Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

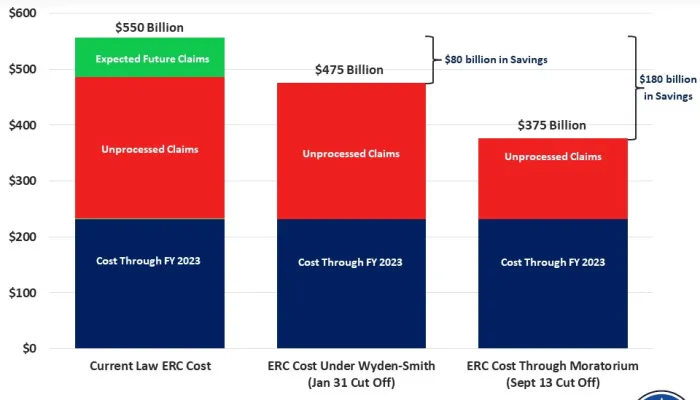

Employee Retention Credit Faces 7X Cost Overrun

The pandemic-era Employee Retention Tax Credit (ERC) was designed to help businesses retain workers during the pandemic. But after low initial uptake...

Is Life Expectancy Really Falling?

During the fifth GOP presidential primary debate, Florida Governor Ron DeSantis argued against raising the Social Security retirement age because...

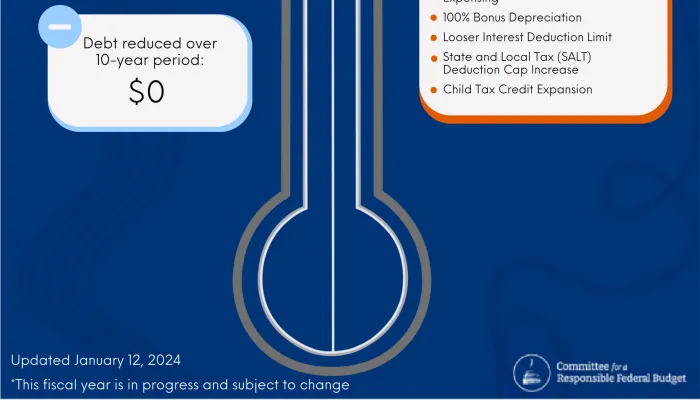

Introducing the 2024 Debt Thermometer

We are releasing the Committee for a Responsible Federal Budget’s new 2024 Debt Thermometer, along with the Debt Thermometers from 2017 through 2022...

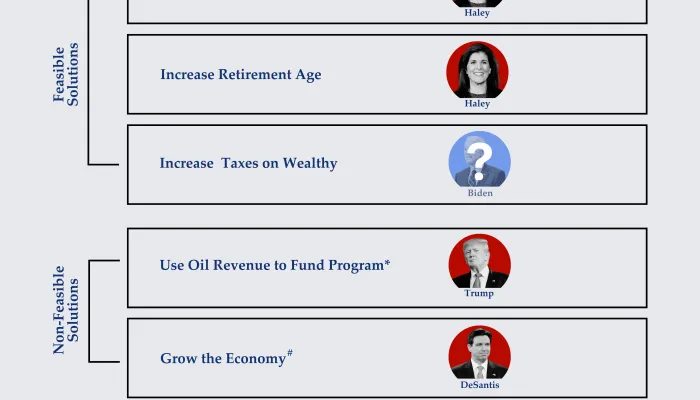

Where Do the Candidates Stand on Social Security?

In less than ten years, Social Security’s retirement trust fund will be insolvent. Under the law, this will trigger an immediate 23 percent cut in...

