Top 13 Fiscal Charts of 2024

It was a busy year for fiscal policy in 2024, with a big focus on the presidential election. In addition to releasing a few major papers, we also wrote our usual analyses of major budget reports and other federal policies. This year, we published over 170 analyses and below are the top fiscal charts of the year.

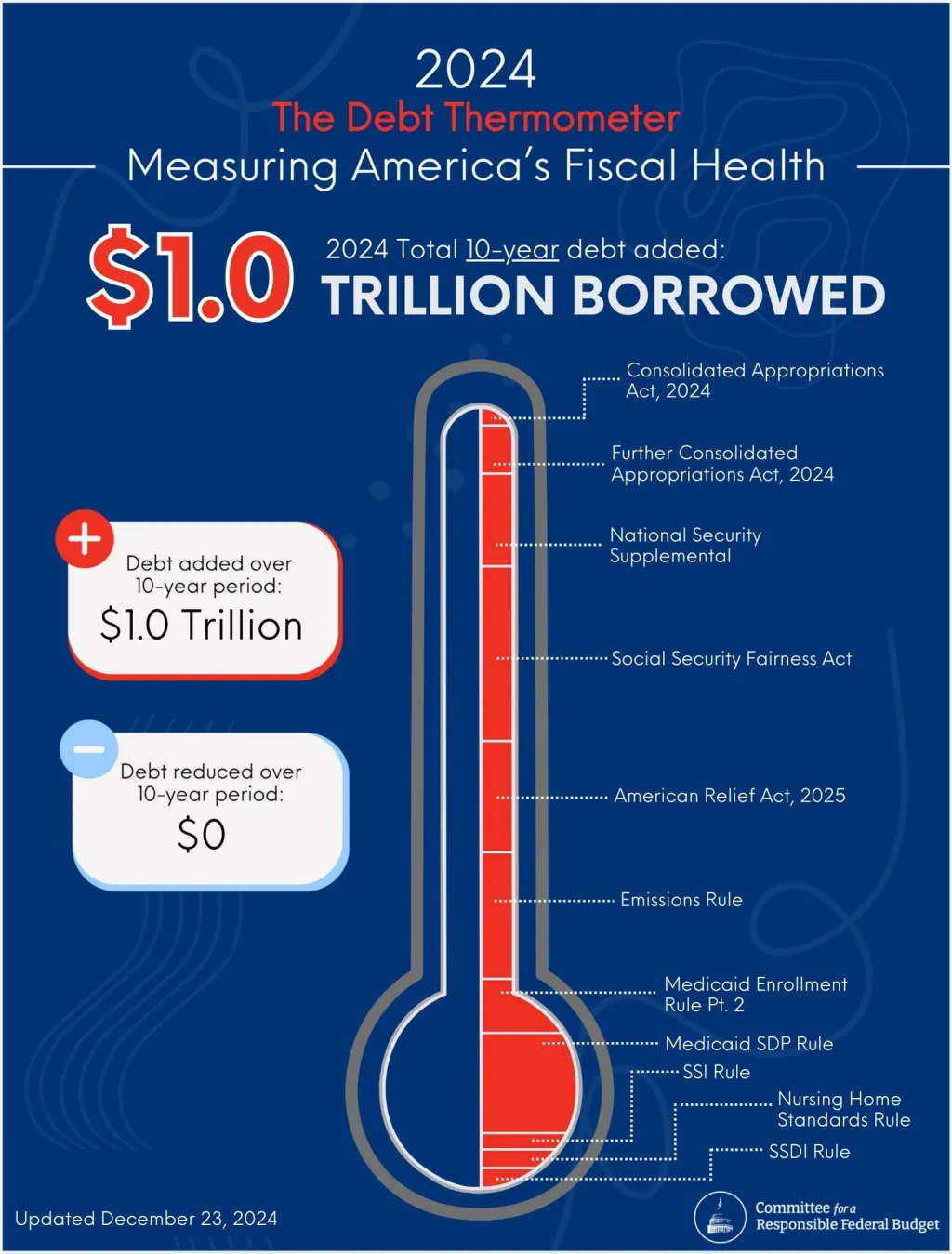

1. Debt Thermometer

In a reversal from 2023, policymakers enacted $1 trillion of ten-year debt increases in 2024, including roughly $380 billion in the final days of the 118th Congress. About 60 percent of the $1 trillion increase came from legislation, while the other 40 percent came from executive actions approved by the Biden Administration.

