SALT Cap Repeal Below $500k Still Costly and Regressive

According to press reports, the Senate is considering repealing the $10,000 cap on the state and local tax (SALT) deduction for those making $500,000 per year or less. This would be in place of the House plan to lift the cap to $80,000 through 2030 and reinstate it at $10,000 for 2031. While the rumored Senate proposal would cut taxes less for the very rich than the House proposal, it would nonetheless remain costly and regressive.

Depending on the details, we estimate eliminating the SALT deduction cap for those earning $500,000 or less would cost $150 billion to $200 billion over five years. Furthermore, the largest benefits would be distributed to households with more than $500,000 of annual income – many with millions of dollars in wealth.

Though this new proposal has not been formally modeled, our rough estimate suggests 90 percent of the benefit would go to those in the top fifth of the income spectrum, with roughly half of that going to those in the top 5 percent. This is substantially less skewed to the rich than full SALT cap repeal or the House proposal to raise the SALT cap to $80,000, but it is still quite regressive. Only a tenth of the benefit would go to households in the bottom 80 percent – those making less than $180,000 per year. The average taxpayer would see only a $20 per year benefit.

Because the value of the SALT deduction grows with income, the largest benefit would go to those with $500,000 of Adjusted Gross Income (AGI) – or perhaps somewhat above that if there is a phase out. When considering retirement account contributions and other income adjustments, that means the largest benefits may go to households with as much as $600,000 of pre-tax income and millions of dollars in assets.

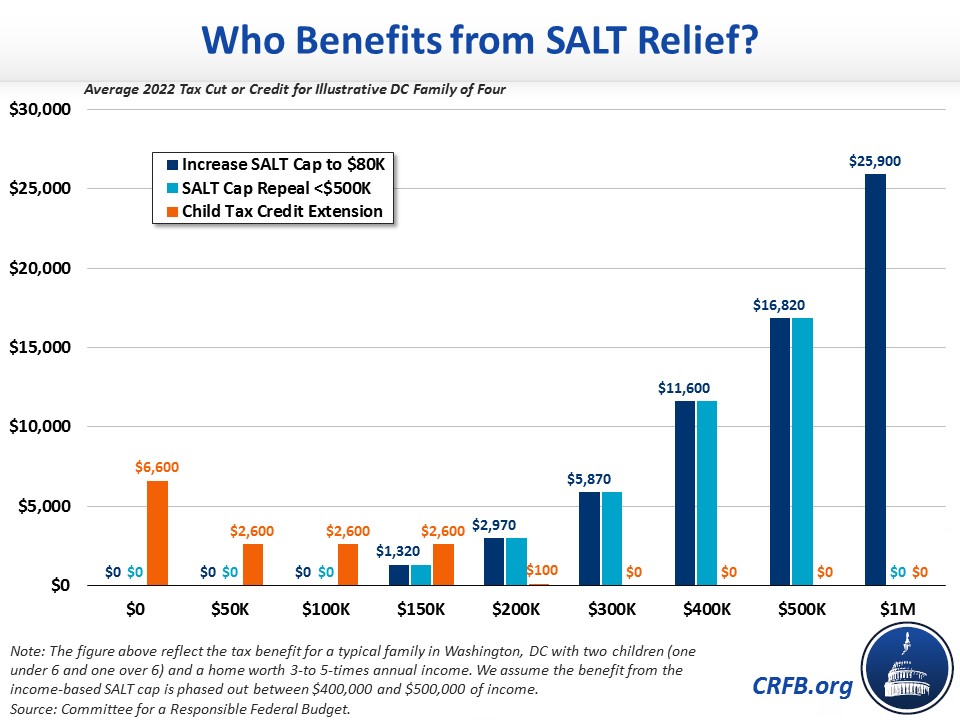

Unlike the House proposal to lift the cap to $80,000, this would not deliver a benefit to many households with over $1 million of income. But it would deliver a benefit of $16,820 to a typical Washington, DC family with an AGI of $500,000, compared to $5,870 to a family with $300,000 of income, and $1,320 for a family with $150,000 of income and a $750,000 home. Less than 5 percent of DC households with income below $150,000 would receive any benefit from SALT cap repeal, a figure that is even lower nationally. Meanwhile, a typical family of four might enjoy a $2,600 tax cut from extension of the expanded Child Tax Credit (CTC) in 2022 under the Build Back Better Act.

