Trump and Biden: Executive Actions

In a recent analysis, we estimated that former President Trump approved $8.4 trillion of new ten-year borrowing ($4.8 trillion excluding the CARES Act and other COVID relief) during his full term in office, and President Biden approved $4.3 trillion ($2.2 trillion excluding the American Rescue Plan) in the first three years and five months of his term. Some of this new borrowing came from executive actions by the President and his administration, which do not include Congressional involvement, rather than legislation.

In this piece, we show:1

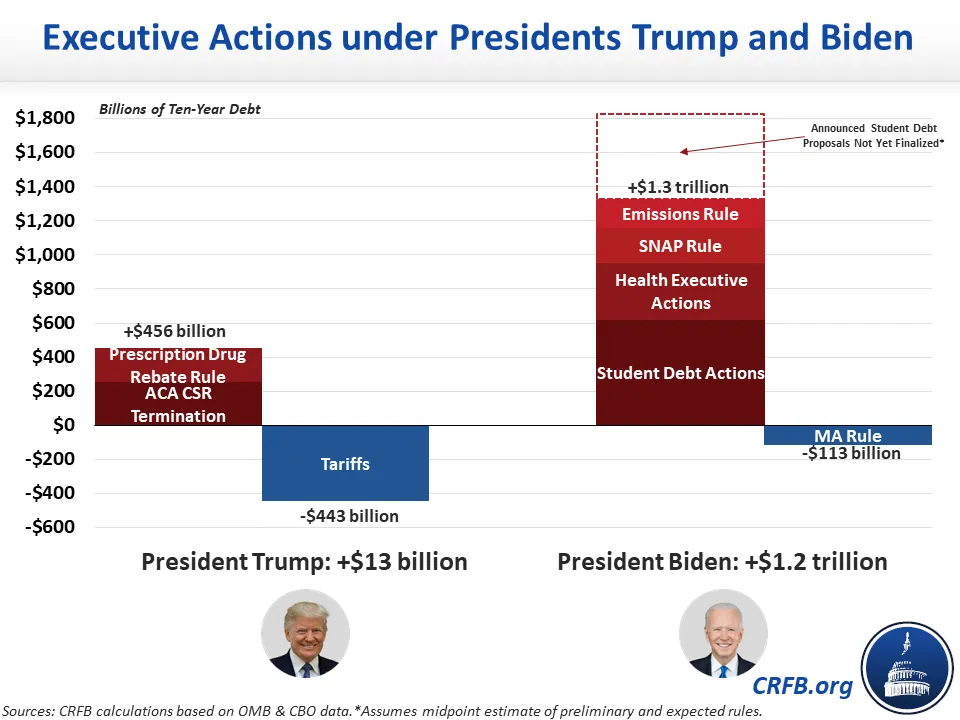

- President Trump’s major executive actions during his four years in office increased net ten-year borrowing by $13 billion with $456 billion of deficit-increasing actions largely offset by $443 billion in deficit-reducing tariffs.

- President Biden’s major executive actions during his first three years and five months in office increased net ten-year borrowing by roughly $1.2 trillion, with $1.3 trillion of deficit-increasing actions slightly offset by $113 billion of deficit reduction.

- Of the $8.4 trillion of new borrowing that President Trump approved, less than 1 percent came from executive actions, while about 29 percent of President Biden’s $4.3 trillion of new borrowing approved so far comes from executive actions.

- President Biden also has announced two additional major executive actions that are not included in these numbers because they have not been finalized. We estimate they would add a further $200 to $800 billion to the ten-year debt approved under President Biden if finalized without changes.

US Budget Watch 2024 is a project of the nonpartisan Committee for a Responsible Federal Budget designed to educate the public on the fiscal impact of presidential candidates’ proposals and platforms. Throughout the election, we will issue policy explainers, fact checks, budget scores, and other analyses. We do not support or oppose any candidate for public office.

On net, we estimate that President Trump’s executive actions have added $13 billion to ten-year debt while President Biden’s executive actions finalized so far have added $1.2 trillion to ten-year debt. Of the absolute value of President Trump’s major executive actions, 51 percent were deficit-increasing, and 92 percent of the absolute value of President Biden’s major executive actions were deficit-increasing.

While Congress is generally charged with tax and spending authority, presidential administrations can sometimes change spending and revenue collection unilaterally through executive orders, rules and regulations, administrative decisions, and other executive actions.

Between 2017 and 2021, the Trump Administration approved two major deficit-increasing regulatory changes and executive actions that we estimate added a gross $456 billion to the debt over ten years. This includes $252 billion from the termination of payments for cost-sharing reductions (CSRs) for Affordable Care Act plans, which CBO found would lead to higher premiums and premium subsidies (through a process known as “silver loading”), and $204 billion from a prescription drug rebate rule (later reversed through legislation) that changed how savings were rebated from drug manufacturers to pharmacy benefit managers.

Largely offsetting these changes was $443 billion of estimated deficit reduction from import tariffs – including on washing machines, solar panels, aluminum and steel products, and a variety of Chinese goods – that President Trump imposed using certain presidential authorities related to trade and national security.

On net, we estimate President Trump’s executive actions increased ten-year deficits by $13 billion, which represents 0.2 percent of the $8.4 trillion of net debt he approved.