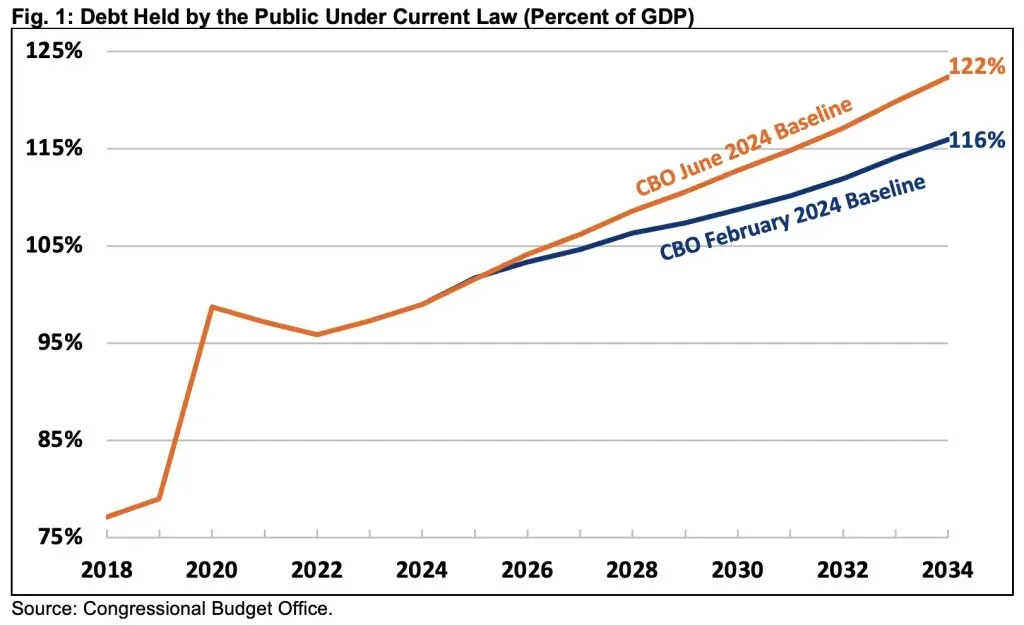

2. Debt Remains On An Unsustainable Path

In February 2024, the Congressional Budget Office (CBO) projected that debt would continue to rise unsustainably from its current level of roughly the size of the economy to 116 percent of the economy by 2034; this was revised up in June 2024 to 122 percent of the economy by 2034.

