Senate Instructions Could Add $1.1T in Interest Costs

Congress’ concurrent budget resolution includes reconciliation instructions to allow lawmakers to pass a bill that adds a net $5.8 trillion to primary deficits through 2034 and nearly $7 trillion including interest. As a share of the economy, interest would grow from a record 3.2 percent in Fiscal Year (FY) 2025 to 4.6 percent by 2034.

Passing an additional $5.8 trillion of new and extended tax cuts and spending without offsets would be unprecedented, and we estimate it would:

- Boost interest spending costs by $1.1 trillion between FY 2025 and 2034.

- Increase annual federal net interest payments to nearly $2.0 trillion by FY 2034, $260 billion higher than what is currently projected.

- Triple the interest-to-revenue ratio from 9 percent in 2021 to over 27 percent in 2034 (compared to 22 percent under current law).

- Cause the average interest rate (R) to exceed economic growth (G) by 2035, increasing the risk of a debt spiral.

This is an update to our previous February analysis in response to reports that the House was considering passing a reconciliation bill with $5.5 trillion in net deficit increases.

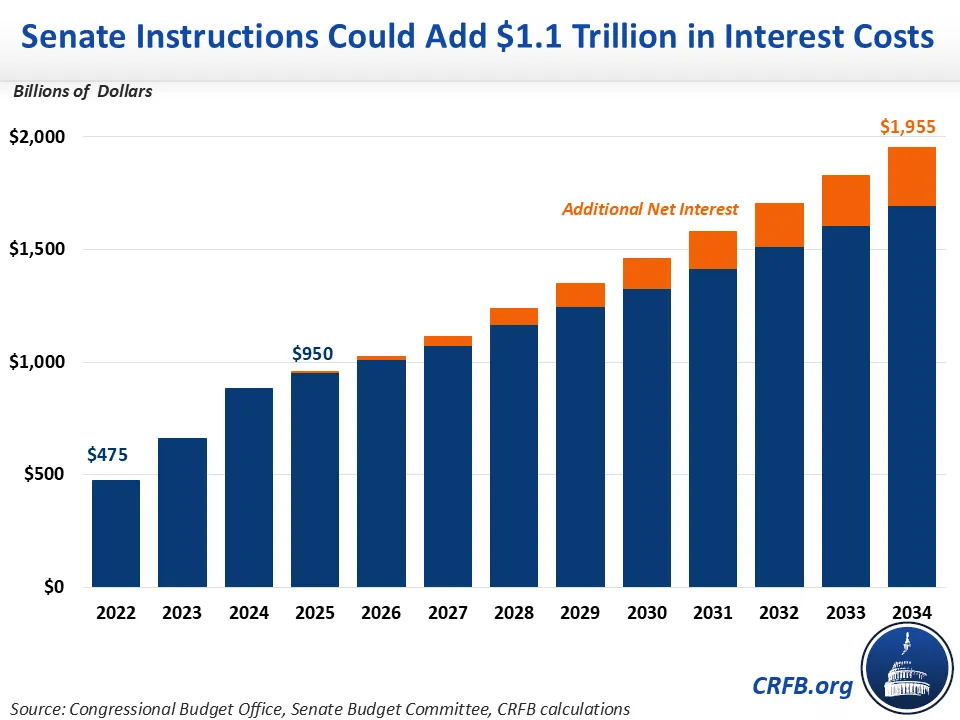

Borrowing for Senate Instructions Could Boost Interest Payments by $1.1 Trillion

Net interest payments are already the fastest growing part of the budget, surpassing all spending on Medicare and national defense in 2024. If lawmakers were to pass a reconciliation bill with $5.8 trillion in primary deficit increases, that would more than double interest payments from about $950 billion in FY 2025 to nearly $2.0 trillion in FY 2034, compared with $1.7 trillion under current law. The $1.1 trillion in additional interest costs includes roughly $900 billion in direct service costs for the new debt and $200 billion from higher interest rates induced by this new debt.

