Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

Maya MacGuineas on Bloomberg TV's "Balance of Power"

Committee president Maya MacGuineas recently joined Bloomberg's "Balance of Power" with Annmarie Hordern and Joe Mathieu to discuss the chances of a...

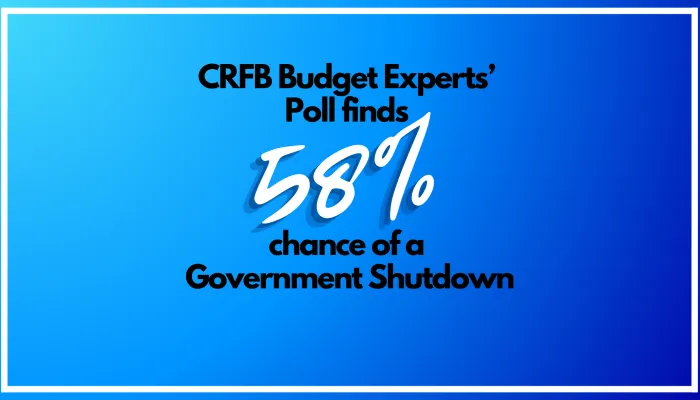

Budget Experts’ Prediction of a Government Shutdown

We expect there will be an awful lot of talk about a government shutdown in the coming weeks and months, so we decided to create a highly unscientific...

Fact-Checking the First 2024 GOP Primary Debate

In the first Republican primary debate of the 2024 presidential election cycle, candidates made a number of claims relating to fiscal policy, the...

Interest Rates Hit 16-Year Record

Interest rates are on the rise, with daily Treasury yields up in nearly every maturity since the beginning of August. This piece takes a closer look...

CBO Outlines Negative Implications of High & Rising National Debt

In its June 2023 Long-Term Budget Outlook, the Congressional Budget Office (CBO) dedicated an entire section to discussing the risks and threats of...

Senate Budget Committee Holds Hearing on Raising Revenue to Save Social Security

On July 12, the Senate Budget Committee held a hearing titled " Protecting Social Security for All: Making the Wealthy Pay Their Fair Share" to...

Donald Trump's Proposal to Use Impoundment Authority

In a video published to his campaign website on June 20, 2023, former President Donald Trump declared he would use “impoundment” authority to reduce...

White House Calls for $40 Billion Supplemental

The White House recently proposed a supplemental appropriations package to boost Fiscal Year (FY) 2024 ordinary appropriations by $40 billion above...

Tax Cut Extensions Cost Over $3.3 Trillion

Some parts of the 2017 Tax Cuts and Jobs Act (TCJA) have recently expired or changed, and large portions of the TCJA will expire by the end of...

Retirees Face a $17,400 Cut if Social Security Isn't Saved

As the 2024 presidential campaign ramps up, candidates are facing pressure to pledge not to touch Social Security. While this pledge is framed as...

The Deficit Was $2.3 Trillion Over Past Year

The federal budget deficit totaled $2.3 trillion over the past 12 months, up 65 percent from the $1.4 trillion deficit in Fiscal Year (FY) 2022 and...

Rising Debt Could Reduce Income Growth by One-Third

A high and rising national debt poses a series of risks and threats, including slower income and wage growth. A new report from the Congressional...