Tim Scott's Proposal for Cutting Spending, Cutting Government, and Cutting Taxes

GOP presidential candidate and Senator Tim Scott (R-SC) recently unveiled a comprehensive economic plan, titled “Build. Don’t Borrow." The plan is subdivided into three sections, one of which features a slate of proposals meant to reduce spending, taxes, and the overall size of the federal government. We estimate that this portion of Senator Scott’s broader economic plan will cost $3.0 trillion to $3.5 trillion over the ten years from Fiscal Year (FY) 2026 – the first fiscal year for which the next President will submit a budget proposal – through FY 2035. Relative to a full extension of the individual and estate tax provisions in the Tax Cuts and Jobs Act (TCJA), the plan would cost as much as $70 billion or save as much as $350 billion. These estimates do not include debt service nor any dynamic effects.

| US Budget Watch 2024 is a project of the nonpartisan Committee for a Responsible Federal Budget designed to educate the public on the fiscal impact of presidential candidates’ proposals and platforms. Through the election, we will issue policy explainers, fact checks, budget scores, and other analyses. We do not support or oppose any candidate for public office. |

Senator Scott’s plan for “Cutting Spending, Cutting Government, and Cutting Taxes” would reduce spending by $250 to $670 billion over ten years and reduce taxes (or expand tax credits) by $3.7 trillion, according to our estimates. Spending reductions would come from his plan to revert Nondefense Discretionary (NDD) spending back to a pre-pandemic baseline, though savings would vary depending on the baseline and other details. Tax cuts would come mainly from extending and expanding large parts of the TCJA.

| Proposal | Ten-Year Cost/Savings (FY '26 - FY '35) |

|---|---|

| Cut Nondefense Discretionary Spending to Pre-Pandemic Baseline Levels | -$250 to -$670 billion |

| Make 20% Pass-Through Deduction Permanent | $715 billion |

| Repeal the Estate Tax | $465 billion |

| Make Other Expiring Individual Provisions in the TCJA Permanent | $2,435 billion |

| Expand the Child Tax Credit to Expecting Mothers | ~$100 billion |

| Make the Adoption Tax Credit Fully Refundable | |

| Expand "Section 45b" Tax Credit to Beauty Salons | |

| Extend the Educator Tax Credit to Early Childhood Educators | |

| Extend the Educator Tax Credit to Athletic Coaches | |

| Total | $3.0 to $3.5 trillion |

| Cost Relative to Full Extension of Individual and Estate Tax Provisions in TCJA | $70 to -$350 billion |

Note: Figures may not sum due to rounding

Sources: Committee for a Responsible Federal Budget, Congressional Budget Office, Office of Management and Budget, votetimscott.com

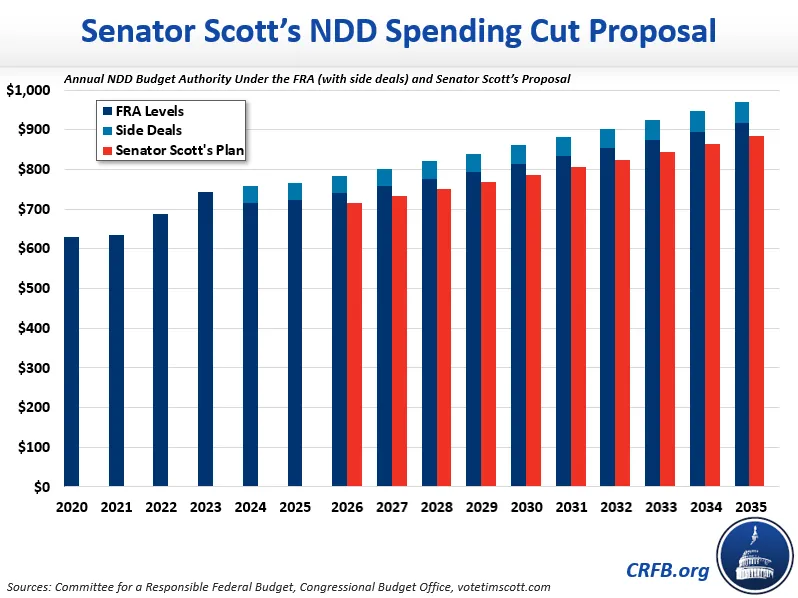

Senator Scott’s plan proposes to cut NDD spending back to a pre-pandemic baseline. NDD, or Nondefense Discretionary, is a term used to describe the money Congress appropriates each year to cover many nonmilitary functions of government, including homeland security, education, and infrastructure. Although it represents only 11 percent of the budget, this money funds much of the federal workforce, most federal buildings, and all federal departments and agencies. Between 2017 and 2022, ordinary NDD spending grew 33 percent on a nominal basis, from about $520 billion to roughly $690 billion.

As we interpret Senator Scott’s proposal, it would reduce NDD budget authority to a pre-pandemic baseline – which we define as CBO’s projections in March of 2020 – for all fiscal years beginning in 2026.1 This would result in about $690 billion of spending in FY 2026, $755 billion in FY 2030, and an extrapolated $850 billion by FY 2035.