In other words, a household making $500,000 per year would receive a tax cut from SALT relief approximately 6.5 times as large than the benefit a middle-class family might receive from extension of the expanded CTC. Since SALT cap relief would last for five years and the CTC increase for only one, a household making $500,000 per year would receive 32 times as large a tax cut from SALT over five years as a typical family would from the CTC expansion.

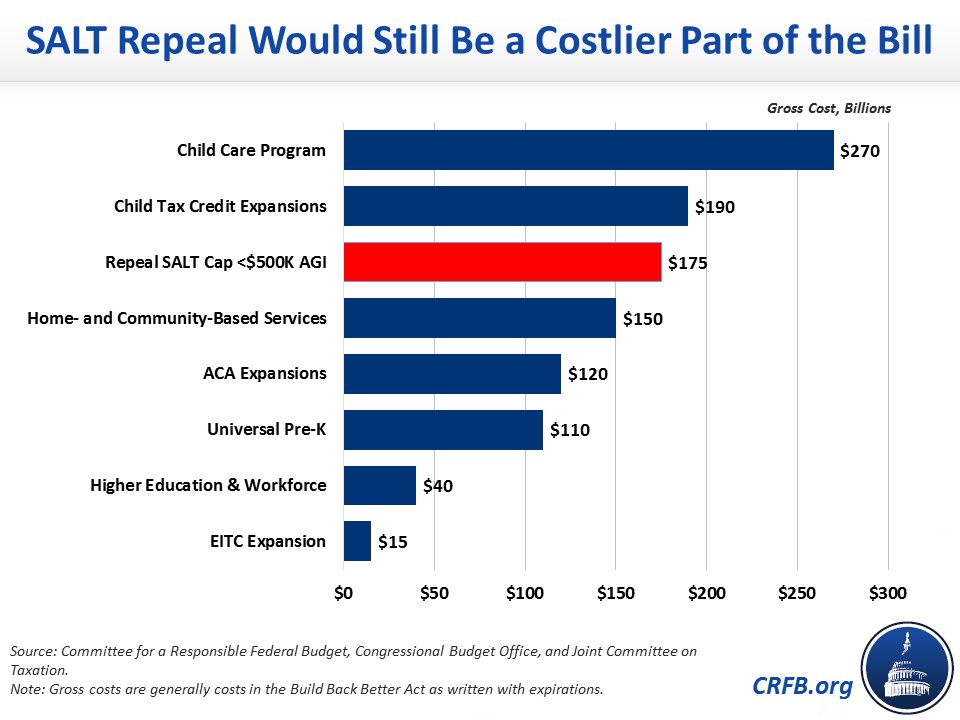

SALT cap repeal would also be one of the costliest parts of Build Back Better. Assuming $175 billion of costs (the midpoint of our range), it would be larger than spending on universal pre-K, long-term care, expansions of the Affordable Care Act, and higher education and workforce investments.

While such a repeal would presumably be "paid for" on paper by extending the cap for those earning more than $500,000 beyond its current expiration date of 2025, this offset is largely a shell game that would increase the cost of future tax changes (we’ll write more on this soon).

Overall, repealing the SALT deduction cap for those making less than $500,000 would be less costly and less regressive than lifting the cap to $80,000. However, it's still incredibly costly and regressive, with the largest benefit going to multi-millionaires making $500,000 per year or more.

SALT cap relief does not belong in Build Back Better.

Read more options and analyses on our Reconciliation Resources page and our SALT Deduction Resources page.