Biden Administration’s SNAP Increase Could Add $180 Billion to Deficits

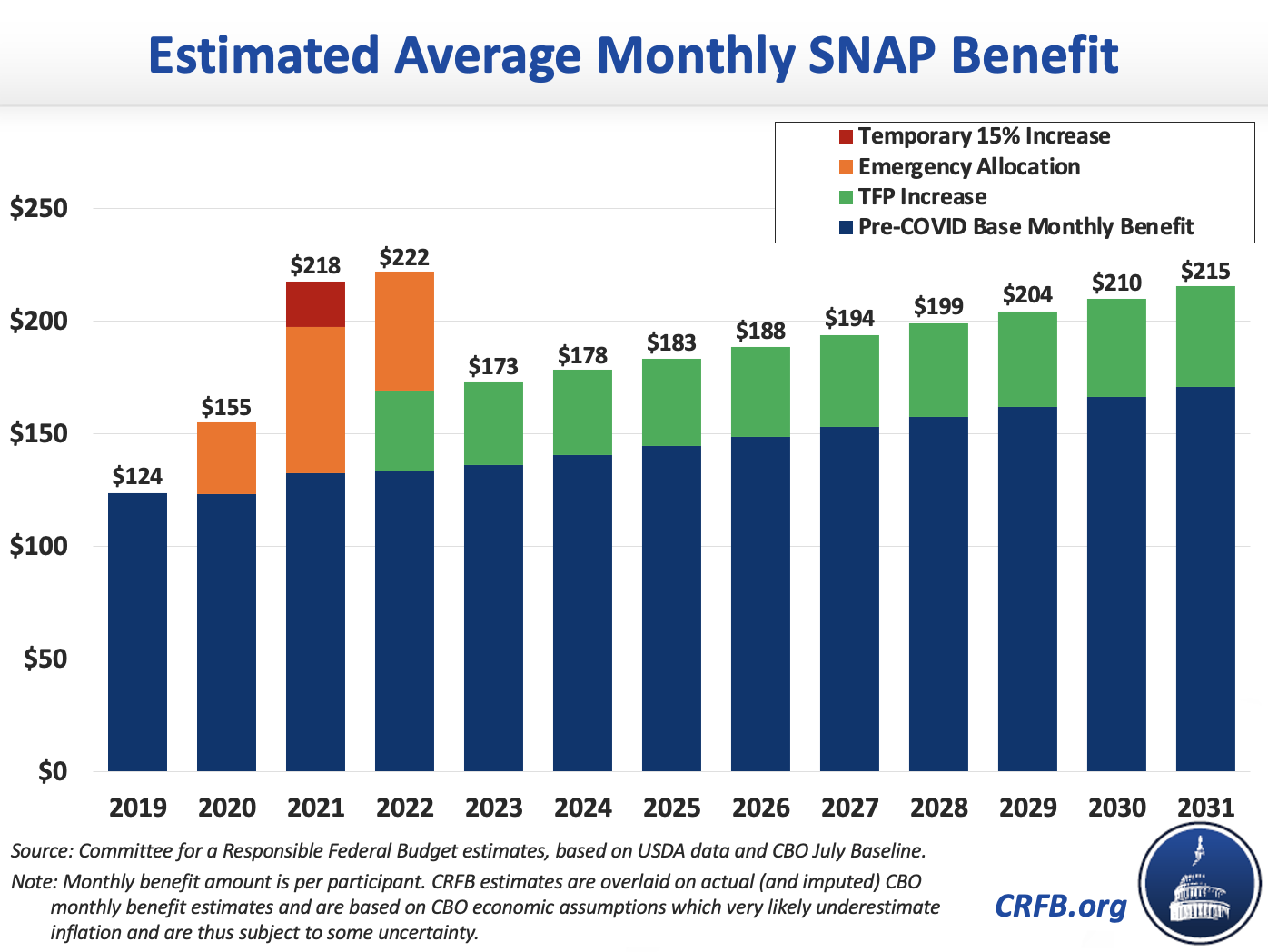

The U.S. Department of Agriculture (USDA) recently announced it will be revising the Thrifty Food Plan (TFP), used for the calculation of Supplemental Nutrition Assistance Program (SNAP) benefits (formerly known as “food stamps”). The revision increases the reference food plan’s cost by 21 percent and, as a result, the average monthly SNAP benefit will increase by $36.24 per person. We estimate these changes, which will take effect on October 1, could cost at least $180 billion over the next decade.

Title IV of the 2018 Farm bill required that the USDA reevaluate the TFP by 2022 to better reflect current food costs, food composition, eating habits, and dietary guidelines. President Biden issued an executive order in January that urged the USDA to accelerate its reevaluation. Going forward, the TFP will be revaluated every five years, per the 2018 Farm Bill, and the cost will continue to be adjusted for inflation each month using the Consumer Price Index (CPI).

