House Considers $320 Billion of Tax Cuts

The House of Representatives is considering this week whether to revive several tax breaks known as the "tax extenders" and add their cost to the deficit. The bills under consideration, which include extensions of previously renewed tax breaks in addition to new and expanded tax breaks, would cost almost $320 billion, or almost $385 billion with interest.

The tax extenders are a set of temporary tax breaks that have typically been continued for a year or two at a time. Most recently, about 55 extenders expired at the beginning of 2014 and were renewed retroactively for one year last December, before expiring a few weeks later at the end of 2014.

The House Ways & Means Committee today approved renewing and permanently extending two of these provisions, including a drastically expanded research tax credit and a deduction for sales taxes paid, as well as new modest expansions to 529 education savings accounts. The three approved bills being considered would cost about $225 billion, or $265 billion with interest.

The House is also voting today and tomorrow on permanent extensions of six more provisions, as well as a policy from last year's Tax Reform Act that would reduce taxes paid by private foundations on their investment income.

The table below shows each of the ten bills, with links to where we described the provisions last year. Three comprise $300 billion (or about 95 percent) of the cost.

| Costs of Permanent Tax Provisions Considered by the House or Ways & Means Committee | |||

| Policy | Cost (2015-2025) | Description | Status |

| Expand Research and Experimentation credit | $182 billion | Expansion (~$100 billion) | Committee approved 2/12 |

| Extend small business expensing (Section 179) | $77 billion | Expansion (~$8 billion) | House will consider 2/13 |

| Extend the deduction for state & local sales taxes | $42 billion | Extension | Committee approved 2/12 |

| Allow tax-free charitable donations from retirement plans | $9 billion | Extension | House approved 2/12 |

| Enhance the charitable deduction for businesses donating food | $2 billion | Extension | House approved 2/12 |

| Extend two provisions for S corporations | $2 billion | Extension | House will consider 2/13 |

| Reduce tax on private charitable foundations | $2 billion | New Policy | House approved 2/12 |

| Extend more generous limits for donating conservation easements | $1 billion | Extension | House approved 2/12 |

| Expand the tax breaks associated with 529 education savings accounts | minimal | New Policy | Committee approved 2/12 |

| Subtotal, Cost of Tax Provisions | $319 billion | ||

| Interest Cost | ~$65 billion | ||

| Grand Total, Addition to the Debt | ~$385 billion | ||

Source: JCT, CBO, CRFB calculations. Totals may not add due to rounding.

Proponents of the tax cuts say that the costs should not need to be offset because Congress is merely continuing current policy. This, however, makes costs disappear from the budget process and would lower the bar for tax reform so that it loses revenue compared to current law. Furthermore, once lawmakers agree to disregard budget discipline, there's little incentive to make provisions cost-efficient, as we explained in Without Budget Discipline, a Spending Spree Ensues. These provisions are not just an extension of current policies, but include about $110 billion of new and expanded tax breaks.

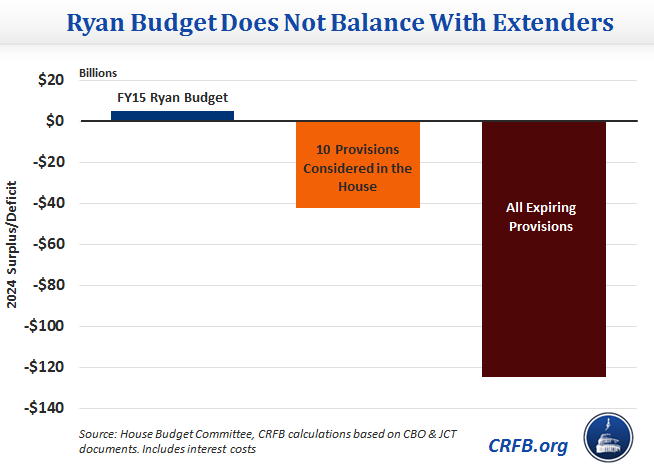

Finally, extending these tax breaks could make it more difficult for House Republicans to propose a budget resolution next month that achieves balance. The past two House budgets have set a goal of balancing the budget within 10 years. However, those budgets relied on current levels of revenue, without any tax cuts. A budget that follows the same principle of using only spending cuts to balance the budget would need even deeper cuts to balance if it includes the unpaid-for extension of these provisions.

In fact, if all of the expiring tax extenders were continued without offsets, the Ryan budget would have been $125 billion short of balance.

The White House has issued two official veto threats for the bills on the House floor. Although the Administration supports some of the provisions, even including an expanded research credit and section 179 expensing in their budget, the Administration opposes the irresponsible way these bills are being proposed without offsets. They also made the point that extending these tax breaks permanently would squander most of the revenue raised in the fiscal cliff deal.

Adding certainty to the tax code by ending the on-again, off-again nature of these provisions is a noble goal. However, our fiscal situation is already on an unsustainable path without adding hundreds of billions more to the debt. Congress should abide by PAYGO for this and all other legislation, finding savings to offset the new costs. The best way to deal with these provisions would be in tax reform, where lawmakers can examine each provision and extend the ones that are found worthwhile.

Related Posts, written about the 2014 extenders debate:

- Senate Moves Forward On Increasing Deficits With Tax Extenders, listing eight reasons why extenders should be paid for.

- Cost of Ways & Means Tax Cuts Passes the Trillion Dollar Mark

- Want to Understand the Tax Extenders? Here's a Few Charts.

- Tax Break-Down: Tax Extenders, which explains the history and rationale of the provisions.

Update 2/12/2015: interest calculations have been revised down by $15 billion from original post.