Tax Cut Extension Would Only Pay for 1% to 14% of Itself

Several major elements of the 2017 Tax Cuts and Jobs Act (TCJA) are scheduled to expire at the end of 2025. While the estimated cost of extending these expiring provisions has gone up dramatically – to $4 trillion over a decade under one possible scenario – the extension could theoretically pay for some of itself to the extent that it leads to faster economic growth.

However, analyses from four different organizations spanning the ideological spectrum, along with comments from the Director of the Congressional Budget Office (CBO), show that this dynamic feedback effect is likely to be quite modest.

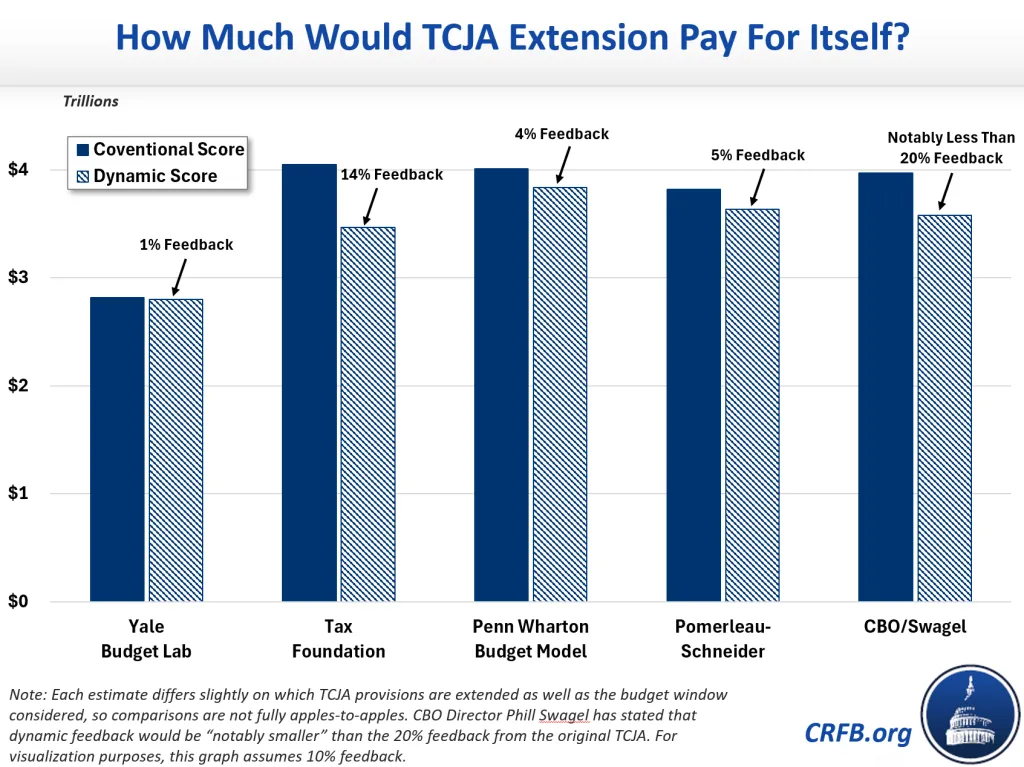

Based on estimates from the Yale Budget Lab, Tax Foundation, Penn Wharton Budget Model, Kyle Pomerleau and Donald Schneider, and CBO Director Phill Swagel, we find:1

- TCJA extension would create dynamic feedback sufficient to offset between 1 percent and 14 percent of its static cost over a decade.

- TCJA extension would have a modest effect on economic output – resulting in between a 0.5 percent reduction and a 1.1 percent increase in long-run output.

- While almost no tax cut would pay for itself, the dynamic effects of extending the TCJA would be particularly modest due to the composition of the expiring tax cuts and the high economic cost of growing the national debt.

How Much Would TCJA Extension Pay for Itself?

After it was enacted in 2017, CBO estimated the TCJA would stimulate economic growth enough to offset about 20 percent of its static cost. In a recent speech delivered to the Tax Council Policy Institute, CBO Director Swagel explained that extending the expiring parts of the TCJA would have a far smaller dynamic effect.