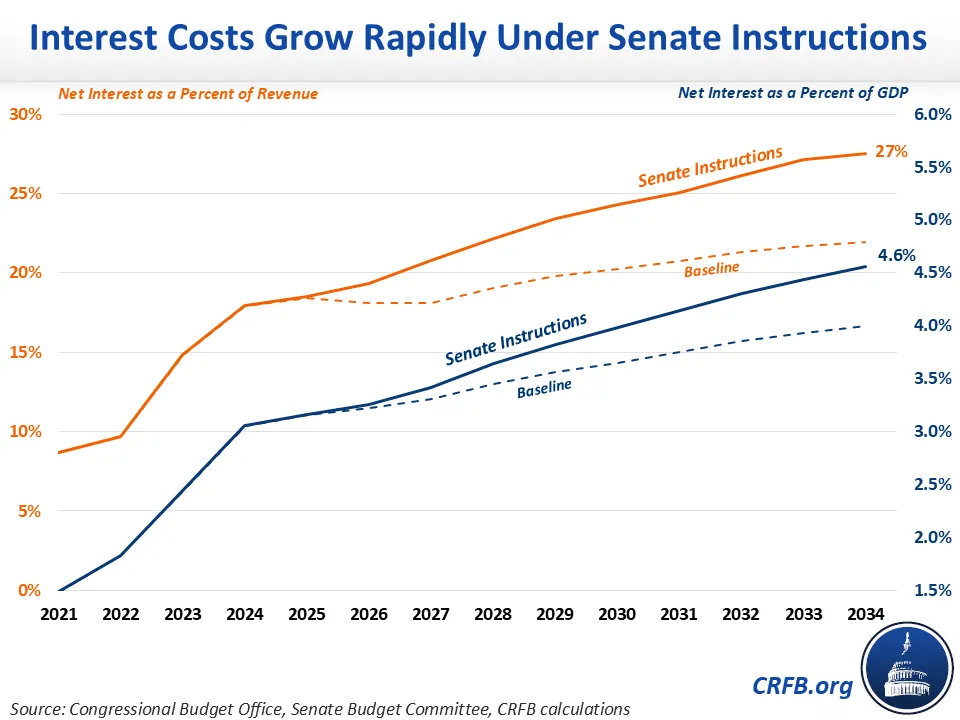

Interest Payments Will Consume More of Federal Revenue and the Economy

Under this $5.8 trillion proposal, we estimate that debt growth would double over the next decade and beyond to 134 percent of Gross Domestic Product (GDP) by 2034. Interest costs would follow a similar trajectory, from 3.2 percent of GDP today to 4.6 percent by 2034 and would continue to climb in later years.

As a share of revenue, interest costs have gone from comprising 9 percent of all revenue in 2021 to 18 percent of all revenues in 2024 and are projected to make up 22 percent of all revenues in 2034. However, we estimate interest could consume over 27 percent of all revenue by 2034 under this $5.8 trillion proposal, three times as much as they did just four years ago.

A Debt Spiral Could Be Coming Soon

While thoughtful tax cuts can strengthen the economy, estimates of economic growth from extending the tax cuts have been modest and will be nowhere close to generating the type of growth needed to finance $5.8 trillion over the next nine years. In fact, the Congressional Budget Office (CBO) estimates that unpaid-for tax cuts would shrink the economy over the long term.

Instead, higher interest payments to service the debt can raise interest rates, slow economic growth and further boost debt, pushing average interest rates (R) above the economic growth rate (G) and putting the US at risk of a debt spiral.

Based on estimates from CBO, the average interest rate will exceed economic growth by 2045, but passing a massive tax and spending bill could cause R to exceed G by 2035. Given current Treasury market turmoil and the recent spike in bond yields, the actual date could come sooner. As we’ve warned before, this could ultimately cause the debt to spiral out of control.

Interest costs have already doubled in just three years and – under the Senate reconciliation instructions – would double again in just 9 years. Lawmakers should be working to slow the growth of debt and interest, not approving an unprecedented $5.8 trillion primary deficit increase. Instead, the focus should be on finding ways to limit the fiscal impact of any tax extensions and, at a minimum, fully pay for any tax cuts.