SALT Deduction Resources

The 2017 Tax Cuts and Jobs Act (TCJA) includes a $10,000 limit on the deduction for State and Local Taxes (SALT), which helps finance some of its costs. Large parts of the TCJA are scheduled to expire at the end of 2025, including the SALT cap. Extending all the expiring individual and estate tax provisions from the TCJA would cost $3.9 trillion through 2035. Failing to extend the SALT cap would increase that cost by $1.2 trillion, to $5.1 trillion.

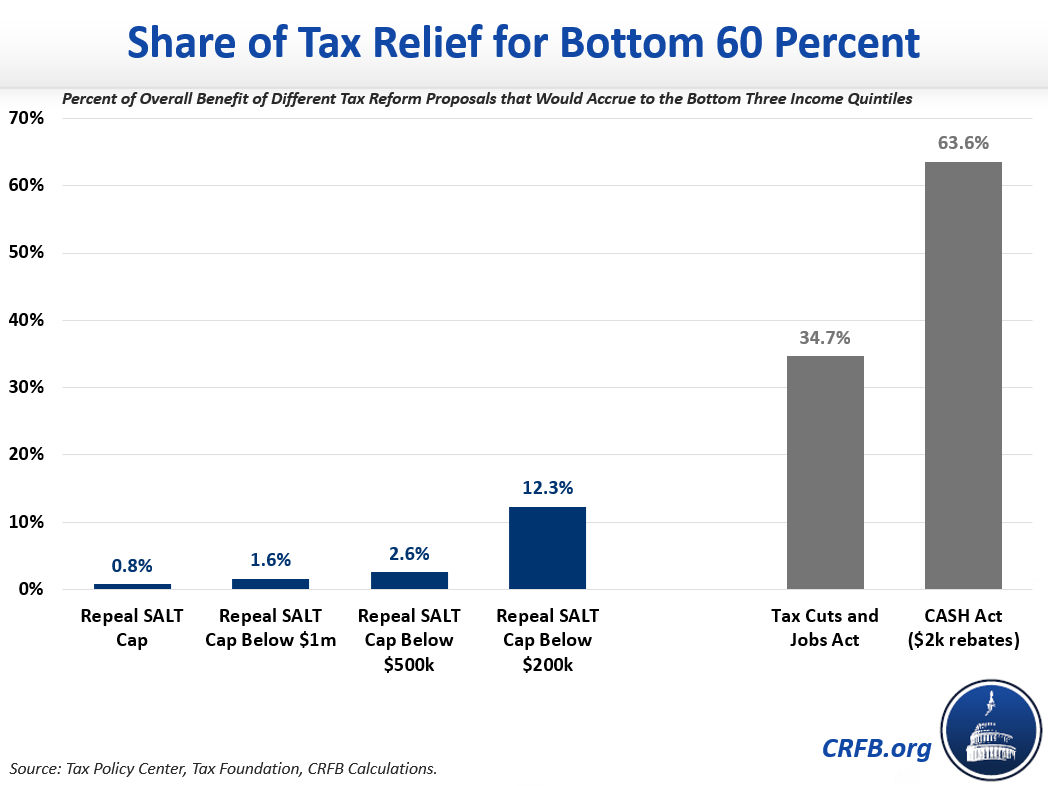

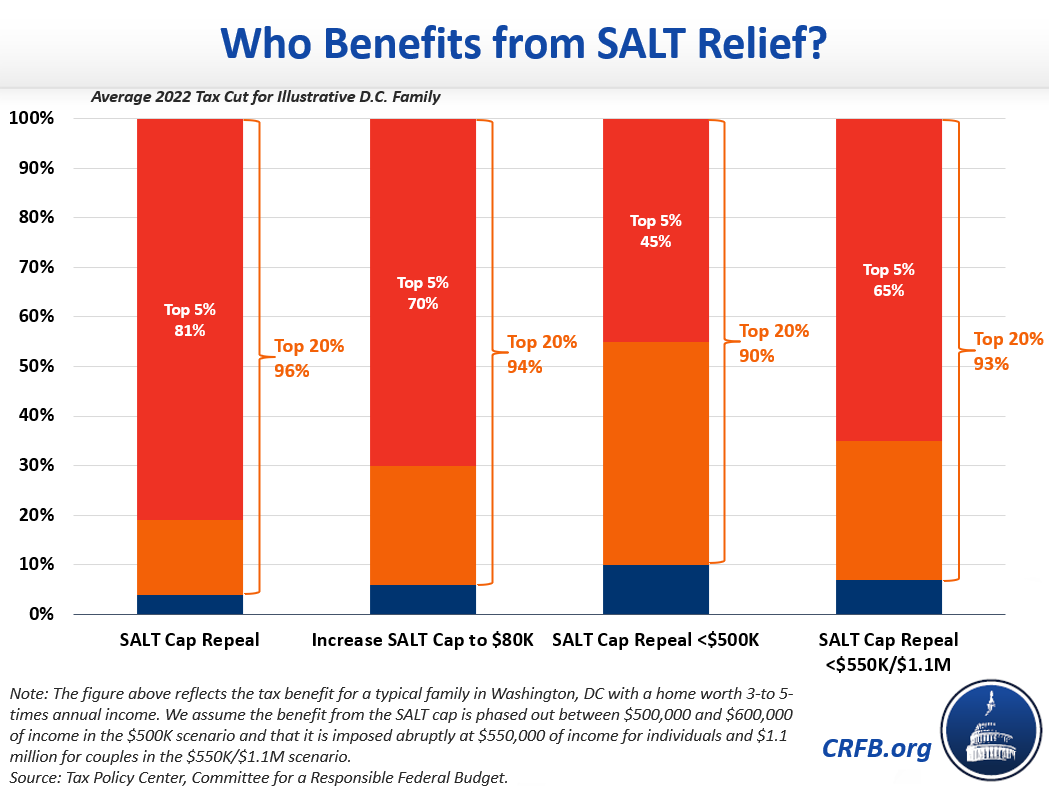

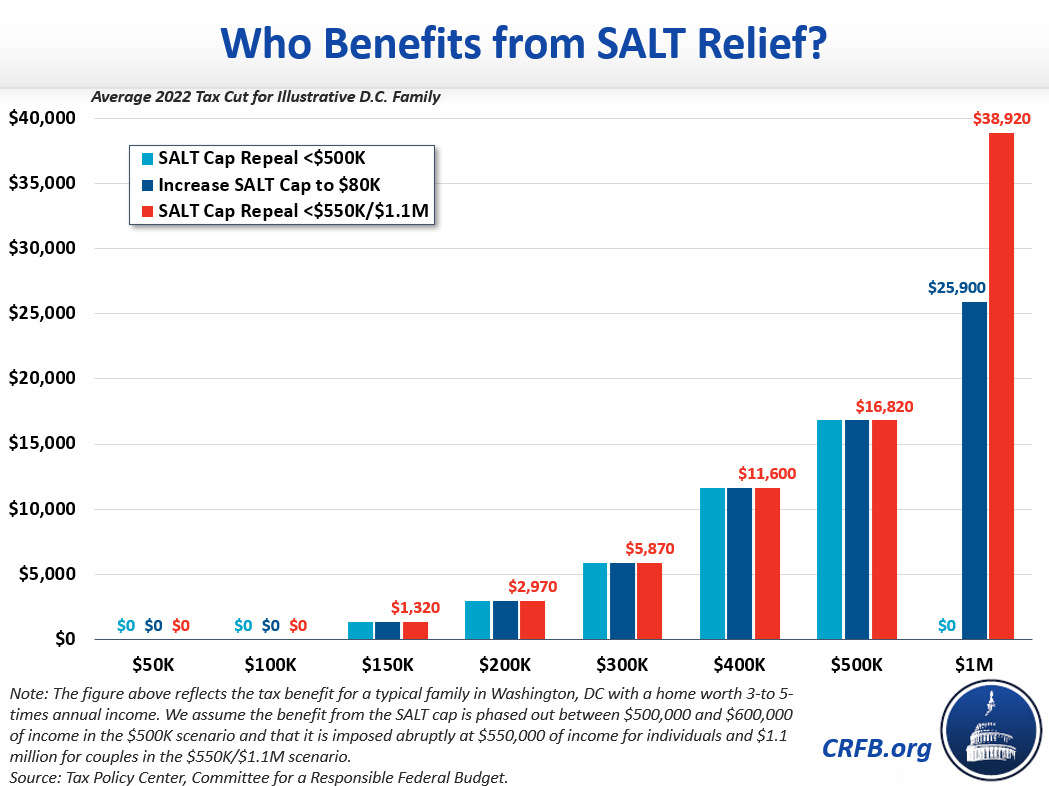