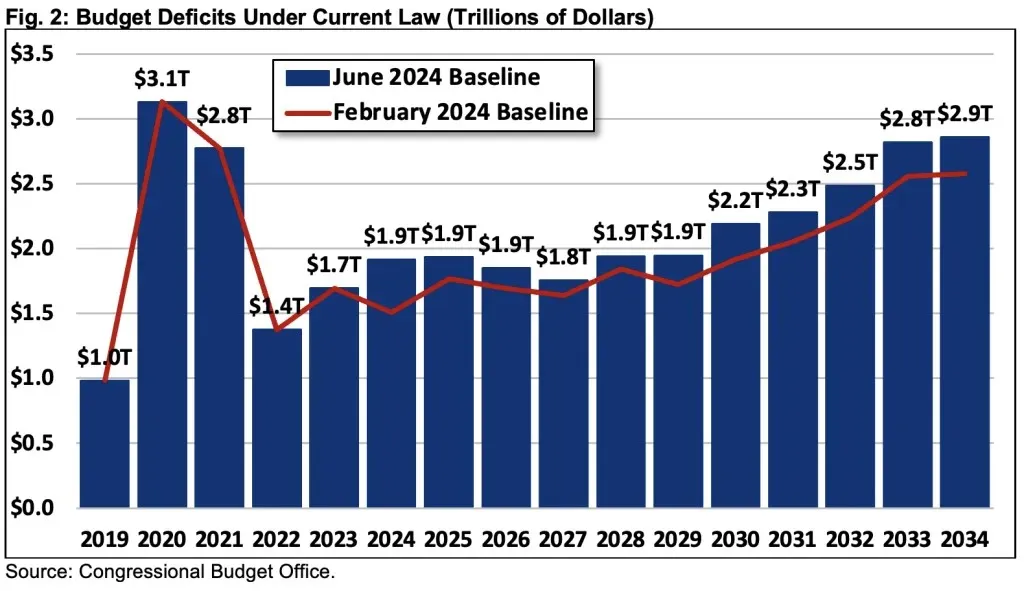

3. Deficits Are High and Rising

The deficit in Fiscal Year (FY) 2024 totaled $1.8 trillion, almost double the pre-pandemic deficit of $984 billion in FY 2019. Over the next few years, deficits are projected to remain slightly below $2 trillion before rising to $2.2 trillion in FY 2030, $2.5 trillion in FY 2032, and $2.9 trillion by FY 2034. As a share of the economy, deficits are expected to fall from their non-emergency high of 6.4 percent of Gross Domestic Product (GDP) in 2024 to 5.5 percent of GDP in 2027, under the assumption that lawmakers allow many provisions in the 2017 Tax Cuts and Jobs Act (TCJA) to expire and discretionary spending grows with inflation after the Fiscal Responsibility Act caps expire at the end of FY 2025, growing to 6.9 percent of GDP by 2034. Under an alternative scenario where tax provisions are extended and appropriations grow with the economy, deficits would be $3.9 trillion (9.4 percent of GDP) by 2034.