Under Scott’s proposal, NDD budget authority would total $8.0 trillion over ten years. Assuming appropriators spend at the levels set by the Fiscal Responsibility Act (FRA) over the next two years, baseline NDD budget authority will be $8.3 trillion. However, if appropriators ultimately follow through with the various side-deals apparently agreed to as part of the FRA, baseline budget authority will be $8.7 trillion. Adjusting for the spend out rate of these funds, we estimate that Senator Scott’s NDD proposal could therefore save between $250 billion and $670 billion.

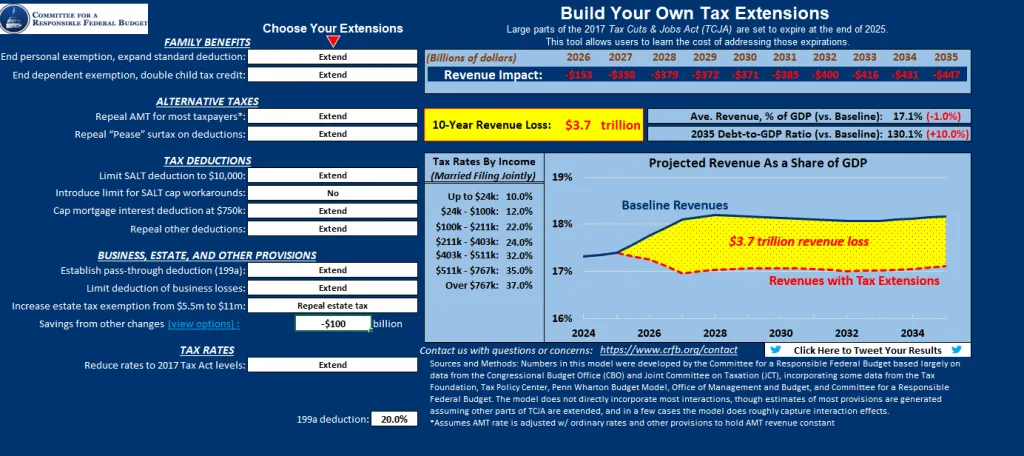

On the revenue side, Senator Scott proposes several tax cuts, mainly in the form of tax cut extensions, which we estimate would cost $3.7 trillion in total.

Senator Scott proposes to make permanent the 20 percent deduction for certain types of pass-through business income, which we estimate will cost approximately $715 billion through FY 2035. He also proposes eliminating the Estate Tax, which we estimate would cost $465 billion over a decade.

In his plan, Senator Scott declares that “I wrote the legislation that cut your family’s taxes in 2017. As President, I will make them permanent.” We interpret this to mean support for extending all remaining individual income tax provisions from the TCJA that are scheduled to expire at the end of 2025.2 These include lower tax rates at all income levels, replacement of the personal and dependent exemptions with a larger standard deduction and child tax credit, the repeal of the Alternative Minimum Tax for most taxpayers, a $10,000 limit on the deduction for state and local taxes, a limit on the deduction for noncorporate business losses, and other measures. We estimate that extending these provisions would reduce revenue collection by an additional $2.4 trillion through 2035.

The screenshot below displays Senator Scott’s tax plan as run through our Build Your Own Tax Extensions model:

Senator Scott’s plan also includes some smaller tax credit expansions. In particular, he proposes extending the Child Tax Credit to expecting mothers, to make the Adoption Tax Credit fully refundable, and to expand eligibility for the Educator Tax Credit to early childhood educators and athletic coaches. He also proposes to extend the “Section 45B” tax credit – which reimburses employers in the food and beverage industry for a portion of Social Security taxes paid on employee tips – to beauty salons. We estimate these changes together will cost less than $100 billion.

Along with these tax and spending proposals, Senator Scott’s plan includes several proposals that would have either an insignificant or indeterminate budget effect. For instance, Senator Scott proposes the establishment of a federal balanced budget amendment, as well as a “10th Amendment” commission meant to return certain powers back to state governments. He proposes relocating most of the Department of Energy to Tennessee and most of the Department of Agriculture to Iowa, which would likely have a small net cost over a decade. Senator Scott also proposes replacing the current wage scale for federal employees with a merit pay system and passing reforms to regulations affecting the banking industry designed to make it easier to hold executives accountable for bank failures.

*****

Throughout the 2024 presidential election cycle, US Budget Watch 2024 will bring information and accountability to the campaign by analyzing candidates’ proposals, fact-checking their claims, and scoring the fiscal cost of their agendas.

By injecting an impartial, fact-based approach into the national conversation, US Budget Watch 2024 will help voters better understand the nuances of the candidates’ policy proposals and what they would mean for the country’s economic and fiscal future.

You can find more US Budget Watch 2024 content here.

1 To estimate Senator Scott’s proposal, we took the Budget Control Act cap on nondefense discretionary spending for FY 2021 – $627 billion – and extended it out through FY 2035, growing at the same rate as overall nondiscretionary spending in CBO’s March 2020 baseline (extrapolated beyond 2030).

2 Senator Scott proposes extending other parts of the TCJA, like Opportunity Zones and 100 percent bonus depreciation, in other sections of his economic plan.