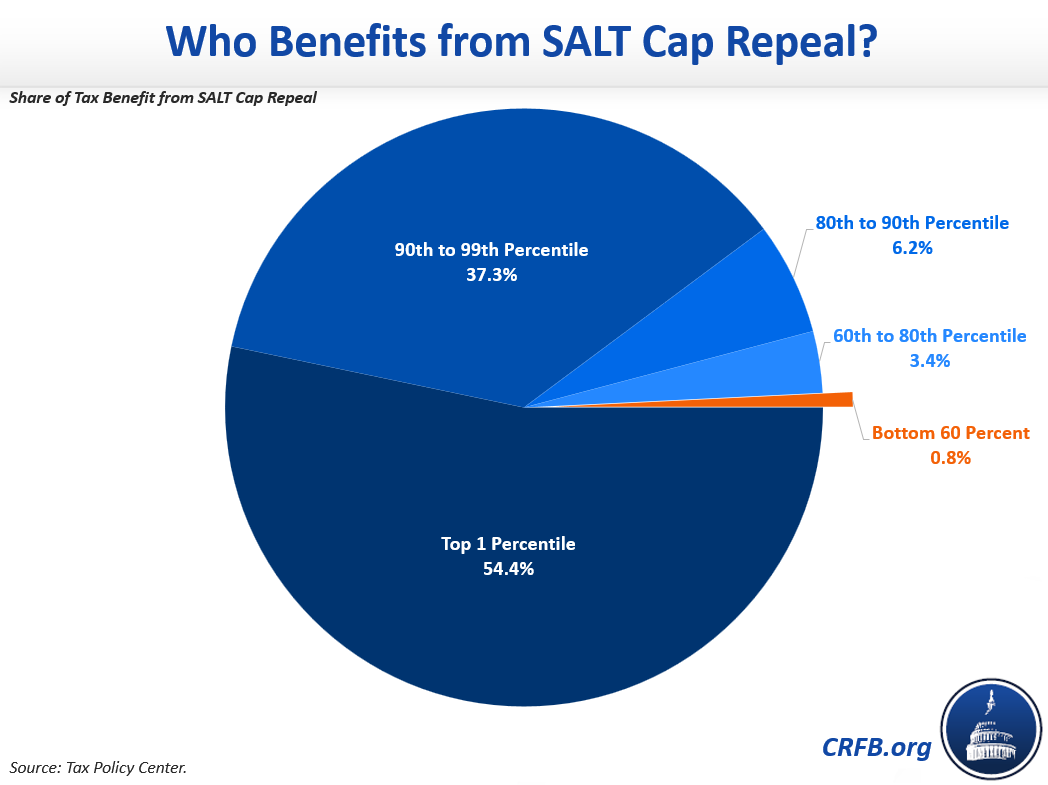

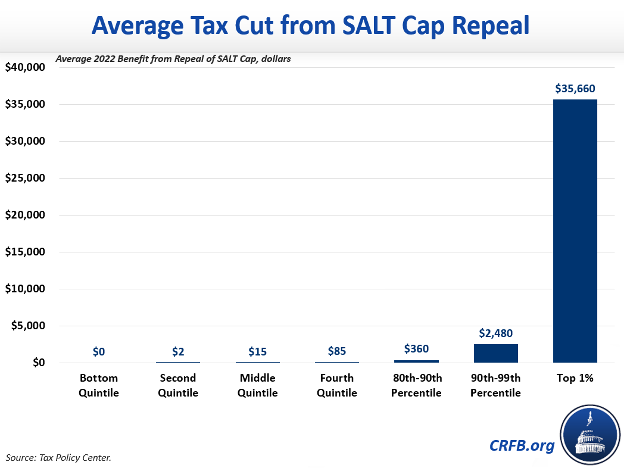

While extending or expanding the SALT cap could help finance parts of a TCJA extension, allowing the cap to expire would be costly, regressive, and potentially problematic from a tax policy perspective.