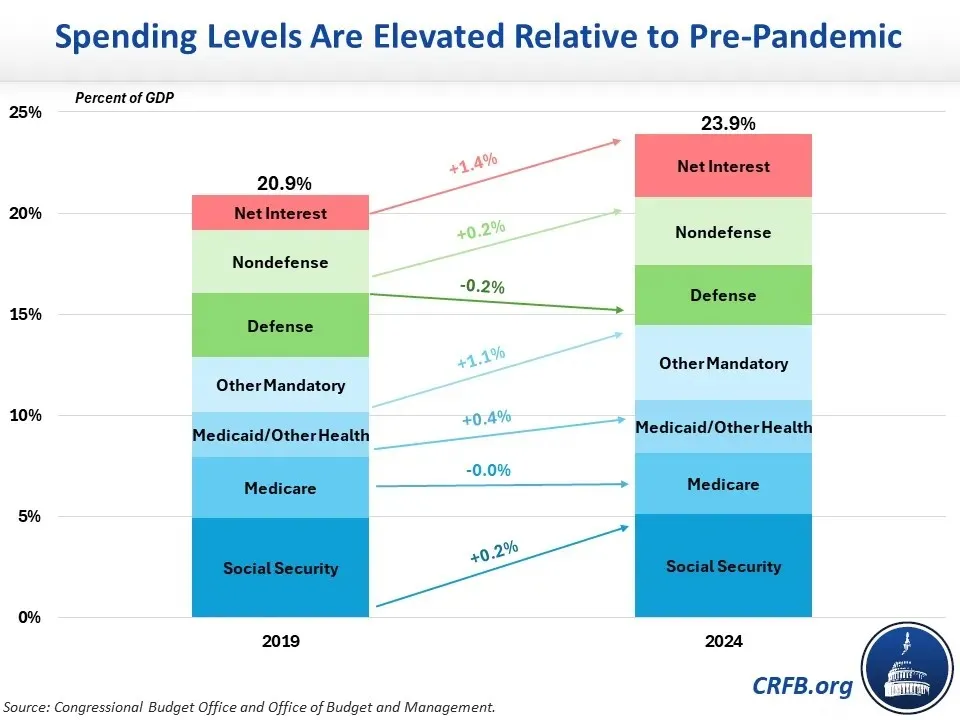

4. Government Spending Has Grown Significantly

Growing deficits and debt can be explained by the growing disparity between spending and revenue. Spending in FY 2024 was projected to total 23.9 percent of GDP, compared to 20.9 percent of GDP in FY 2019. Nearly half of all spending growth between FY 2019 and today is due to increased interest payments on the federal debt. Most of the remaining increase in spending over the last five years comes from non-health and non-Social Security "other mandatory" spending. A small portion of the remaining increase is due to lingering COVID relief.

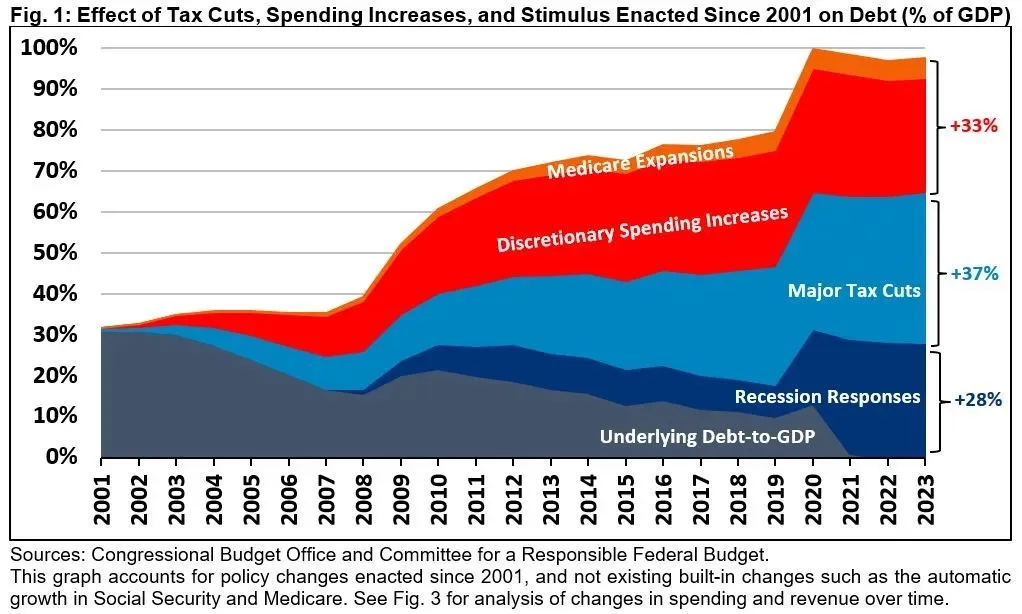

5. Our Fiscal Situation Has Deteriorated Dramatically Since 2001

In 2001, the federal government ran a surplus and CBO projected that the national debt would be fully paid off by 2009. Instead, our fiscal situation has deteriorated, with debt held by the public growing from 32 percent of GDP at the end of FY 2001 to 98 percent of GDP at the end of 2023.

We analyzed what caused this debt growth in our paper, "From Riches to Rags: Causes of Fiscal Deterioration Since 2001." We find that debt growth can be attributed to both tax cuts (37 percentage points of debt-to-GDP) and spending increases (33 percentage points of debt-to-GDP). Another one-third of growth is due to recession responses (28 percentage points of debt-to-GDP). Absent these tax cuts and spending increases, the debt would be fully paid off. Our paper also finds that most of the debt, 77 percent of GDP, was approved on a bipartisan basis.

