New SALT Proposals Would Improve House Bill

So far, nearly every proposal introduced or suggested to change the state and local tax (SALT) deduction cap would be unnecessarily costly and regressive. However, two new proposals – one from Representative Jared Golden (D-ME) and the other modeled by the Tax Policy Center (TPC) – represent significant improvements. Though there are issues with almost any changes to the SALT cap, these proposals – the Golden proposal in particular – would dramatically reduce costs and regressivity relative to the proposal included in the House-passed version of the Build Back Better Act.

The first proposal, modeled by TPC, would increase the current $10,000 SALT deduction cap to $25,000 for those making up to $400,000 per year. The cap would then be phased back down to $10,000 for those earning between $400,000 and $500,000 per year in Adjusted Gross Income (AGI).

The second proposal, suggested by Golden in the Washington Post, would fully repeal the $10,000 SALT deduction cap but only for those making less than $175,000 per year. According to Golden, this would help “the small number of truly middle-class families who benefit from the deduction” by lifting the cap for “essentially the bottom 80 percent of households in the country.” We assume the cap would be phased back in between $175,000 and $225,000 of income – though policymakers could consider a different phase-in.

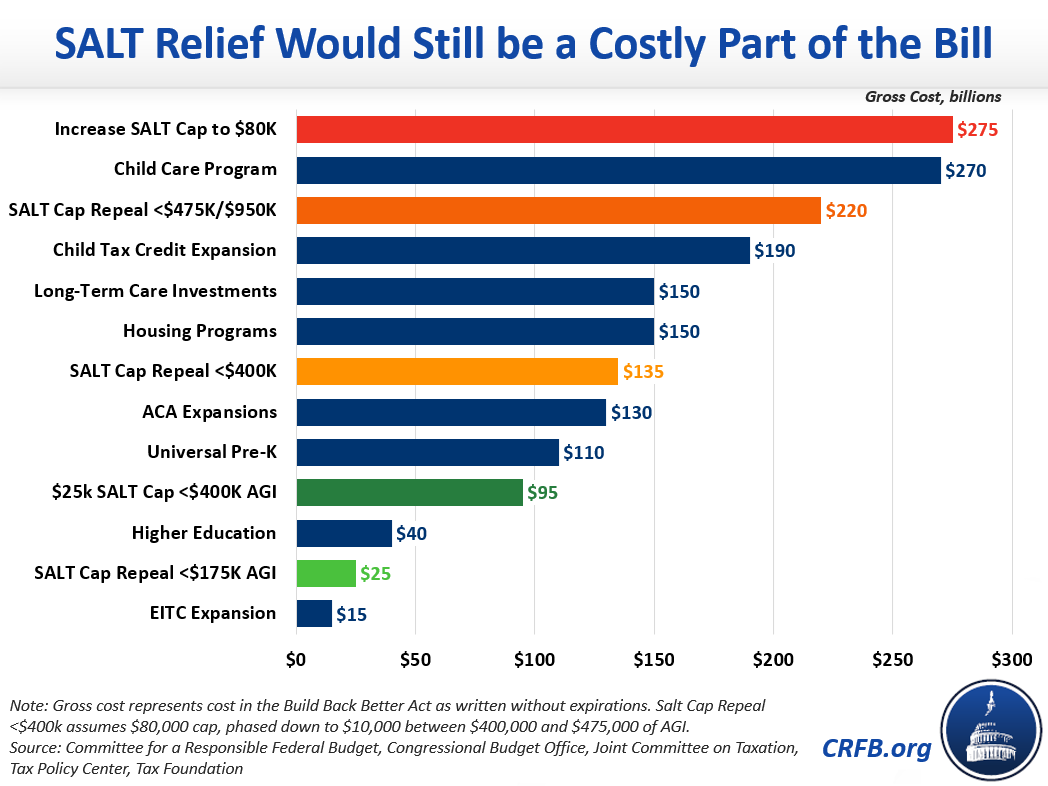

Based on TPC data, we estimate increasing the cap to $25,000 for those earning up to $400,000 would cost roughly $95 billion, with 36 percent going to the top 5 percent of households by income and 86 percent going to the top quintile. By comparison, the House proposal to lift the cap to $80,000 would cost $275 billion, with 70 percent going to the top 5 percent of earners and 94 percent to the top quintile.

The Golden proposal would do even better than the plan TPC modeled. Based on our very rough estimates, it would cost only $25 billion, with none of the benefit going to the top 5 percent and only 35 percent going to the top quintile.

Neither of these proposals would provide much benefit to those in the bottom 60 percent of the income spectrum; households in the middle quintile would receive an average tax cut of only $20. However, both proposals would limit the tax cut for high-income households (and especially the Golden proposal).

In Washington, D.C., as an illustrative example, the SALT relief proposal included in the House-passed Build Back Better Act would provide a $3,000 tax cut to a household making $200,000 per year, a $11,600 tax cut to a household making $400,000, and a $25,900 tax cut to a household making $1 million. The TPC-modeled proposal would provide the same benefit to the household making $200,000 but less than $5,000 for the household making $400,000 and nothing for households making $500,000 or more. Meanwhile, the Golden proposal (with our assumed phase-out) would provide nearly $1,500 for a household making $200,000 and no additional tax cut for households earning over $225,000 per year.

Though few households making below $150,000 per year would benefit from any form of SALT cap relief, those who do would receive the full benefit of the SALT deduction under both these proposals. Unlike the House proposal, neither the Golden nor the TPC-modeled proposal would offer benefits to families in the top 2 percent of earners or to those making $500,000 per year or more.

These proposals would also cost significantly less than the version included in the House-passed Build Back Better Act. While lifting the SALT deduction cap to $80,000 would cost $275 billion over five years, lifting it to $25,000 for those earning up to $400,000 per year would cost roughly $95 billion. Furthermore, restricting SALT cap relief to those making under $175,000 (with partial relief up to $225,000) would cost only $25 billion. These costs would be much more manageable and would represent a much smaller part of the Build Back Better Act relative to other SALT cap relief proposals.

There is no such thing as progressive SALT cap relief, and any version of SALT cap relief would not benefit a significant swath of the middle class. Increases in the SALT deduction cap also lose revenue, increase tax complexity, and undermine tax neutrality.

However, these new plans – and the Golden plan in particular – would limit unnecessary tax cuts for the rich while providing benefits to middle-class families. If SALT cap relief must be part of the Build Back Better Act, either of these new proposals could present a reasonable, better path forward.

Read more options and analyses on our Reconciliation Resources page and our SALT Deduction Resources page.