Per the 2021 TFP report, the higher cost of the new plan is a consequence of three major updates. The first is a change in the method of data collection on food prices, with the new plan using price data directly collected from retailers rather than surveying low-income households. The second change is an increase in recommended caloric intake due to higher median adult weights and a change in the physical activity levels of children under 12. The third change switches to using the latest Dietary Guidelines for Americans to calculate the market baskets of foods that form the TFP.

In the past, changes to the TFP have been adjusted on a “cost neutral” basis, which held that the changes wouldn’t substantially increase benefits. However, the USDA’s interpretation of the 2018 Farm bill finds that adjustments can increase costs.

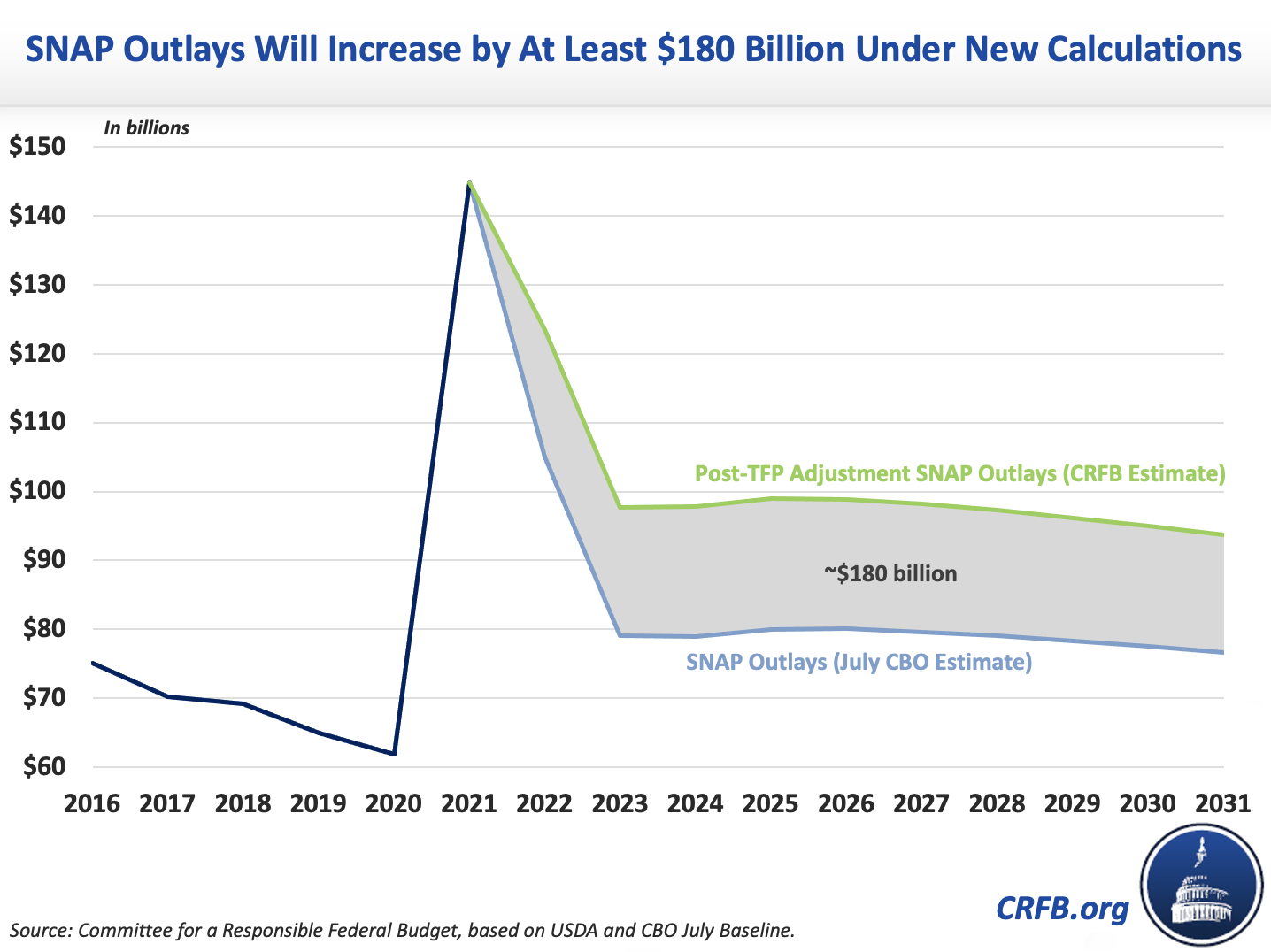

We estimate this adjustment will cost $18 billion in the first year, $94 billion over five years, and over $180 billion over ten years assuming the next reevaluation is cost neutral. This estimate is consistent with revised projections from the Office of Management and Budget (OMB) that forecasted SNAP expenditures will be $254 billion higher from 2022 through 2031 as a result of both the TFP changes and much higher inflation projections.