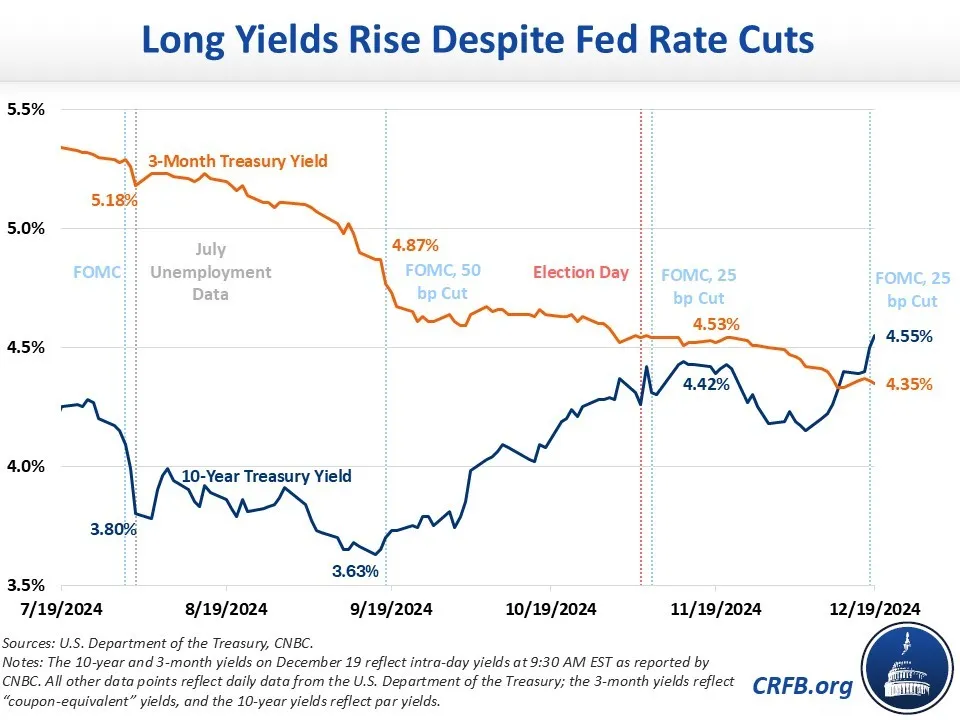

6. Treasury Yields Are Rising

Yields on short-term Treasury bills continued to fall throughout 2024, though longer-term Treasury yields have been more volatile. The Federal Open Market Committee cut interest rates by 50 basis points in mid-September, 25 basis points in early November, and another 25 basis points in mid-December. Each time a cut was announced, longer-term yields moved in the opposite direction. The ten-year Treasury note also increased by 21 basis points as the presidential election results came in.

A total increase of roughly 90 basis points between September and the end of the year can be explained by a more bullish economic outlook, higher inflation expectations, and expectation of rising national debt.

7. Net Interest Payments Surging

In 2024, interest costs surpassed spending on defense and Medicare, making net interest the second largest government expenditure. Interest is the fastest growing part of the federal budget, and by 2051, spending on net interest will exceed spending on Social Security and be the largest line item in the budget. In FY 2024, the government continued to spend more on interest than all spending on children. From 2020, interest costs have nearly tripled from $345 billion to $882 billion and grew $223 billion in just one year between FY 2023 and FY 2024.

CBO projects that net interest will continue to grow and exceed its record as a share of the economy, 3.2 percent set in FY 1991, this year.

