Options to Raise Tariff Revenue

Note: (02/13/2025) We are updating our estimate for Reciprocal Tariffs on Countries that Impose Tariffs on U.S. Exports; it has been removed in the meantime.

As policymakers look to offset their priorities and address the unsustainable growth of the national debt, they may consider raising or imposing tariffs – taxes on imports. Indeed, President-elect Donald Trump called for trillions of dollars of new tariffs in his campaign plan.

While the Constitution gives Congress authority to regulate foreign commerce, certain trade laws give the President authority to adjust tariffs and address concerns related to national security. Tariffs could in theory generate significant deficit reduction, though they also tend to slow economic growth – especially if retaliatory tariffs are imposed – which could counter some of the revenue gains.

As part of our Budget Offsets Bank, the below table includes several tariff options that have recently been discussed.

Note: these options are based on the FY 2026-2035 budget window; savings would likely be 15 percent less over the FY 2025-2034 budget window, varying by option. Savings are estimates based on CBO scoring, are rounded to the nearest $5 billion, and are subject to change based on policy specification.

The table below is a menu of options and does not represent recommendations from the Committee for a Responsible Federal Budget, its board, or its staff.

Tariff Scenarios and Their Net Impact on Revenue

| Policy | Conventional Impact (2026-2035) |

Dynamic Impact, with Retaliation (2026-2035) |

|---|---|---|

| Universal Baseline Tariffs | ||

| 10% Universal Baseline Tariff | $1.8 trillion | $1.6 trillion |

| 20% Universal Baseline Tariff | $3.3 trillion | $2.9 trillion |

| 10% Baseline Tariff, Excluding Free Trade Agreement Countries | $1.0 trillion | $900 billion |

| 20% Baseline Tariff, Excluding Free Trade Agreement Countries | $1.9 trillion | $1.7 trillion |

| Chinese Tariffs | ||

| 10% Minimum Tariff on Chinese Imports | $150 billion | $125 billion |

| 10% Additional Tariff on Chinese Imports | $200 billion | $150 billion |

| 60% Import Tariff on Chinese Goods | $650 billion | $550 billion |

| 60% Import Tariff (Assuming 10% Universal Baseline Tariff) | $575 billion | $500 billion |

| Remove De Minimis Exclusion for Chinese Imports | $5 billion | $5 billion |

| 20% Additional Tariff on Chapter 99 Chinese Imports | $95 billion | $70 billion |

| Other Tariffs | ||

| Reciprocal Tariffs (Assuming 10% Baseline Tariff) | $90 billion’* | $80 billion’* |

| 50% Tariff on Automobile Imports | $500 billion | $450 billion |

| 100% Tariff on Automobile Imports | $600 billion | $550 billion |

| Carbon Border Adjustment Tariff | $100 billion* | - |

| 100% tariffs on BRICS countries | $1.1 trillion | $950 billion |

| 25% Tariff on Goods from Canada and Mexico | $1.3 trillion | $1.2 trillion |

| Remove De Minimis Exclusion for All Imports | $25 billion | $20 billion |

| Rules of Thumb (based on 10%) | ||

| Universal Baseline Tariff | $180 billion per point | - |

| Universal Baseline Tariff, Excluding Free Trade Countries | $100 billion per point | - |

| Chinese Minimum Import Tariff | $15 billion per point | - |

| Chinese Additional Import Tariff | $20 billion per point | - |

| Destination-Based Cash Flow Tax | $250 billion per point^ | - |

Sources: Committee for a Responsible Federal Budget estimates mainly based on data from the Congressional Budget Office (CBO) and U.S. Census Bureau.

Notes: Numbers are rough and rounded. Conventional estimates reflect the average of scenarios where lost trade is and isn’t diverted to other trading partners. Conventional estimates assume tariffs would reduce import levels consistent with elasticities derived from research and that all gained tariff revenue would be subject to income and payroll tax revenue offsets. For diversion estimates, diverted imports are subject to elasticities to the degree that tariffs on imports from other countries have also risen. Impacts on the economy are roughly created using CBO estimates as a reference, and the resulting revenue impacts assume GDP losses are due to productivity losses.

* Represents very rough estimates

' Based on 2021 sector-level data from the World Integrated Trade Solution (WITS) using a sample of ten U.S. trading partners

^ Based on calculations by Ernie Tedeschi

While tariffs can raise significant amounts of new revenue under conventional scoring, the negative economic consequences associated with tariffs can result in lower “dynamic” scoring for scenarios – for which changes in economic growth and the resulting impact on revenue is also accounted for. While the degree that tariffs impact the economy is dependent on the details of the tariffs that are ultimately implemented, there is general agreement among most experts that significant increases in tariff levels would have noticeably negative impacts on the economy. Additionally, retaliation by countries impacted by tariffs can worsen economic consequences.