The Committee for a Responsible Federal Budget has produced numerous analyses related to the SALT cap and SALT cap repeal or revision. We list those below. To sign up for updates on other budget news, click here.

Analyses of SALT Cap Repeal

- Weakening the SALT Cap is Costly, Benefits High-Earners, & Increases Tax Complexity (1/29/2025)

- Weakening the SALT Cap Would be a Costly Mistake (1/9/2025)

- SALT Cap Expiration Could Be Costly Mistake (8/28/2024)

- Two-Thirds of the "One Percent" Get a Tax Cut Under Build Back Better, Due to SALT Relief (12/10/2021)

- Two-Thirds of Millionaires Get a Tax Cut Under Build Back Better, Due to SALT Relief (11/12/2021)

- Build Back Better SALT Gains for the Rich Eclipse Child Credit Boost (11/9/2021)

- 5-Year SALT Cap Repeal Would Be Costliest Part of Build Back Better (11/2/2021)

- Reconciliation May Deliver a Tax Cut to the Rich (10/29/2021)

- Repealing the SALT Cap Would be More Regressive than the TCJA (4/20/2021)

- Debt Cancellation and SALT Cap Repeal Would Benefit Higher Earners (1/11/2021)

- Loosening the SALT Cap is Poorly Targeted (3/31/2020)

- Repealing SALT Caps Would Cost Another $500 Billion (6/25/2019)

Analyses of SALT Cap Modifications

- Ways & Means Has Plenty of Deficit Reduction Options (5/5/2025)

- Options for Reducing the Revenue Loss of TCJA Extension (12/3/2024)

- Plans to Address TCJA Expirations (10/17/2024)

- New SALT Proposals Would Improve House Bill (12/13/2021)

- SALT Repeal Just Below $1 Million is Still Costly and Regressive (12/11/2021)

- "Revenue Neutral" SALT Cap Relief is Costly and Regressive (12/2/2021)

- SALT Cap Repeal Below $500k Still Costly and Regressive (11/19/2021)

- $72,500 SALT Cap is Costly and Regressive (11/3/2021)

- SALT Cap Repeal Does Not Belong in Build Back Better (10/25/2021)

- SALT Cap Repeal Would Be a Costly Mistake (9/10/2021)

- There is No Such Thing as Progressive SALT Cap Relief (7/7/2021)

Additional SALT-Related Analysis and Tools

- Build Your Own Tax Extensions (2024)

- TCJA Extension Could Add $4 to $5 Trillion to Deficits (6/13/2024)

- The State and Local Tax Deduction Should Be on the Table (10/11/2017)

- The Tax Break-Down: The State and Local Tax Deduction (8/20/2013)

Press Releases and Op-Eds

- Don’t Add SALT to the Tax Deal (1/31/2024)

- Marc Goldwein: There’s a baffling tax gift to the wealthy in the Democrats' social-spending bill (11/16/2021)

- SALT Cap Repeal Does Not Belong in Reconciliation (9/15/2021)

- Weakening the SALT Cap Would Be a Wasteful Giveaway During a Crisis (3/31/2020)

- Policymakers Should Reject Efforts to Weaken SALT Cap (10/23/2019)

Below are some key SALT related charts.

10-Year Changes in Revenue Based on SALT Adjustments

| Under Current Law | Under Extended TCJA | |

|---|---|---|

| Let SALT Cap Expire | N/A | -$1.2 trillion |

| Extend $10,000 SALT CAP | +$1.9 trillion | N/A |

| Extend SALT Cap Above $400k | +$1.3 trillion | -$410 billion |

| Extend SALT Cap, Loosened to $15k/$30k | +$1.1 trillion | -$530 billion |

| Fully Repeal SALT Deduction | +$2.3 trillion | +$240 billion |

| Close SALT Cap Workarounds | N/A | +$180 billion |

| Extend SALT Cap to Corporate Income Tax | +$210 billion | +$210 billion |

| Extend SALT Cap to Business Income Taxes, Closing SALT Cap Workaround | N/A | +$390 billion |

Share this graphic on Twitter and Facebook.

Share this graphic on Twitter and Facebook.

Share this graphic on Twitter and Facebook.

Share this graphic on Twitter and Facebook.