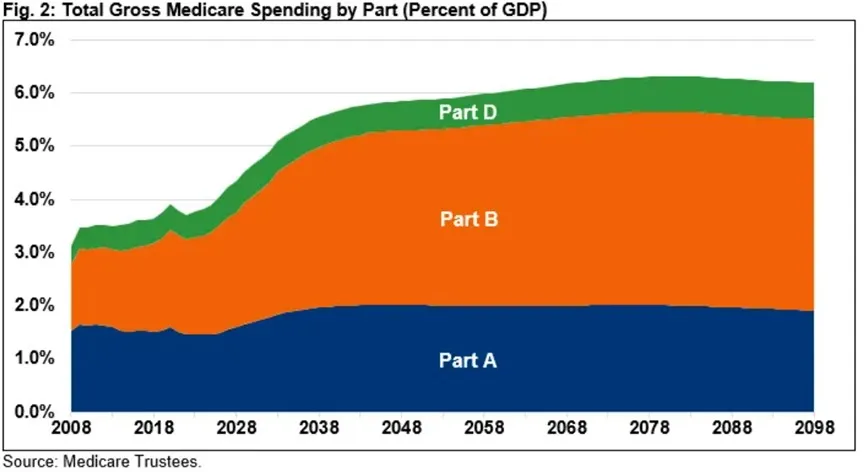

8. Medicare Costs Will Grow Rapidly

The May 2024 Medicare Trustees Report showed that all parts of Medicare will grow over the coming decades, and the Medicare Hospital Insurance (HI) trust fund will be insolvent by 2036. Total gross Medicare costs are projected to be 3.9 percent of GDP in 2025, up from 2.2 percent of GDP in 2000. By 2098, Medicare costs are projected to be 6.2 percent of GDP and even higher, 8.4 percent of GDP, under an alternative scenario. Most of the growth in Medicare spending will come from Medicare Part B, which mainly funds outpatient physician services. The Medicare Advantage (MA) program is a key contributor to growth in all parts of the Medicare program, costing the government significantly more per person than traditional Medicare. MA is projected to cover nearly three-fifths of all beneficiaries over the next decade.

Throughout the year, we continued to propose solutions to address the rising cost of health care, which can be found in our Health Savers Initiative.

9. Social Security Trust Fund Insolvency Nears

The May 2024 Social Security Trustees Report showed that the Social Security Old-Age and Survivors Insurance (OASI) trust fund will deplete its reserves by 2033 when today’s 58-year-olds reach the normal retirement age and today’s youngest retirees turn 71. Lawmakers have not offered any plans to address the impending solvency challenges, though doing so could stabilize the debt. On the contrary, as covered as part of US Budget Watch 2024, there have been proposals that would actually make things worse.

Inaction on Social Security will lead to a 21 percent across-the-board cut to retirees' benefits in 2033 – a $16,500 benefit cut for a typical dual-income couple retiring at insolvency.

