Tax Cut Extensions Would Add $37 Trillion to Debt by 2054

In a recent letter, the Congressional Budget Office (CBO) estimated that extending and reviving various provisions from the Tax Cuts and Jobs Act (TCJA) would boost debt in Fiscal Year (FY) 2054 from 166 percent of Gross Domestic Product (GDP) under CBO’s March 2024 baseline to 214 percent of GDP, on a dynamic basis.

Based on these estimates, we find that extending the TCJA would add over $37 trillion to the debt over the next 30 years, including $4.5 trillion over the next ten years and $15.0 trillion over the next 20 years. In real 2031 dollars – adjusted for inflation to be roughly comparable to the ten-year score – we estimate the extensions would add $23.5 trillion to the deficit over the next three decades, the equivalent of 2.4 percent of GDP.

Fiscal Impact of Extending TCJA

| 10-Year | 20-Year | 30-Year | |

|---|---|---|---|

| Total Impact on Deficit (with Interest) | |||

| Nominal Dollars | +$4.5 trillion | +$15.0 trillion | +$37.2 trillion |

| Real (2031) Dollars | +$4.3 trillion | +$11.6 trillion | +$23.5 trillion |

| Share of GDP | +1.3% | +1.8% | +2.4% |

| Change in Debt as a Share of GDP | +11.0% | +26.4% | +47.5% |

| Impact on Primary Deficits | |||

| Nominal Dollars | +$3.9 trillion | +$10.4 trillion | +$20.4 trillion |

| Real (2031) Dollars | +$3.9 trillion | +$9.4 trillion | +$16.3 trillion |

| Share of GDP | +1.1% | +1.2% | +1.3% |

Sources: CRFB estimates based on CBO data, including dynamic feedback.

Note: CBO's March 2024 projections of growth in the GDP Price Index are used for calculating "Real Dollars" figures.

As lawmakers debate what to do about the expiring provisions of the TCJA, it is important to consider the long-term implications of their decision. This is especially true as they consider whether to adopt a “current policy baseline” for scoring tax changes – which might allow them to circumvent the Byrd rule prohibition on adding to deficits beyond the budget window.

CBO considered a set of changes that would extend all expiring individual and estate tax changes from the TCJA, continue certain corporate provisions scheduled to change over the next year, and revive 100 percent bonus depreciation for equipment. Incorporating dynamic effects on revenue but not interest rates, these changes would increase primary deficits by $3.9 trillion through FY 2034, by $10.4 trillion through 2044, and by $20.4 trillion through 2054. With interest – accounting for both debt service and the upward pressure on interest rates resulting from higher debt – the extensions would boost deficits by $4.5 trillion through 2034, $15.0 trillion through 2044, and $37.2 trillion through 2054.

However, it is important to note that nominal numbers are of limited use in the distant future, as the value of a dollar erodes over time due to inflation. Converting to “real” dollars by accounting for expected inflation can help provide further perspective on these figures. In inflation-adjusted 2031 dollars – the measure that is most consistent with ten-year nominal scores – the revenue loss from full TCJA extension would amount to $3.9 trillion over ten years, $9.4 trillion over 20 years, and $16.3 trillion over 30 years. With interest, the impact would be $4.3 trillion over ten years, $11.6 trillion over 20 years, and $23.5 trillion over 30 years.

As a share of GDP, the tax cut extensions would increase primary deficits by 1.1 percent of GDP over ten years, by 1.2 percent over 20 years, and by 1.3 percent over 30 years. They would increase total deficits by 2.4 percent of GDP over 30 years. By FY 2054, primary deficits would be 1.5 percent of GDP higher as a result of the tax cut extensions, and total deficits would be 3.8 percent of GDP higher. Debt as a share of GDP would be 47.5 percentage points higher by 2054 as a result of the tax cuts.

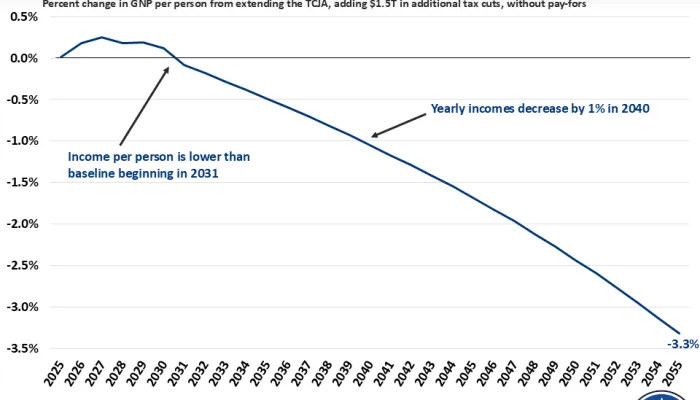

Importantly, these figures incorporate dynamic feedback effects on revenue, interest costs, and GDP itself. While CBO finds the TCJA extensions would boost output over the next decade, they find that the higher debt load from deficit-financed extension would negatively impact the economy over the long run while also pushing up interest costs. By FY 2054, CBO estimates that GDP would be 1.8 percent smaller and the average interest rate on federal debt would be 29 basis points higher relative to its baseline scenario.

To avoid the negative economic and fiscal impact of TCJA extensions, lawmakers should limit extensions to the most important and pro-growth elements of TCJA, make thoughtful and fiscally responsible adjustments to the tax cuts, and couple any net tax cuts with enough offsets to pay for the costs and lower debt. The House budget resolution’s inclusion of spending cuts represents a start, but it would still allow $2.8 trillion to be added to primary deficits – more than 70 percent of the impact of full extension. Instead, reconciliation should aim to reduce deficits.