Debt Cancellation and SALT Cap Repeal Would Benefit Higher Earners

In her recent Washington Post column, Catherine Rampell argues progressives should “be more progressive in an old-fashioned sense: by helping the poor more than the rich.”

Rampell argues against three policies that are “handouts to the wealthy” — the repeal of the limit of the federal deductibility of state and local taxes (the SALT cap), canceling up to $50,000 per borrower of federal student debt, and the proposed $2,000 stimulus checks.

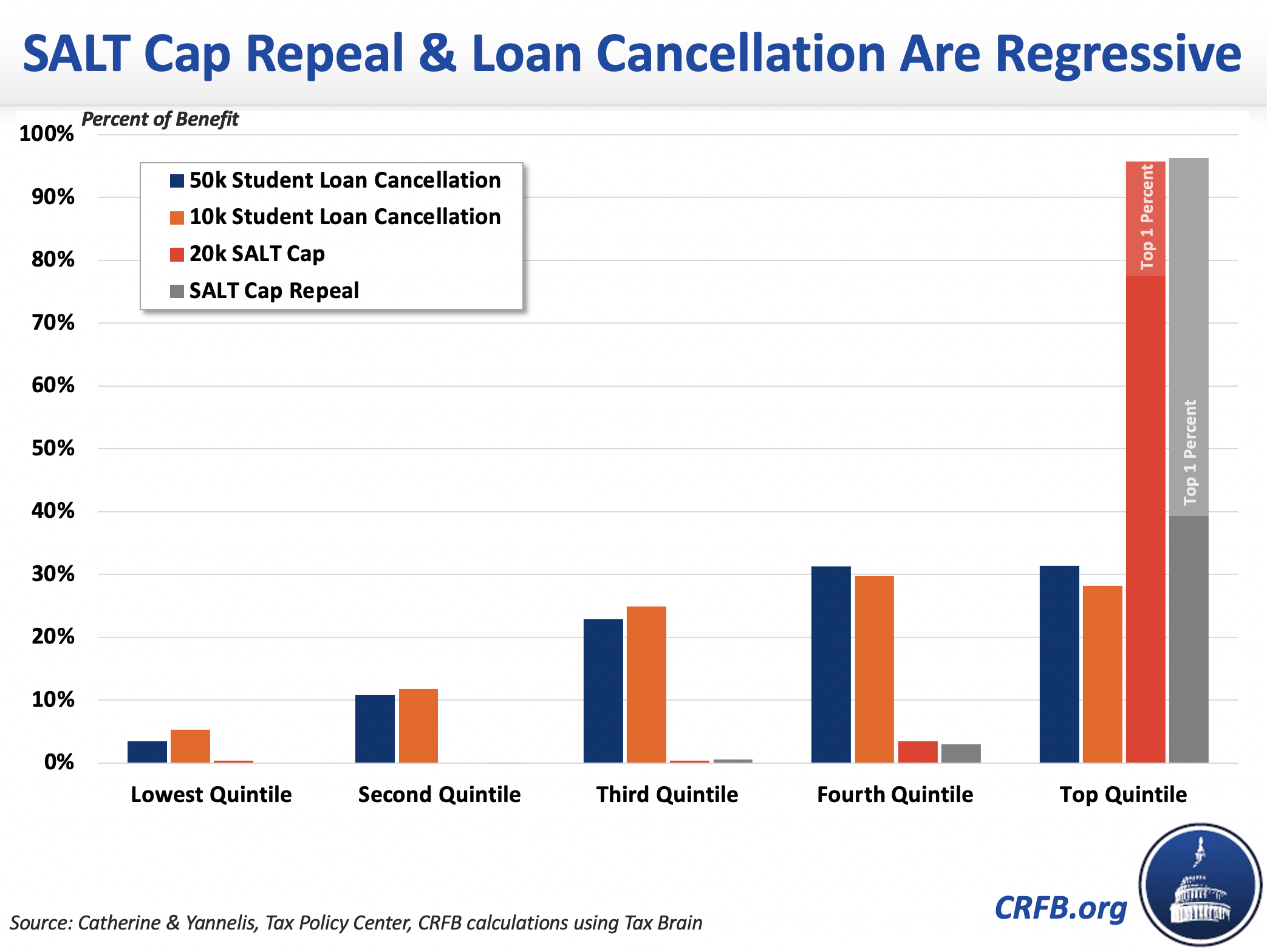

Rampell’s description of the $50,000 in student debt cancellation and SALT cap repeal is apt — the vast majority of the benefits of these policies would go to the highest earning families (we’ve written separately on the distribution of the $2,000 checks here).

Nearly two-thirds of the benefit of canceling $50,000 in student debt per person would go to the top 40 percent of households and over three-tenths would go to the top quintile, according to a recent paper by Sylvain Catherine and Constantine Yannelis. Less than 5 percent would go to the bottom quintile. They estimate an average net lifetime benefit of $5,775 for someone in the top quintile and only $731 for someone in the bottom.

SALT cap repeal is even more regressive. The Tax Policy Center estimates that 96 percent of the benefit of repealing the $10,000 cap on the state and local tax deduction would go to the top quintile. 57 percent would go to the richest one percent of taxpayers. Those at the top would enjoy an average tax cut of $31,000 — while the average taxpayer would see no tax cut at all (the average cut in the middle quintile would be $10).

Even efforts to better target these policies don’t appear to fundamentally change their regressive nature. Catherine and Yannelis find that capping debt cancellation at $10,000 per household would still distribute 28 percent of the benefits to the top quintile and only 5 percent to the bottom. Similarly, doubling the SALT cap to $20,000 rather than repealing it still delivers over 95 percent of the benefit to the top quintile and almost none to the bottom half of earners, based on estimates using Tax Brain.

This type of targeting can reduce the benefit of these policies for the very wealthiest Americans, but still offers little benefit to the vast majority of lower-earning and middle-class borrowers and taxpayers.

In her piece, Rampell argues that “in the new year, under a new president, Democrats should remember their obligation to aim their fiscal firepower at those who need it most.” There are many effective ways to boost the economy and support struggling households during the current crisis. Repealing the SALT cap or offering blanket debt cancellation are expensive, regressive polices, offer little bang for the buck, and most certainly do not qualify.

Read more options and analyses on our SALT Deduction Resources page.