2023 Interest Costs Reach $659 Billion

According to final data from the Treasury Department, net interest costs reached $659 billion (2.5 percent of GDP) in fiscal year 2023, a $184 billion increase from the previous year. In this piece, we explain that:

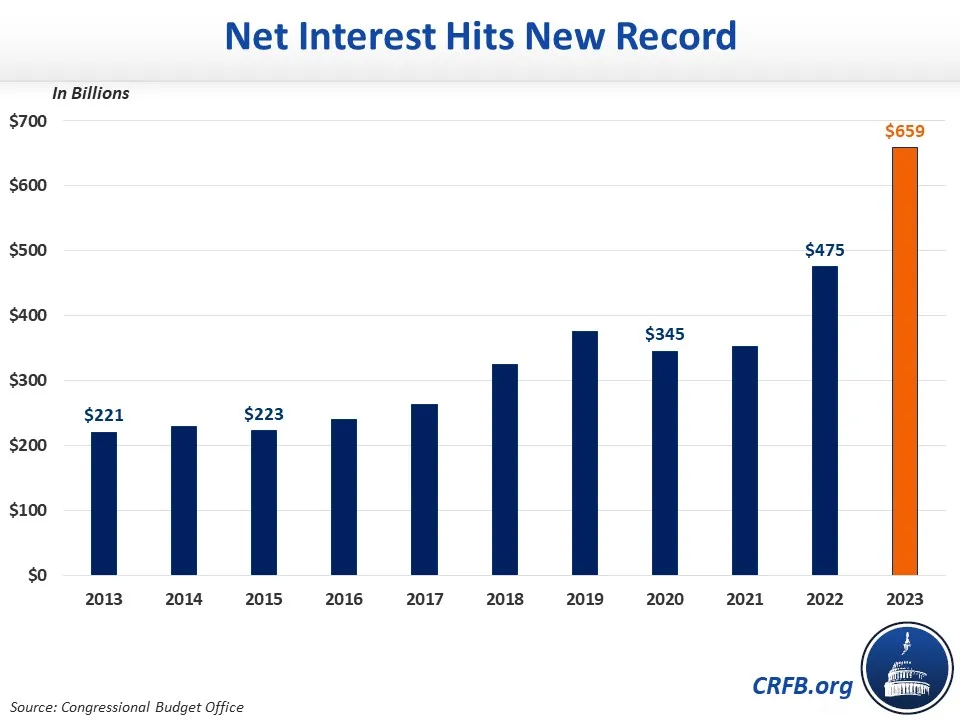

- Interest costs nearly doubled over the past three years, from $345 billion in 2020 to $659 billion in 2023.

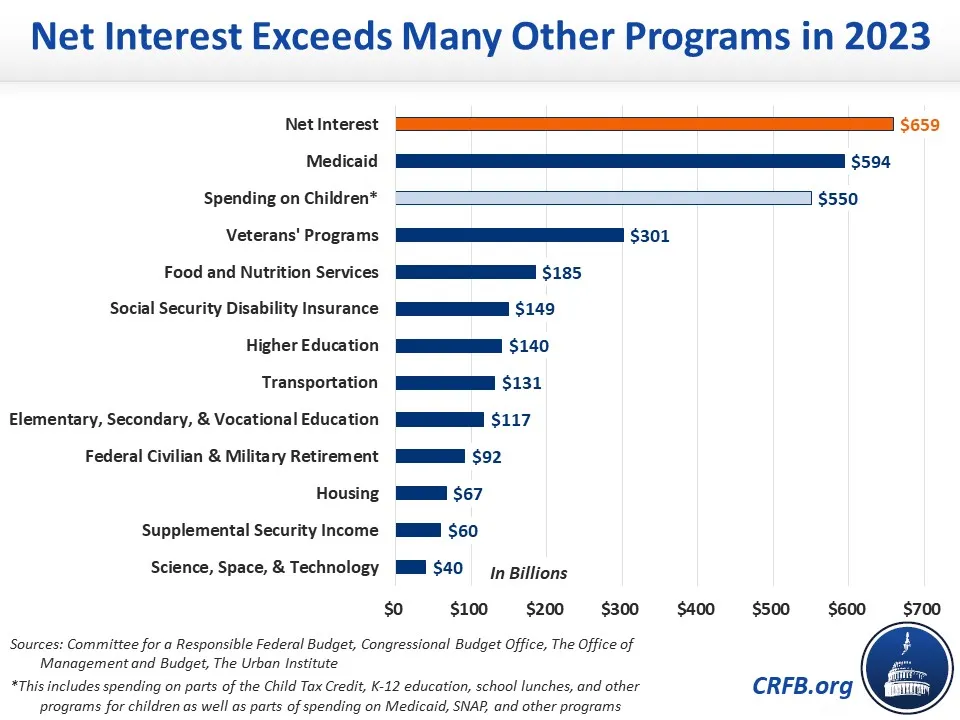

- Interest is now the fourth-largest government program, behind only Social Security, Medicare, and defense.

- The federal government in 2023 spent more on net interest than it did all spending on children, and it also spent more on interest than most major programs or program areas including Medicaid, veterans’ programs, food and nutrition programs, and education.

Interest is currently the fastest growing part of the federal budget. After growing from $221 billion in 2013 to $345 billion in 2020, it has nearly doubled to $659 billion in 2023. Relative to the economy, net interest costs grew from 1.6 percent of GDP in 2020 to 2.5 percent in 2023.

This huge increase is due in part to the $9.5 trillion increase in debt held by the public between the beginning of 2020 and the end of 2023. But it is also due to much higher interest rates. Newly issued ten-year Treasury Notes paid an average of 3.8 percent in fiscal year (FY) 2023, compared to 2.4 percent in 2019 and 1.1 percent in 2020. Newly issued three-month Treasury Bills paid an average yield of 5.0 percent in 2023, compared to 2.3 percent in 2019 and 0.7 percent in 2020. Rates today are even higher.

At $659 billion, interest was the fourth largest government program in 2023, exceeded only by Social Security, Medicare, and defense. The federal government spent significantly more on interest than all spending on children. Interest costs also exceeded spending on Medicaid, veterans, food and nutrition services, and more.

In the coming years, interest costs are likely to further explode. With interest rates at a 16-year high, current debt holdings originally borrowed in a low interest rate environment will increasingly be rolled over at much higher rates. Meanwhile, the federal government continues to add roughly $2 trillion per year to the national debt.

In its previous baseline, the Congressional Budget Office (CBO) projected that interest would cost more than $10 trillion over the next decade and exceed the defense budget by 2027. Since then, interest rates have risen far more than CBO projected. If Interest rates remain about 1 percent above previous projections, we recently estimated interest would cost more than $13 trillion over the next decade, exceed the defense budget by 2025, and become the second-largest government program – exceeding Medicare – by 2026.

To prevent this massive runup in interest costs, lawmakers will need to slow the growth of debt and work to lower interest rates and boost economic growth where possible. Thoughtful and responsible fiscal reforms can help achieve this goal. A fiscal commission can offer a useful path forward.