Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

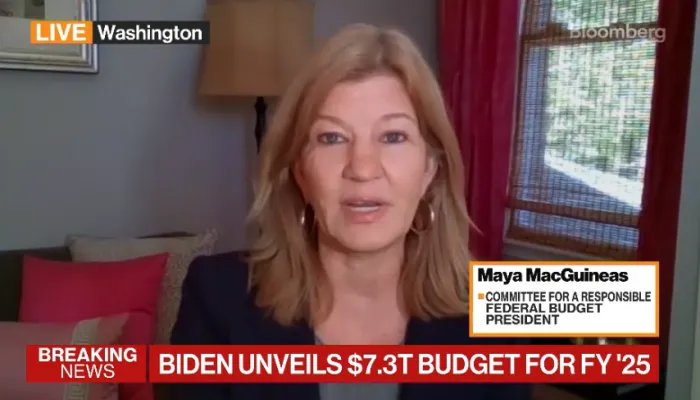

Maya MacGuineas Discusses President's Budget on "Bloomberg Markets"

Committee president Maya MacGuineas recently joined "Bloomberg Markets" with host Sonali Basak to offer breaking analysis of President Biden's Fiscal...

The Deficit Totaled $1.8 Trillion Over the Past Year

The federal budget deficit totaled $1.8 trillion over the past 12 months, up $36 billion from the 12-month period ending in January and up $107...

Fact-Checking the 2024 State of the Union

In last night's State of the Union Address, President Biden made a number of claims related to the budget deficit. We've fact-checked three of those...

New RECA Bill Would Worsen the Debt

The Senate is expected to vote this week on a bill ( S.3853) to dramatically expand the Radiation Exposure Compensation Act (RECA) created to...

College Cost Reduction Act Could Save $150 Billion, Lower Tuitions

The House Committee on Education and the Workforce recently passed The College Cost Reduction Act, a bill designed to lower higher education costs and...

Congress Just Prevented Pell Costs from Exploding

The cost of the Pell Grant program already exceeds its funding. A recently announced change from the Department of Education, made due to an error in...

CBO Baseline Highlights Troubling Long-Term Future

The Congressional Budget Office’s (CBO) February 2024 Budget and Economic Outlook projects that the national debt will exceed its record as a share of...

Bipartisan Support for a Fiscal Commission

This week, the American Road & Transportation Builders Association led a coalition letter to leadership asking for a fiscal commission to be included...

Can Donald Trump Eliminate the Debt?

In discussing another potential term in office, last month, former President Donald Trump declared, "we’re going to pay off our debt.” President Trump...

Pell Grants Face a Big Shortfall

The Pell Grant program helps low-income students to fund their education by offering them up to $7,395 per year to fund tuition and other expenses...

Do We Spend More On Interest Than Defense?

During a recent town hall, former United Nations Ambassador and current Presidential candidate Nikki Haley claimed, “for the first time we're paying...

Measuring the Savings from Preventative Health Care

This month, the House Budget Committee passed a bill that would direct the Congressional Budget Office (CBO) to evaluate the long-term budget impacts...