...

The Deficit Was $2.0 Trillion Over the Past Year

The federal budget deficit totaled $2.0 trillion over the past 12 months, $310 billion below last month's $2.3 trillion estimate. This reduction can...

Donald Trump’s Universal Baseline Tariff

Former President and current Republican presidential candidate Donald Trump recently suggested implementing a baseline tariff of 10 percent on all U.S...