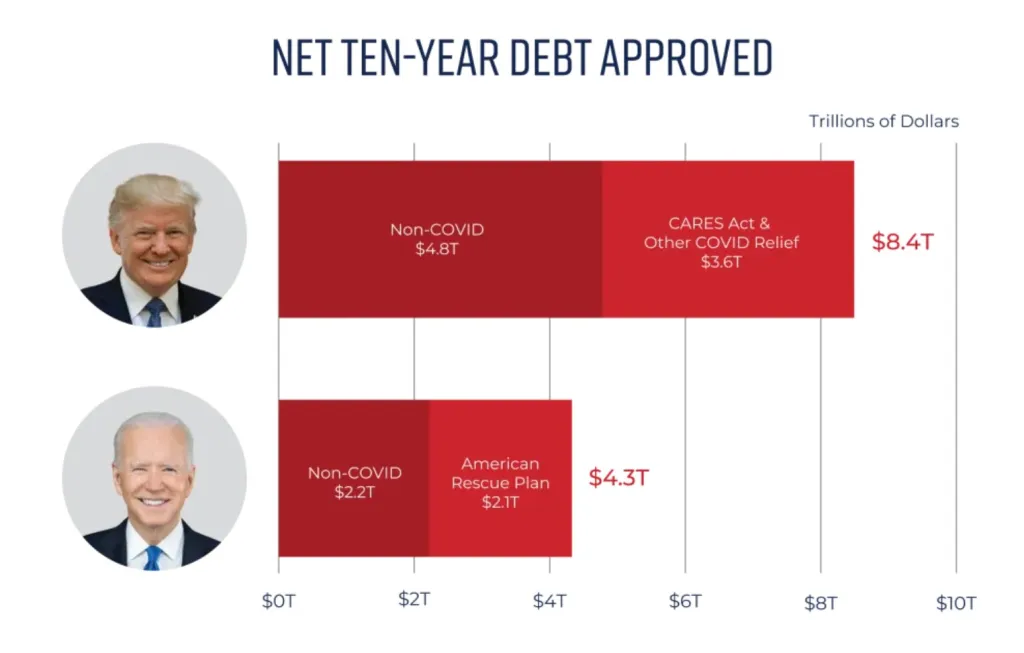

10. The National Debt Under Presidents Trump and Biden

Much of the fiscal policy debate this year surrounded the presidential election, and our US Budget Watch 2024 project looked at the candidates' fiscal legacies and proposals. In June, when the two general election candidates were presumed to be former President Trump and President Biden, we published an analysis showing that President Trump approved $8.4 trillion of new ten-year debt in his term, or $4.8 trillion of non-COVID ten-year debt, while President Biden had thus far approved $4.3 trillion of new ten-year debt or $2.2 trillion of non-COVID ten-year debt. We followed this analysis with deeper looks at both Presidents' debt in terms of tax and spending policies, executive actions, debt from partisan and bipartisan actions, and debt growth during their terms.

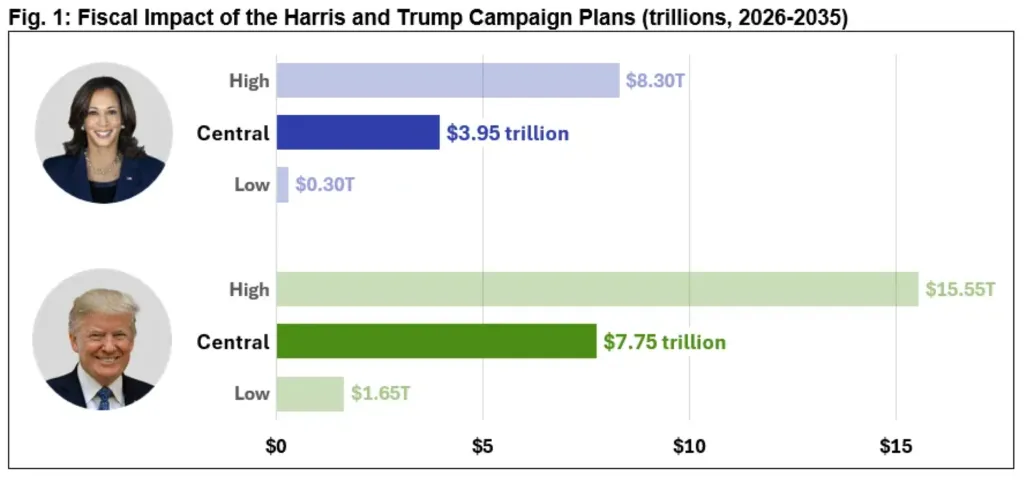

11. Analyzing the Harris and Trump Campaign Plans

After President Biden bowed out of the race in favor of Vice President Harris, we began to examine the policies that the Harris campaign proposed in addition to the policies the Trump campaign was proposing. In October, we published our comprehensive analysis of both campaign plans, finding that under our central estimate, Vice President Harris’s plan would increase the debt by $3.95 trillion through 2035 and President Trump’s plan would increase the debt by $7.75 trillion. We revised these analyses for new information at the end of October, pushing up our low- and high-cost estimates for the Harris plan from $300 billion to $8.30 trillion and for the Trump plan from $1.65 trillion to $15.55 trillion.