Importantly, the over $36 increase in monthly SNAP benefits for Fiscal Year (FY) 2022 replaces a temporary $27 average monthly increase in effect from January through September 2021 as a result of a 15 percent boost enacted through COVID relief legislation. In addition to the direct increase, all households can currently collect the maximum SNAP benefit – which means a minimum monthly boost of $95 per family – as a result of emergency supplementary SNAP allocations enacted in earlier COVID relief legislation.

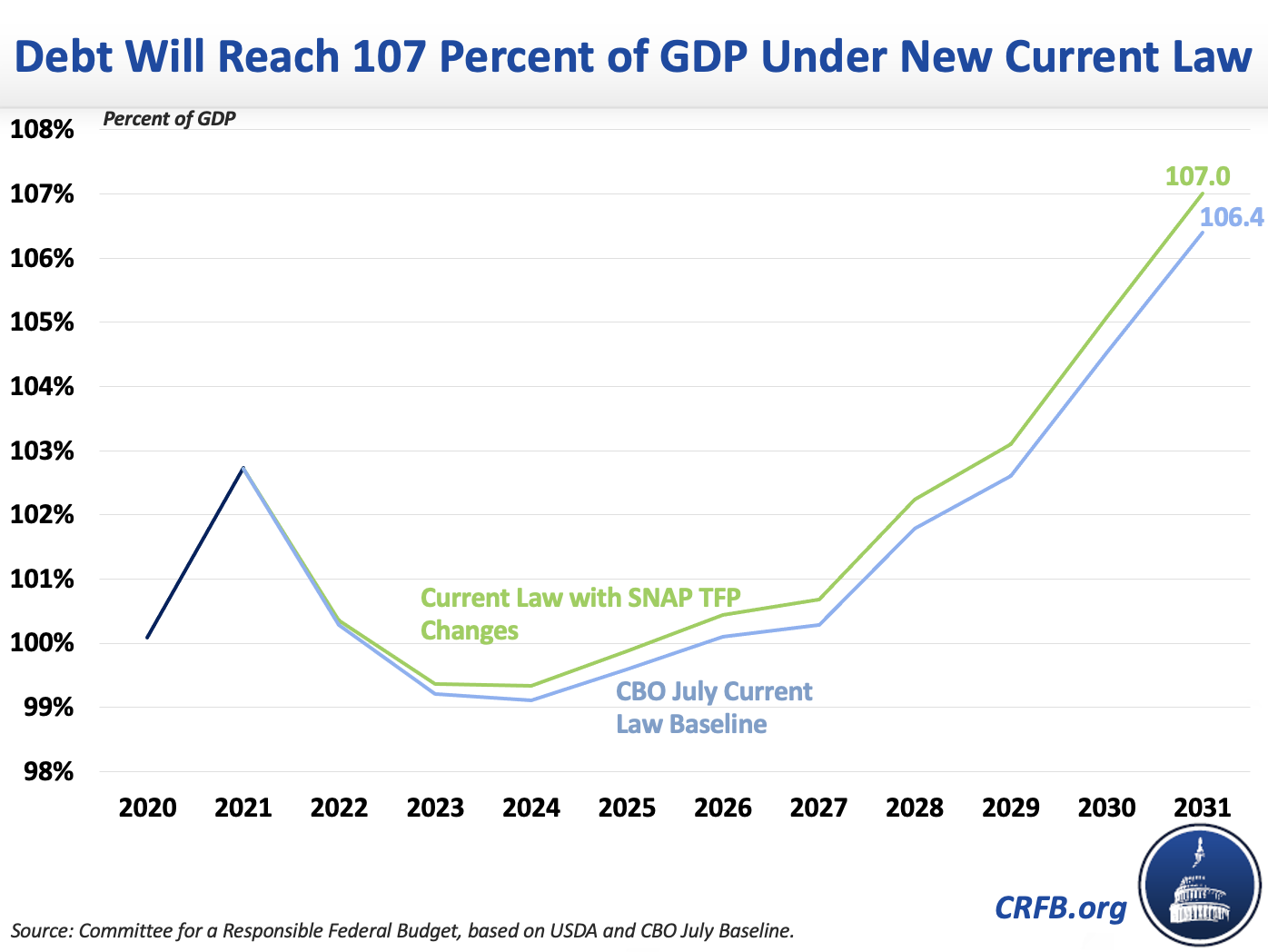

The $180 billion cost of this revision would have a modest but meaningful effect on the debt. Under CBO’s current law baseline, debt is projected to reach 106.4 percent of Gross Domestic Product (GDP) by the end of the FY 2031. With this policy in effect, we estimate debt as a share of the economy would reach 107 percent of GDP by 2031.

Many families in need will benefit from the more generous SNAP benefits that will soon become available. However, this increase does not come for free. When Congress enacts a major spending increase or tax cuts, they are required to fully offset the costs under the pay-as-you-go law with tax increases or spending cuts. Administrative PAYGO, which was in effect prior to the current administration, would require similar offsets for regulatory changes with substantial new costs. It should be restored.

With our debt headed toward record levels, it is important that new priorities be fully paid for.