SALT Cap Expiration Could Be Costly Mistake

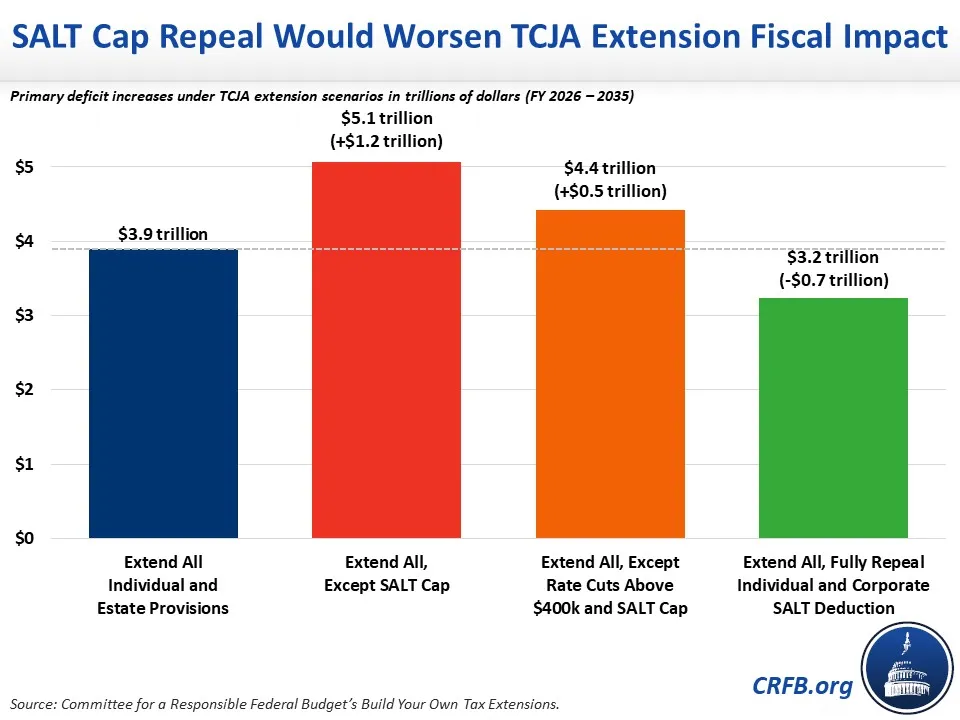

Some policymakers have suggested allowing the $10,000 cap on the State and Local Tax (SALT) deduction to expire as scheduled at the end of 2025. We estimate this would increase the cost of extending the 2017 Tax Cuts and Jobs Act (TCJA) by $1.2 trillion over a decade. This would largely or more than fully offset any revenue gains from allowing the TCJA tax cuts to expire for those making above $400,000 per year.

Prior to the TCJA, many taxpayers could subtract their state and local income and property taxes from their reported taxable income – although this deduction was not available to those paying the alternative minimum tax (AMT). The TCJA eliminated the AMT for most taxpayers and capped the SALT deduction at $10,000 per household; these changes as well as many other individual and estate provisions are set to expire at the end of 2025.

As we’ve shown before, repealing the SALT cap would be costly, distortionary, and regressive. Roughly 92 percent of the tax cut would go to households in the top 10 percent of earners, and less than 1 percent would go to the bottom 60 percent.

Even with the SALT cap in place, extending the TCJA could substantially increase deficits; allowing the SALT cap to expire would substantially increase the potential revenue loss.

While a strict extension of the TCJA’s expiring individual and estate tax provisions would increase deficits by $3.9 trillion (excluding interest) through 2035, extending the TCJA while letting the SALT cap expire would increase deficits by $5.1 trillion. These estimates are based on our Build Your Own Tax Extensions tool.

The additional revenue loss from letting the SALT cap expire could outweigh the effects of allowing some TCJA tax cuts above $400,000 to expire, as some policymakers have proposed.

For example, a TCJA extension that sets the top tax rate to 39.6% on income above $400,000 ($450,000 for couples) as proposed in the President’s budget while also letting the SALT cap expire would add $4.4 trillion to the deficit over a decade – roughly $500 billion more than the cost of a full extension.

If the increase to the estate tax exemption was allowed to expire as well, the deficit impact would drop to $4.2 trillion – still $300 billion more than full extension.

Fiscal Impact of Various TCJA Extension Scenarios

| Primary Deficit Impact (FY 2026-2035) |

Primary Deficit Impact Beyond Full Extension |

|

|---|---|---|

| Extend all individual and estate provisions | $3.9 trillion | - |

| Extend except SALT cap | $5.1 trillion | +$1.2 trillion |

| Extend except rate cuts above $400k and SALT cap | $4.4 trillion | +$0.5 trillion |

| Extend except rate cuts above $400k, estate tax cut, and SALT cap | $4.2 trillion | +$0.3 trillion |

| Extend except rate cuts and 199a above $400k, estate tax cut, and SALT cap | $3.8 trillion | -$0.1 trillion |

| Extend except rate cuts, AMT cut, Pease cut, and 199a above $400k; estate tax cut; and SALT cap | $3.3 trillion | -$0.6 trillion |

| Extend individual and estate provisions, but repeal SALT deduction for households and businesses | $3.2 trillion | -$0.7 trillion |

| Extend individual and estate provisions, but let SALT cap expire and revive ARP child tax credit | $6.2 trillion | +$2.3 trillion |

Source: Committee for a Responsible Federal Budget's Build Your Own Tax Extensions.

To bring the revenue loss below that of full extension, policymakers would need to also phase out the 20 percent pass-through deduction (199a) above $400,000. And to meaningfully reduce the revenue loss, they would need to restore the AMT and Pease limitation above $400,000 – this could bring the loss to $3.3 trillion.

A $3.3 to $5.1 trillion revenue loss would significantly worsen our nation’s fiscal picture, increasing debt by 9 to 14 percent of Gross Domestic Product (GDP) by 2035 if not offset. With debt already approaching record levels and rising unsustainably, this could prove a costly mistake for the budget and economy.

Instead of letting the SALT cap expire, lawmakers should consider strengthening it. Simply closing existing SALT cap workarounds would reduce the revenue loss from TCJA extension by about $200 billion, by our estimates. Fully repealing the SALT deduction for individuals and corporations in addition to addressing workarounds would reduce the loss by roughly $700 billion.

Even with these reforms, a full extension would significantly worsen our fiscal situation. Lawmakers should not extend the TCJA without a plan to – at a minimum – offset the costs of extension, but ideally the plan would raise revenues relative to current law and help put the nation’s debt on a better trajectory. A variety of plans have been put forward to address the TCJA’s expirations in a fiscally responsible way, and policymakers can create their own plan (or understand the effects of others’ plans) with our Build Your Own Tax Extensions tool.