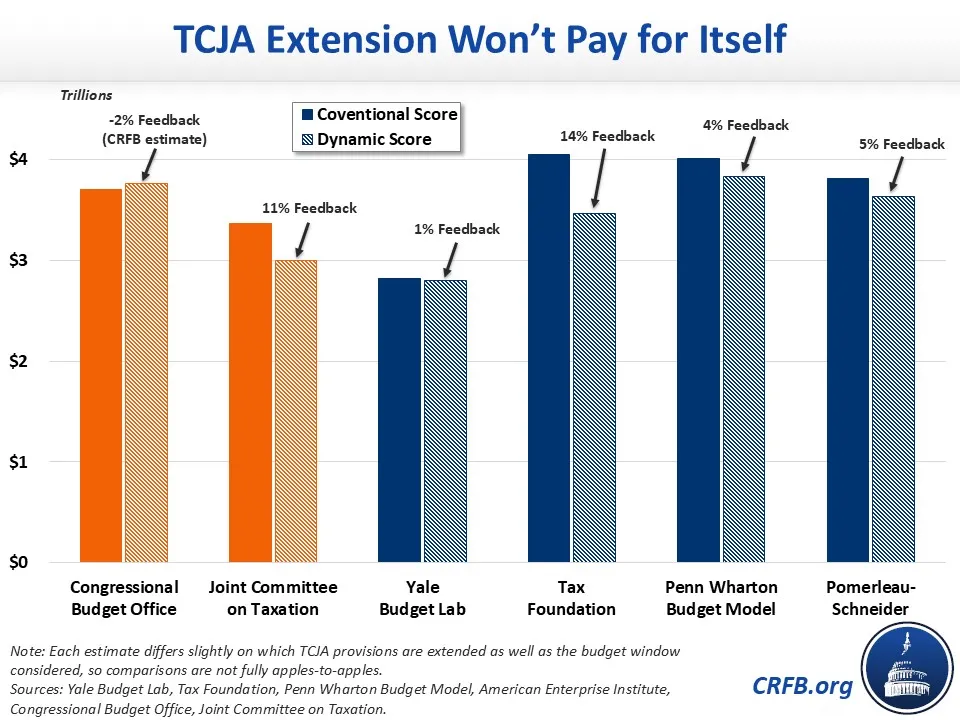

12. Extending the Tax Cuts and Jobs Act Without Offsets Could Add $4 to $5 Trillion to Deficits

In March 2024, we launched the Build Your Own Tax Extensions Tool, which allows user to design their own fair, pro-growth, and fiscally responsible alternative for a tax extension package. If lawmakers are to extend the individual and estate tax provisions of the TCJA without offsets, it would add $3.9 trillion to deficits or $4.5 trillion with interest. Extending these provisions would increase debt in FY 2035 by 10.5 to 14.2 percent of GDP.

Though some lawmakers have argued that tax cuts may pay for themselves, a wide array of experts and organizations have found that the economic effects of extending the expiring parts of the TCJA would offset only 1 to 14 percent of the revenue loss and a dynamic estimate may find even more debt from an unpaid-for TCJA extension.

13. Options to Reduce the Deficit

We launched our Budget Offsets Bank as a resource to help policymakers find ways to reduce deficits and/or offset their preferred policies. With the national debt on course to exceed its record as a share of the economy in the next two years, interest payments on the debt surging, and major trust funds approaching insolvency, policymakers will need to enact policies to reduce deficits and/or pay for new spending or tax cuts. The Budget Offsets Bank includes offset options for extending the TCJA, savings from reversing President Biden's executive actions, options to reduce federal Medicaid spending, options to raise tariff revenue, and an additional $700 billion of easy deficit reduction. We will be adding trillions of dollars of additional options in the coming weeks and months.

***

As we head into 2025, the Committee for a Responsible Federal Budget will continue to track fiscal policy developments in what is sure to be an exciting year of fiscal policymaking. You can see many more analyses and charts from the year by visiting our blog page, following our Budget Offsets Bank, and following all of our work at CRFB.org.