A number of estimates from third-party modelers have come to a similar conclusion. On the high end, the Tax Foundation – which does not fully account for the negative economic effects of higher debt – has estimated a TCJA extension would pay for more than 14 percent of its ten-year revenue loss through higher economic growth. Meanwhile, Kyle Pomerleau of the American Enterprise Institute and Donald Schneider of Piper Sandler expect dynamic feedback from TCJA extension to offset 5 percent of its static cost, Penn Wharton Budget Model projects the cuts to be 4 percent self-financing, and Yale Budget Lab projects less than 1 percent dynamic feedback.2

All four modelers agree with Swagel’s assessment that extending the TCJA would generate positive economic growth within the ten-year budget window, leading to some additional revenue over the next decade. However, each modeler estimates that dynamic revenue feedback to be modest relative to the overall cost of the package.

How Much Would TCJA Extension Grow the Economy?

While maintaining the lower tax rates and investment incentives in the TCJA would almost certainly boost economic growth by encouraging work and investment, that boost would likely be modest and could decline – perhaps even dipping into negative territory – when accounting for the economic cost of additional debt.

The Tax Foundation – which does not fully account for the economic cost of that debt – estimates these incentives would boost Gross Domestic Product (GDP) by about 0.6 percent after a decade, 1 percent after 30 years, and 1.1 percent over the very long run. Economic growth would increase by less than 0.07 percentage points per year in the first decade and 0.02 percentage points per year in the next two decades.

Penn Wharton Budget Model expects TCJA extension would boost output by 0.3 percent after a decade, with that boost tapering down to 0.2 percent by 2054. In other words, the growth rate would increase by an average of 0.033 percentage points per year in the first decade (though we believe this growth would be heavily front-loaded) and would actually slow by an average of 0.005 percentage points per year in the next two decades.

Lastly, Yale Budget Lab projects extending the TCJA would boost the economy by as much as 0.4 percent after three years – about 0.138 percentage points per year – but then slow economic growth by an average of 0.035 percentage points per year thereafter. After three decades, GDP would be 0.5 percent smaller with the expiring TCJA provisions extended than if they were allowed to expire.3

Why Are Effects So Modest?

As we have explained before, tax cuts rarely if ever fully pay for themselves. Because taxes capture only a fraction of income and some spending grows with income, a policy would need to produce $5 to $6 of economic activity for every $1 of cost to be self-financing.

However, tax cuts are often partially self-financing. For example, CBO estimated the original 2017 TCJA would pay for 20 percent of itself (other estimates ranged from 8 percent to 70 percent). As shown above, an extension of the TCJA would likely generate far less dynamic feedback.

One reason for the modest estimates of dynamic feedback from extension is that the most pro-growth elements of the TCJA were mostly made permanent in the original legislation, leaving the less pro-growth provisions to expire. That includes the (partially paid-for) cut in the corporate income tax rate from 35 to 21 percent. It also includes some of the offsets – particularly those related to international taxation and to the individual mandate penalty in the Affordable Care Act – which offset costs without meaningfully reducing (and in some cases increasing) incentives to work and invest.

Most of the expiring provisions in the TCJA have to do with individual income taxes, where there tends to be less opportunity to dramatically increase economic activity. Furthermore, while a broader tax base is generally conducive to stronger economic growth, the expiring provisions in the TCJA include elements that would narrow the tax base, such as a $750 billion expansion of the Child Tax Credit and a $680 billion tax break for pass-through business income.4

In addition, the large increase in the debt that would result from extending the TCJA without offsets would counteract the positive economic effects of extension by crowding out private investment and slowing income growth. Excluding economic feedback, CBO projects that extending major parts of the TCJA would increase debt by nearly 11 percent of GDP by Fiscal Year (FY) 2034, compared to less than 8 percent by FY 2028 in its original estimate from 2018. Meanwhile, interest rates, inflationary pressures, and the debt itself are all much higher now than when the TCJA was enacted.

Can Tax Reform Be More Pro-Growth?