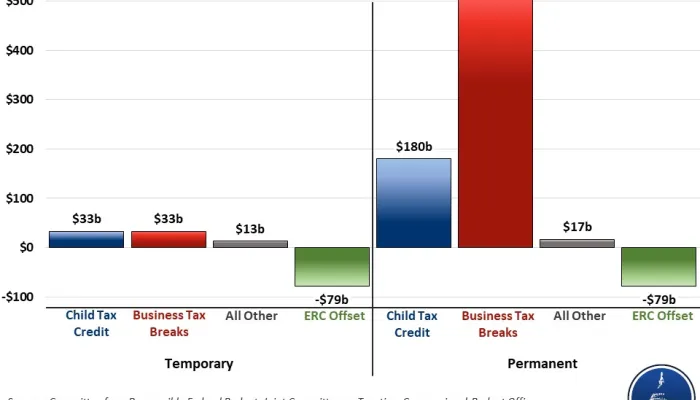

How Much Would the Wyden-Smith Tax Deal Cost?

Senate Finance Committee Chairman Ron Wyden (D-OR) and House Ways & Means Committee Chairman Jason Smith (R-MO) recently put forward a bipartisan plan...

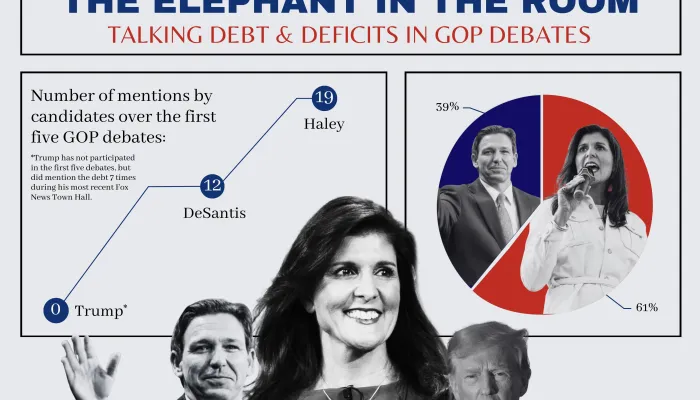

Update: Talking Debt and Deficits in the GOP Debates

In the first five Presidential GOP primary debates, the current active GOP candidates have mentioned the deficit or debt a combined 31 times, with...

The Deficit Hit $1.8 Trillion in Calendar Year 2023

The federal budget deficit totaled $1.8 trillion in calendar year (CY) 2023, up 5 percent from the fiscal year deficit of $1.7 trillion and 20 percent...

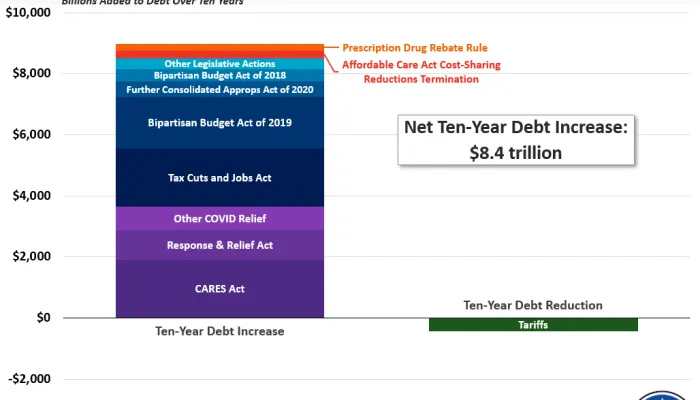

How Much Did President Trump Add to the Debt?

In the recent GOP primary presidential debate, former United Nations Ambassador Nikki Haley claimed that President Trump added $8 trillion to the...

Maya MacGuineas on Bloomberg TV's "Wall Street Week"

Committee president Maya MacGuineas recently joined "Wall Street Week" with David Westin to discuss President Joe Biden and Donald Trump's policy...

OMB & CBO Release Memos on FY 2024 Discretionary Spending Limits

The Office of Management and Budget (OMB) recently released a Frequently Asked Questions document and the Congressional Budget Office (CBO) published...

GAO Recommends Actions to Reduce Tax Gap

The Government Accountability Office (GAO) recently released revised recommendations for the Treasury Department and the Internal Revenue Service (IRS...

Top 10 Fiscal Charts of 2023

Fiscal policy was once again at the forefront of congressional debates in 2023, giving us many opportunities to write about and illustrate the...