Camp Makes Responsible Choices on Tax Extenders

While Ways and Means Chairman Dave Camp's (R-MI) Tax Reform Act of 2014 (TRA) misses a critical opportunity to use tax reform to slow the unsustainable growth of the federal debt, his proposal should be commended for abiding by pay-as-you-go rules and responsibly paying for the set of expiring tax provisions often called the "tax extenders" and certain temporary expansions of refundable tax credits.

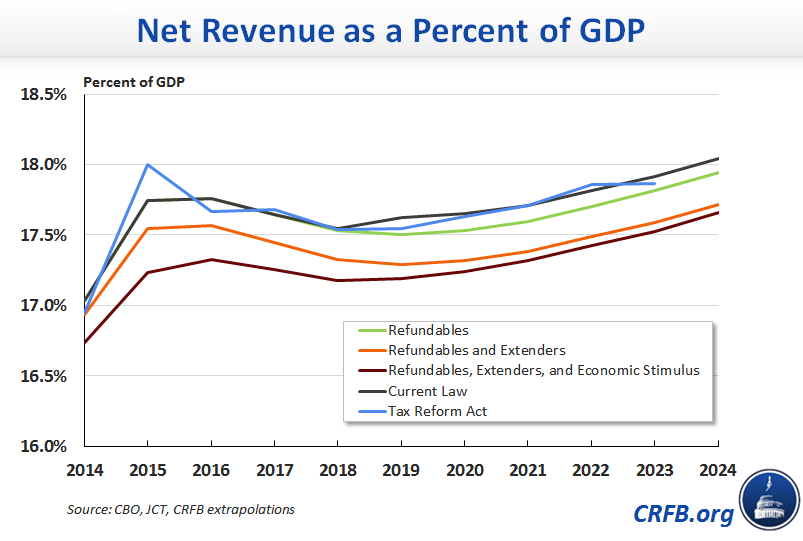

Although many of these provisions—such as the research and experimentation tax credit—have technically already expired due to a lack of Congressional action, they are often extended retroactively and often without being paid for. Extending all of these provisions permanently without offsets, as some in Congress have proposed, would be irresponsible and would reduce revenues by between $630 billion and almost $1 trillion over the next 10 years. With interest costs, debt would be 3.0 to 4.4 percentage points of GDP higher than scheduled in 2024.

By abiding by PAYGO based on current law (under which all of these provisions would expire and thereby increase federal revenue), the TRA at least maintains revenue at currently projected levels. It should not be taken for granted that revenue will stay at projected levels, as many policymakers from both parties have advocated extending tax cuts and putting the bill on the nation's credit card.

Broadly, these expiring provisions could be thought of in three categories:

- Refundable Credits. Three refundable tax credits (the American Opportunity Tax Credit, Earned Income Tax Credit, and Child Tax Credit) were expanded in the 2009 stimulus bill, and were extended in 2010 and 2012. However, these expansions are set to expire at the end of 2017.

- Normal tax extenders. A host of temporary provisions, such as the research and experimentation credit and incentives for alternative energy production, expire every year or two and are continuously renewed on a temporary basis. Currently, most of these measures are expired but can be renewed retroactively.

- Temporary economic stimulus. A number of temporary tax provisions were implemented during the Great Recession to help support the fragile economy. Two measures—bonus depreciation rules intended to boost business investment and tax relief for mortgage debt forgiveness—were in the tax code in 2013 and could be renewed retroactively

If all three categories of provisions were extended without offsets, deficits would be nearly $1 trillion higher over ten years (or $1.2 trillion with interest). Even if the temporary stimulus provisions were allowed to expire as currently scheduled, deficits would be $620 billion higher ($750 billion with interest). Thus, the draft would raise $620 billion more than if the rest of the "extenders" and refundable credits are extended without offsets. The TRA, at least represents a significant improvement over the current modus operandi in Congress—financing tax cuts with larger deficits.

Under current law assuming a war drawdown, debt is expected to reach 76.7 percent of GDP by the end of the decade. The Tax Reform Act is revenue-neutral, which means that debt ends up in nearly the same place. However, if all of the expiring tax provisions were extended without offsets, debt would be 4.4 percentage points higher, at 81.1 percent of GDP.

The draft deals with these various provisions in different ways (as shown below), but importantly, no extension or expansion is allowed to add to the debt. Given our perilous fiscal trajectory, however, it is not sufficient to avoiding digging a deeper hole. Hopefully, lawmakers can work together to improve upon the TRA, and also use tax reform as an opportunity to reduce our indebtedness.

Costs of Major Tax Extenders (2014-2024, Billions)

| Provision | Tax Reform Act | Cost of Fully Extending | Tax Reform Act Policy |

| Expired in 2013 | |||

| Bonus Depreciation (half of new investments can be written off immediately, instead of deducted over time) | $0 | - $296 | Allowed to expire |

| Research & Experimentation Credit | - $40 | - $77 | The main R&E credit was extended permanently and slightly modified. Of the three other research credits, two were repealed, while the last credit for research payments was reduced from 20 to 15 percent. |

| Active Finance Exception (financial companies are treated like other multinationals—they can defer tax by keeping profits offshore) | - $18 | - $71 | Extended for 5 years, until the lower corporate rate takes effect in 2019. Limited with a new minimum tax; financial companies must pay at least 12.5 percent in foreign tax to be able to defer U.S. tax. |

| Section 179 (a small business can immediately write off up to $500,000 of investments) | - $58 | - $69 | Made permanent at lower 2009 levels. A small business can immediately write off up to $250,000, phasing-out once the business buys more than $800,000 of property. |

| Sales Tax Deduction | $0 | - $34 | Repealed along with the deductions for property and income taxes paid to states and local governments |

| Wind Production Tax Credit | $11 | - $28 | Reduced by a third, repealed after 2024 |

| Controlled Foreign Corporation Look-Through (allows a company to make payments between its subsidiaries without being taxed) | - $15 | - $20 | Made permanent |

| Expires in 2017 | |||

| American Opportunity Tax Credit (credit for undergraduate tuition) | - $8 | - $68 |

Made permanent and reformed. More refundable, but not as available to high-income households. Part of a broader education reform that repealed many provisions. As a whole, education reforms save about $20 billion. |

| Child Tax Credit | N/A | - $74 | Expanded and extended. The 2009 expansion reduced the income floor on claiming the credit from $10,000 to $3,000. TRA further reduces it to $0. As a whole, the TRA increased the size of the credit, costing $550 billion. |

| Earned Income Tax Credit | N/A | - $23 | Mixed. In 2009, the EITC was expanded in two ways, by reducing the marriage penalty for claiming the EITC and increasing the credit for families with three or more children. TRA further reduces the marriage penalty, but eliminates the increase for families with three or more children. As a whole, the EITC is dramatically reduced, saving almost $220 billion. |

Negative numbers increase the deficit. Source: Joint Committee on Taxation, Congressional Budget Office, CRFB extrapolations.

The two savings numbers are not apples-to-apples, as they are measured against different tax codes with different rates.