Extending Tax Breaks Would Squander Fiscal Cliff Revenue

After allowing taxes to rise on the highest 1 percent of earners at the beginning of last year, many Democrats patted themselves on the back for raising $620 billion of revenue for deficit reduction, while many Republicans declared that the tax increase fulfilled any future need to raise revenue. Yet little by little, Congress is working to give all that revenue back by continuing to extend a host of temporary tax breaks, primarily for businesses.

A recent editorial in The New York Times rightly criticized the Senate Finance Committee extenders package as "hypocritical tax cuts" that would add to the deficit even as lawmakers claim to follow pay-as-you-go rules when it comes to other policy changes. The editorial noted that if Congress continues to pass extenders year after year, "in effect, they will 'give back' more than half of the revenue from the fiscal-cliff deal of 2012, when tax rates were raised on very high income taxpayers."

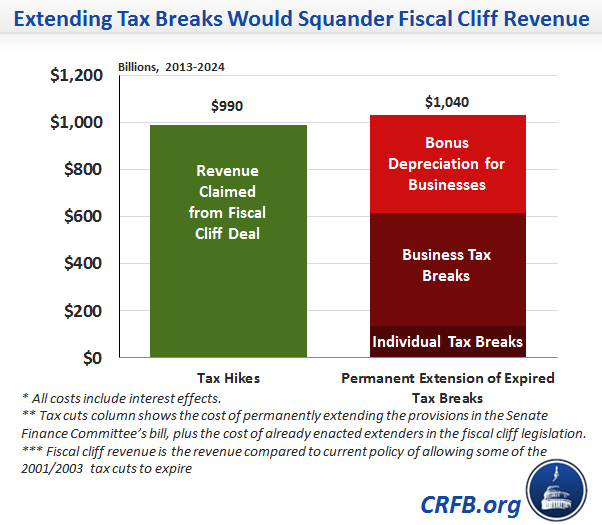

The editorial makes a good point, but dramatically understates the cost of the extenders by relying on the per-year cost of the two-year package. Indeed, if the Senate Finance package were passed and then continued on a permanent basis, the revenue loss of tax extensions would outweigh the gains from the upper-income tax increase for the entire next decade. About 80 percent of that revenue loss would go to businesses.

From 2013 through 2024, the upper-income tax increases from the fiscal cliff deal will raise about $815 billion and reduce deficits by almost $1 trillion, including interest, relative to a current policy baseline where all the tax cuts were extended (in other words, lawmakers left out $1 trillion of additional costs when they chose not to extend all of the 2001/2003 tax cuts). The New York Times likely took the $85 billion two-year cost of the extenders package and multiplied it by five to get a ten year cost. However, included in the package is bonus depreciation, which we've explained before costs many times more to extend permanently than when it is continued for another year or two. By our calculation, if the Senate Finance Committee package is passed and continued permanently, the extenders will cost $830 billion in lost revenue from 2013 through 2024, or almost $1.05 trillion including interest.

In other words, the cost of these extensions would entirely wipe out the gains from the recent tax increases and then some. About $110 billion of these tax cuts go to individuals, while more than $700 billion goes to businesses – including $300 billion for bonus depreciation alone. Interest contributes the remainder of the costs.

Chairman Wyden has said this is the last tax extenders package he intends to enact and that he plans on dealing with extenders as part of tax reform. But even if this turns out to be true (as we hope it does), how Congress deals with tax extenders now could affect the baseline used to evaluate tax reform proposals. Continuing the extenders without offsets risks setting the precedent that no such offsets are needed and thus lead to a much lower revenue baseline as the starting point for tax reform.

With growing health care costs, an aging population, and unsustainable rising debt levels, the country cannot afford to cut taxes without financing the costs. The revenue claimed from the fiscal cliff deal made a small but important contribution to improving our overall fiscal situation. It would be a shame to allow that to be undone, especially through temporary extensions that appear to be cheap because they are enacted only one year at a time. These tax extenders risk becoming debt by a thousand tax cuts.

PAYGO rules must apply not only to new policies, doc fixes, and unemployment benefits, but also to the tax extenders. Now is no time for backtracking.

*: The $1,040 billion cost of continuing to extend the expired tax cuts includes the $75 billion cost of continuing the tax extenders in the fiscal cliff deal, $85 billion cost of extending the provisions for two years as proposed in the Senate Finance Committee's bill, $665 billion cost if these provisions are extended permanently, and interest costs.

Read an explainer about what the tax extenders are here.