President Trump’s net total would likely have been lower had courts not prevented several rules from being implemented, including the Trump Administration’s “public charge” rule related to noncitizens’ use of safety net programs and the “most favored nation” rule that would have prevented Medicare Part B from paying more for physician-administered drugs than what is paid by other countries. If those rules were implemented, President Trump’s executive actions would have led to net deficit reduction – likely in the neighborhood of $100 billion over a decade.

Major Finalized Executive Actions Under President Trump

| Policy | Ten-Year Debt Impact |

|---|---|

| ACA Cost-Sharing Reductions Termination | +$252 billion |

| Prescription Drug Rebate Rule | +$204 billion |

| New & Increased Tariffs | -$443 billion |

| Total, Executive Actions Under President Trump | +$13 billion |

In the first three years and five months of President Biden’s term, between January 2021 and June 2024, the Biden Administration has approved several deficit-increasing regulatory changes and executive actions that we estimate added a gross $1.3 trillion to ten-year debt.

The largest portion of this came from $620 billion of actions related to student debt – specifically, President Biden implemented a new income-driven repayment (IDR) plan that eliminates debt and interest accrual for many borrowers, paused debt repayments and cancelled interest for 31 months, and implemented a number of more targeted debt cancellation measures. These estimates do not include the fiscal impact of broad-based student debt cancellation ruled illegal by the Supreme Court, nor do they include two new student debt proposals from the President – one which has not been finalized and the other which has not been formally introduced. But they do include the President’s full IDR plan, despite the fact that lower courts have issued a temporary stay on parts of it.

The Biden Administration enacted another $338 billion of health care-related executive actions, including loosening of Medicaid enrollment and payment rules, expansion of ACA subsidies related to the so-called “Family Glitch,” changes to Medicare drug rebate rules, and new nursing home staff requirements. The Biden Administration also updated the Thrifty Food Plan, increasing SNAP benefits at a cost of $201 billion, and they implemented a carbon dioxide emissions rule that will increase the size of electric vehicle credits, reduce gas tax revenue, and add $168 billion to the debt.

Offsetting some of the cost of these actions, the Biden Administration also put in place a rule that will reduce payments to Medicare Advantage plans, which we estimate will result in $113 billion of deficit reduction over a decade.

On net, we estimate President Biden’s executive actions so far have increased ten-year deficits by $1.2 trillion, which represents 29 percent of the $4.3 trillion of debt he approved.

Importantly, these totals would be more than $350 billion higher had the Supreme Court not ruled President Biden’s $10,000 to $20,000 per borrowing student debt cancellation policy to be illegal and will be as much as $330 billion lower if the court rules the President’s IDR plan illegal.

Major Finalized Executive Actions Under President Biden So Far

| Policy | Ten-Year Debt Impact |

|---|---|

| Income-Driven Repayment Plan | +$329 billion |

| Targeted Student Debt Cancellations | +$145 billion |

| Student Loan Repayment Pauses | +$146 billion |

| Medicaid State Directed Payments Rule | +$134 billion |

| Medicaid Enrollment Rules | +$98 billion |

| Medicare Drug Rebate Rule | +$44 billion |

| ACA "Family Glitch" Fix | +$38 billion |

| Nursing Home Staffing Requirements Rule | +$25 billion |

| SNAP Rule (Thrifty Food Plan) | +$201 billion |

| Emissions Rule | +$168 billion |

| Medicare Advantage Rule | -$113 billion |

| Total, Executive Actions under President Biden | +$1.2 trillion |

| Memo: Total Executive Actions, including student debt proposals not yet finalized | +$1.4 to +$2.0 trillion |

It is also important to note that President Biden’s term in office is not over, and his Administration has already announced or introduced two executive actions that would add an additional $200 to $800 billion to the debt if finalized and enacted. This includes the $147 billion cost of a preliminary rule to cancel student debt from a variety of borrowers and an estimated $70 to $600 billion cost for a proposal that has not yet been formally introduced to cancel student debt for those facing hardship, plus additional interest costs. President Biden has also called for increasing and adjusting several tariffs, which would modestly reduce deficits if finalized. These actions will be included in this tally if finalized.

****

Throughout the 2024 presidential election cycle, US Budget Watch 2024 will bring information and accountability to the campaign by analyzing candidates’ proposals, fact-checking their claims, and scoring the fiscal cost of their agendas.

By injecting an impartial, fact-based approach into the national conversation, US Budget Watch 2024 will help voters better understand the nuances of the candidates’ policy proposals and what they would mean for the country’s economic and fiscal future.

You can find more US Budget Watch 2024 content here.

1 Because the Congressional Budget Office (CBO) does not score executive actions, our estimates rely on a variety of sources. These include CBO letters and briefs, CBO scores of efforts to reverse executive actions, revisions to CBO’s baseline that incorporate executive actions, estimates put forward by the agencies themselves as part of the rulemaking process, and estimates produced by the Committee for a Responsible Federal Budget. Our estimates are based on final actions we have identified to reduce or increase deficits by at least $25 billion over a decade. We do not include preliminary rules or actions struck down by the courts and removed from CBO’s baseline as a result. Estimates in this analysis closely match those in our paper Trump and Biden: The National Debt but have been updated for new CBO data made available since that analysis.