The conventional estimates above are based mainly on modeling from the Committee for a Responsible Federal Budget and incorporate the fact that higher tariffs will likely reduce the volume of trade. In general, our figures are comparable to those by other estimators, including Clausing & Lovely, Yale Budget Lab, and the Congressional Budget Office.

Our estimates including dynamic and retaliatory effects on revenues are very rough and meant to convey the magnitude of their effects rather than precise scores. While we conservatively assume heightened tariffs have negative economic consequences for the U.S. economy, it is also possible that exporting nations bear more of the burden of tariffs than anticipated. For example, changes in currency valuations by countries on which the tariffs were imposed can directly offset increases in tariffs for U.S. consumers.

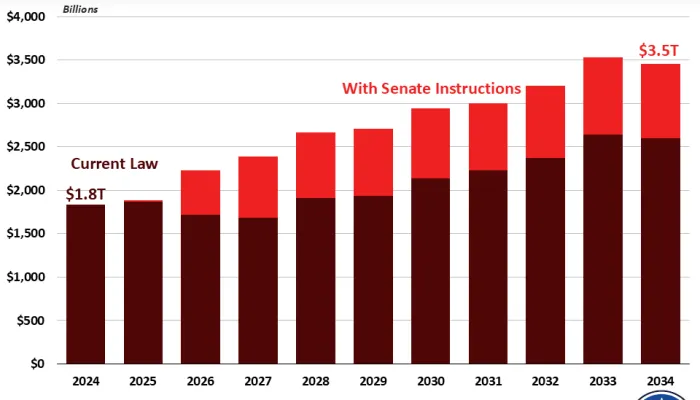

One option proposed by President Trump on the campaign trail is implementing a universal baseline tariff on all imports. Using conventional scoring, we estimate that a 10 percent universal baseline tariff would raise $1.8 trillion of revenue through 2035 while a 20 percent tariff would raise $3.3 trillion. If countries with which the U.S. has free trade agreements with are excluded from the universal baseline tariff, such as Mexico and Canada, then revenues would be nearly halved to $1.0 trillion and $1.9 trillion, respectively. Dynamic scores might reduce these estimates by about one-tenth.

There has also been discussion of specifically imposing tariffs on Chinese imports, with some calls for a tariff rate of between 10 or 60 percent. We estimate a 10 percent tariff would raise $150 to $200 billion on a conventional basis, while a 60 percent tariff could raise $650 billion. Dynamic effects could reduce collection of the 10 percent tariff by about one-fifth.

Many other tariffs have also been suggested by policymakers. For example, President Trump recently threatened a 25 percent tariff on Mexican and Canadian imports if the countries continue to allow drugs such as fentanyl and undocumented immigrants into the U.S., which we estimate could bring in a combined $1.3 trillion ($1.2 trillion dynamically) if allowed to go into effect. A carbon border adjustment tariff – which has been proposed by Members of Congress such as Senators Sheldon Whitehouse (D-RI), Bill Cassidy (R-LA), and Chris Coons (D-DE) – could also raise significant revenue under conventional scoring. Reciprocal tariffs, eliminating the “de minimis” loophole, and tariffs on automobiles could raise revenue as well.

As an alternative to tariffs, lawmakers could consider imposing a Destination-Based Cash Flow Tax (DBCFT) with a border adjustment – something suggested by Yale Budget Lab’s Ernie Tedeschi on top of or in place of the corporate tax, and included in tax plans from House Republicans in 2016 and Pomerleau-Schneider in place of the corporate tax. A DBCFT is effectively a consumption tax on return to capital that taxes business net cash flow. Nearly all expenses – including multi-year investments – are immediately deductible under a DBCFT, while interest payments are non-deductible and a “border adjustment” makes imports non-deductible while exempting exports from taxable income. This tax would raise about $250 billion per percentage point – compared to $180 billion per percentage point for a universal baseline tariff – and is expected to have little if any net cost to the economy.

As previously mentioned, significant increases in tariffs tend to reduce economic output by reducing trade and specialization. Estimates from outside groups have found that a 10 percent universal baseline tariff could reduce output by anywhere from roughly 0.2 percent to 3.6 percent, and tariff policies that are more aggressive would have even larger impacts. Effects could be more dramatic if tariffs led to a trade war or exacerbated existing inflationary pressures.

However, tariffs can have benefits separate from their effects on revenue or output. For example, they can be used as a tool to extract concessions from other countries, reduce reliance on foreign and potentially hostile economies, theoretically boost domestic manufacturing in some cases, and strengthen national security.

Importantly, it would not be possible to fully replace the income tax with tariffs despite claims to the contrary.

But with debt growing to record levels and calls for further deficit-increasing policies on the horizon, policymakers should consider a wide array of possible tax and spending changes to reduce deficits and offset new initiatives. Our Budget Offsets Bank discusses many such options.