Build Back Better SALT Gains for the Rich Eclipse Child Credit Boost

The current version of the Build Back Better Act under consideration in the House would increase the state and local tax (SALT) deduction cap from $10,000 to $80,000 through 2026 while increasing the child tax credit from $2,000 per child to $3,000 per child (and $3,600 per child under 6) for 2022 and make it fully refundable. As we have pointed out many times, there is no such thing as progressive SALT cap relief. Roughly 98 percent of the benefit from the increase would accrue to those making more than $100,000 per year, with more than 80 percent going to those making over $200,000.

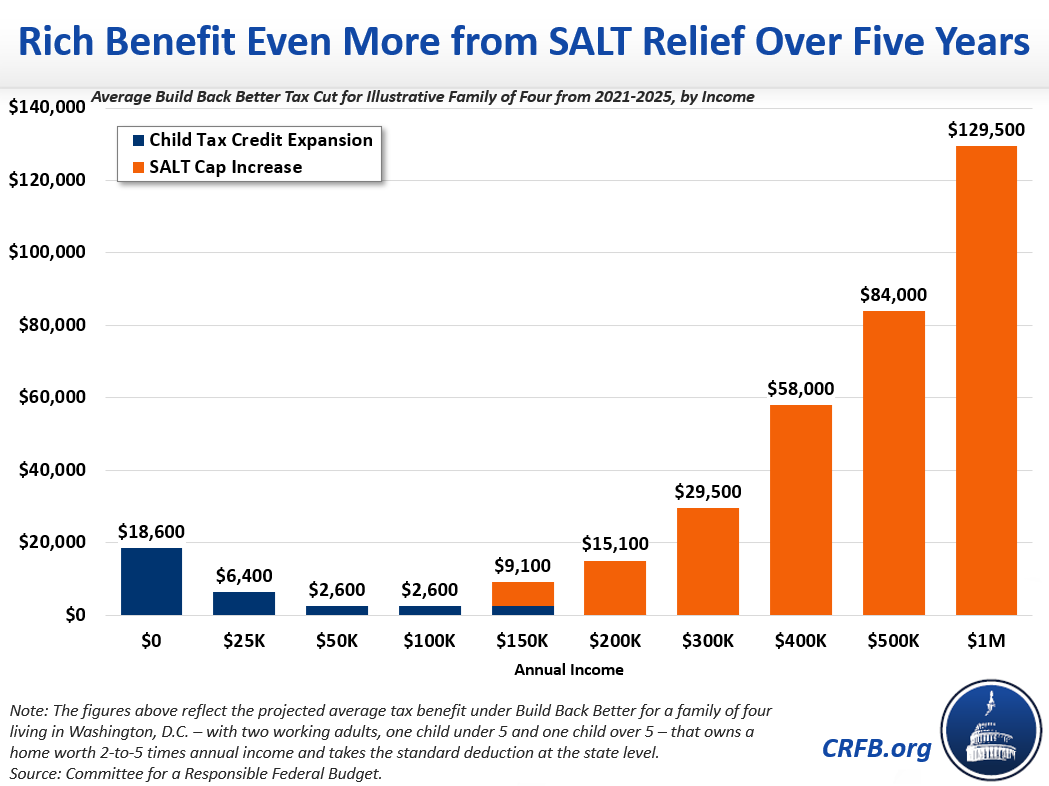

One way to illustrate this distribution is to compare the benefit of SALT cap relief to the benefit of the expanded child tax credit. Under the current House bill, most high-income households will receive more tax cuts from SALT cap relief than low-income and middle-class households will receive from the expanded child tax credit.

The below graph illustrates the tax benefit of a family of four in Washington, D.C. next year. We find that a household making $1 million per year will receive ten times as much from SALT cap relief as a middle-class family will receive from the child tax credit expansion.

This illustrative family of four with little-or-no income will benefit from a $6,600 increase in their child tax credit. Most other families making less than $150,000 per year will enjoy a $2,600 increase in their child tax credits. On the other hand, a family making $300,000 per year will enjoy a $5,900 tax cut from SALT cap repeal, a family making $500,000 will receive a $16,800 tax cut, and a family making $1 million per year will enjoy a $25,900 tax cut.

The difference is far more stark looking over a 5-year period – since the full child tax credit expansion lasts only one year and SALT cap relief continues until the Tax Cuts and Jobs Act (TCJA) expires in 2026.1

The illustrative family with no income will enjoy an $18,600 increase in child tax credits, and a family with roughly $25,000 of income will receive a $6,400 increase.2 Most others making less than $150,000 will enjoy a $2,600 tax cut from the expanded credit. On the other hand, families making $300,000 will enjoy $29,500 in benefits from SALT cap relief, and families making $1 million will receive $129,500 over five years.

In other words, the benefit of SALT cap relief for millionaires under Build Back Better will be nearly 50 times as large as the benefit of the expanded child tax credits for a typical family over five years.

Overall, the 5-year SALT cap relief in the Build Back Better Act would cost about $100 billion more than the expanded child tax credit – roughly $285 billion compared to $185 billion – with the benefit overwhelmingly going to very high earners. This SALT cap relief would be a costly mistake.

Read more options and analyses on our Reconciliation Resources page and our SALT Deduction Resources page.

1 Starting in 2026, the Build Back Better Act actually imposes a SALT cap after the current cap expires. While this is technically a tax increase, it is likely to be accompanied by an extension of most other parts of the TCJA, and therefore may result in lower overall taxes and revenue relative to a full TCJA extension.

2 Assumes inflation adjustment would increase maximum refundability to $1,500 in 2022 and $1,600 by 2025