Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

Build Your Own Child Tax Credit – A Web-Based Version

The Child Tax Credit (CTC) has become a topic of significant debate among policymakers as they wrestle with determining its appropriate size...

Site-Neutral Legislative Proposals Gaining Traction

One of the best ways to reduce health care costs would be to move towards “ site-neutral” payments and away from the current system’s inefficient...

The Case for Raising the Social Security Retirement Age

The Committee for a Responsible Federal Budget’s Marc Goldwein recently appeared on the “Open to Debate” podcast to discuss the benefits of raising...

CBO's Alternative Long-Term Budget Projections

Though the Congressional Budget Office's (CBO) latest Long-Term Budget Outlook projects that federal debt held by the public will reach 181 percent of...

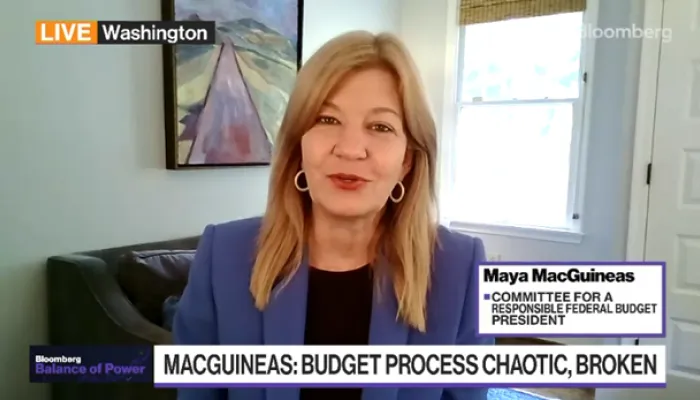

Maya MacGuineas on Bloomberg TV's "Balance of Power"

Committee president Maya MacGuineas recently joined Bloomberg Television's "Balance of Power" with Annmarie Hordern and Joe Mathieu to discuss the...

Senate Appropriations Supplemental Could Add $155 Billion to the Debt

Senate Appropriations Chair Patty Murray (D-WA) and Vice Chair Susan Collins (R-ME) announced yesterday that they would introduce add supplemental...

Restoring Trust Fund Solvency Would Reduce Long-Term Debt Growth

Restoring solvency to the major trust funds would reduce one-half to four-fifths of the projected debt-to-GDP growth over the next three decades. The...

New Evidence Suggests Even Larger Medicare Advantage Overpayments

Update 2/2/24: We have updated our estimate for MA overpayments due to new research into coding intensity and favorable selection from MedPAC . We...

Bipartisan Fiscal Forum Launched

Today marked the launch of the Bipartisan Fiscal Forum, a group of lawmakers focused on drawing attention to and finding solutions for America’s...

Mike Pence’s Proposal to Freeze Nondefense Discretionary Spending

Republican presidential candidate Mike Pence recently proposed freezing nondefense discretionary (NDD) spending, which we estimate could save between...

The Deficit Was $2.2 Trillion Over Past Year

The federal budget deficit totaled $2.2 trillion over the past 12 months, up 64 percent from the $1.4 trillion deficit in Fiscal Year (FY) 2022 and...

IRA Energy Provisions Could Cost Two-Thirds More Than Originally Estimated

At the time of its passage, the Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) estimated that the Inflation Reduction Act...