While extending the expiring provisions of the TCJA alone would do little to promote economic growth and generate additional revenue, the coming expiration could be used as an opportunity to enact thoughtful, responsible, and more pro-growth tax reform. This could involve extending (or expanding) the most desirable elements of the TCJA, allowing the least effective provisions to expire, modifying and reforming other provisions, and offsetting any remaining cost of extension so that the negative economic effects of adding to the debt are minimized.

For instance, the Tax Foundation has outlined two options for extending the TCJA that would further broaden the tax base in order to maintain much (but not all) of the TCJA’s individual and corporate reforms. They also outline more fundamental reform options that would transition from an income-based tax system to a more consumption-based tax system. A plan put forward by professors Kimberly Clausing and Natasha Sarin would increase the progressivity of the tax code, limit existing avenues for tax avoidance, and address issues like climate change while also reducing deficits. And Kyle Pomerleau and Donald Schneider put forward two options for extending most of the structural elements of the TCJA while further broadening the base, reforming corporate international and cost-recovery rules, and setting a new rate structure in order to achieve revenue neutrality. (You can read more about these plans here.)

According to their own estimates, the Tax Foundation plans would boost long-term output by between 0.9 and 2.5 percent, the Clausing-Sarin plan by 0.84 percent, and the Pomerleau-Schneider plan by 0.5 to 3.8 percent. In most cases, these plans would generate significant dynamic revenue.

| Plan | Long-Run GDP Boost | Dynamic Revenue Feedback5 |

|---|---|---|

| Tax Foundation (revenue-neutral extension) | 0.9% to 1.4% | $180 to $494 billion |

| Tax Foundation (fundamental reform) | 1.9% to 2.5% | ~$900 billion |

| Clausing-Sarin | 0.84%6 | -$85 billion7 |

| Pomerleau-Schneider | 0.5% to 3.8% | $82 to $645 billion |

| Memo: TCJA Extension | -0.5% to 1.1% | $15 to $581 billion |

Importantly, all of the pro-growth plans mentioned above would be at least deficit neutral over time and most would actually reduce long-term debt, especially after accounting for the effects of economic growth.

You can design your own deficit-neutral, pro-growth plan for addressing the expiring tax cuts with our Build Your Own Tax Extensions interactive tool.

1 This analysis includes additional information provided by John Ricco (Yale Budget Lab), Kyle Pomerleau (AEI), Erica York (Tax Foundation), and Kent Smetters (Penn Wharton Budget Model).

2 Each of these estimates consider a slightly different set of TCJA provisions for extension and differ on the exact budget window considered, so comparisons are not fully apples-to-apples.

3 Importantly, the policy modeled by Yale Budget Lab does not include extending bonus depreciation and other changes to the corporate tax code that are believed to provide some of the highest “bang for buck” when it comes to economic growth. Also, the 0.5 percent reduction reflects Yale Budget Lab’s estimates in 2054. The long-run impact beyond that may be greater.

4 When it comes to economic incentives, the line between base and rate changes can sometimes be blurry. The deduction for qualified business income (pass-through) narrows the tax base but also lowers effective marginal rates. The $550 billion Alternative Minimum Tax (AMT) repeal lowers effective rates but also narrows the tax base. And the $3 trillion of revenue from limiting the State and Local Tax (SALT) deduction and other itemized deductions and repealing the personal and dependent exemption broadens the tax base but also increases effective marginal tax rates.

5 Dynamic revenue feedback estimates are for the ten-year budget window from 2025 through 2034.

6 Clausing-Sarin’s long-term output figure reflects Yale Budget Lab’s estimates in 2054. The long-run impact beyond that might be greater.

7 Although Yale Budget Lab estimates this proposal would lose $85 billion of dynamic revenue in the first decade, they estimate it would produce $1.5 trillion of positive revenue in the following two decades. Clausing-Sarin proposes over $4 trillion of net tax cuts (after offsetting partial TCJA extension and CTC and ACA subsidy expansions), which would reduce work and investment incentives and thus output in the near term. However, this substantial deficit reduction would significantly boost long-term output, according to Yale Budget Lab.