Unpaid-for TCJA Extension Would Shrink the Economy, CBO Says

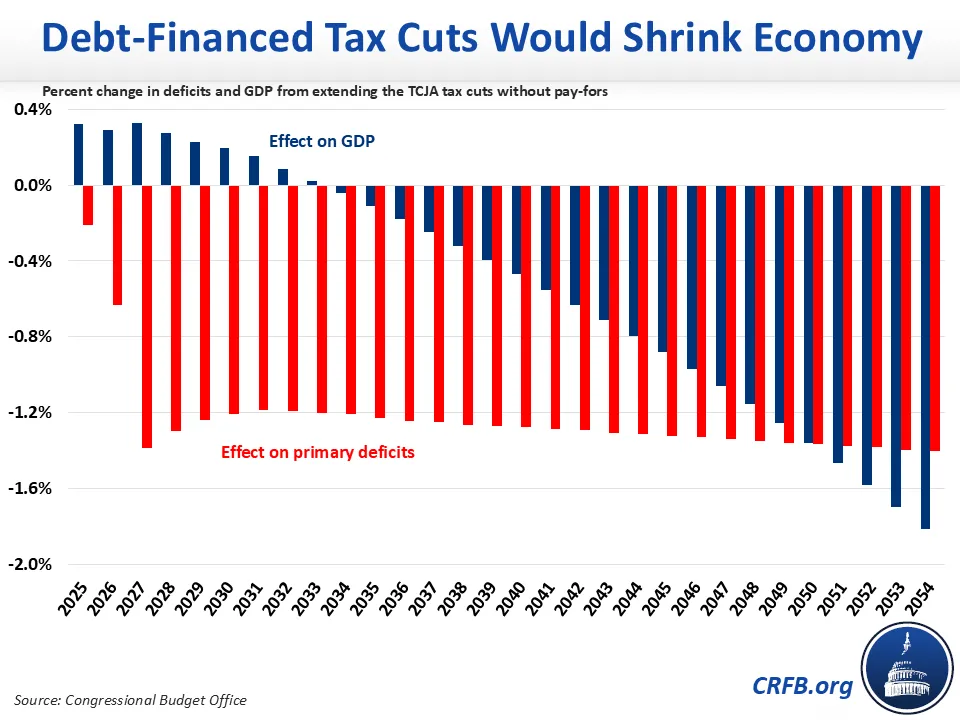

In a recent long-term analysis, the Congressional Budget Office (CBO) found that extending the 2017 Tax Cuts and Jobs Act (TCJA) would not only increase the national debt by $37 trillion over thirty years, but also shrink the economy by 1.8 percent by 2054. That is because the positive economic impact from lower taxes is ultimately negated by the negative effects of higher debt.

CBO finds that “economic growth would be faster in the first several years after the extension of the tax provisions and slower over the longer term,” as the harms of the deficit-financed tax cuts begin to outweigh their benefits. Assuming the extension of expiring individual and business provisions – including a revival of bonus depreciation – they find:

- While TCJA extension would increase the size of the economy by an average of 0.3 percent through 2027, it would begin subtracting from growth in 2028 and overall shrink the economy in 2034 and beyond.

- By 2054, the economy would be 1.8 percent smaller as a result of TCJA extension – a $1.5 trillion yearly reduction in nominal output.

- By 2051 or sooner, TCJA extension would shrink the economy by more than it reduces taxes, suggesting extension would ultimately reduce after-tax income.

This latest report is a reminder that while tax cuts can spur economic growth, financing tax cuts with debt can cause harms that often outweigh the benefits. As interest costs surpass to record highs, deficit reduction, not deficit spending, is the best path to long-term economic growth.

CBO Finds TCJA Extension Will Shrink the Long-Term Economy

In general, tax cuts can boost the economy by stimulating demand and increasing incentives to work, save, and invest. But higher debt can constrain economic growth by pushing up interest rates, crowding out private investment, and thus reducing potential output. In the case of TCJA extension, CBO finds that there will be net positive economic effects for almost a decade, but the negative effects will predominate beyond that.

The near-term macroeconomic benefits of tax cuts are notable. CBO expects the economy will be about 0.3 percent larger in 2025 through 2027 and remain above baseline through 2033. TCJA adds to growth this year and then begins to subtract from growth beginning in 2028.

Over time, however, CBO finds that the added government debt from extending the TCJA will raise interest rates throughout the economy, making it more costly for businesses and households to borrow money and invest over the long term. As more government debt enters the marketplace, investors raise the amount they charge the government to hold the debt. Rising government debt “crowds-out” funding that could go to private debtors, increasing the interest rate that private businesses and consumers must pay for the investors to hold their debt. Higher interest rates and expensive private credit hurts economic growth. As a result the tax cuts begin to subtract from growth rates beginning in 2028 and shrink the economy overall in 2034 and beyond. By 2044, CBO estimates the economy will be 0.8 percent smaller than it would have been without the tax cuts, and by 2054 it will be 1.8 percent smaller than without the tax cuts.

After 2050, estimated GDP loss is actually larger than the overall tax cut. This implies that TCJA extension will ultimately reduce rather than increase after-tax incomes, despite Americans paying less in taxes. Although aggregate after-tax income would not fall until late in the budget projection window, many households would experience income loss in excess of their tax cuts much earlier.

Actual harm could be even larger. If interest rates rise 1 percentage point more than CBO anticipates by 2044, CBO estimates the economy would be 3.5 percent smaller by 2052, more than double the base scenario.

Other Estimates Find Similar Long-Term Harm

CBO is not the only estimator to find negative economic effects from extending the TCJA primarily using deficit financing. Penn Wharton Budget Model released a slightly different analysis of extending the TCJA, along with $1.7 trillion in spending cuts, plus Trump tax policy proposals like ending income taxation of tips and overtime pay. They find that a permanent, mostly deficit-financed package along these lines would shrink the economy by 0.3 to 0.5 percent by 2034, and would shrink it by 1.6 to 1.7 percent by 2054. Yale Budget Lab similarly finds that extending the TCJA would grow the economy by 0.4 percent over the short term, but that the extension would begin to subtract from growth starting in 2028. Yale’s model shows that the effects of greater debt similarly would counteract the positive economic effects of tax cuts and increasingly decrease growth over the long term.

Notably, several other estimates which look at only the ten-year effect of TCJA on the economy have found somewhat more positive results. Nonetheless, we would expect any macroeconomic estimates which incorporate the impact of debt to show declining gains over time and – likely – a smaller economy over the long-run.

CBO’s report is a reminder that economic growth is not a given from passing tax cuts. Growing debt can shrink the economy by more than the growth boost from a tax cut. If policymakers want to sustainably grow the economy they should pass a pro-growth tax cut that is paid for by cutting spending and tax expenditures. We have compiled policy changes amounting to tens of trillions in potential pay-fors for tax cuts in our Budget Offsets Bank.