The Tax Break-Down: American Opportunity Tax Credit

This is the tenth post in our blog series, The Tax Break-Down, which will analyze and review tax breaks under discussion as part of tax reform. Last week, we wrote about individual retirement accounts used for retirement planning.

The American Opportunity Tax Credit (AOTC) was enacted as part of the 2009 stimulus legislation and replaced an existing tax credit for college students called the Hope credit. The AOTC enables undergraduate students or their parents to claim up to $10,000 in tax credits for education expenses over four years.

The American Opportunity Tax Credit allows parents or children to claim a tax credit for education expenses – like tuition or course materials – during the first four years of college. The taxpayer can claim 100% credit for the first $2,000 spent, and 25% credit for the next $2,000 spent, for a total credit of $2,500 per year. Up to 40% of the credit ($1,000) is refundable for taxpayers who have no income tax liability. The AOTC also phases out for single taxpayers making between $80,000 and $90,000 and joint filers making between $160,000 and $180,000.

Under current law, the AOTC will expire in 2017 and revert back to the Hope credit, which had been available since 1998. The Hope credit is non-refundable and only available for the first two years of college. It would also provide a smaller subsidy ($1,800) and starts phasing out at a lower threshold of $57,000/$107,000 (single/joint filer).

Taxpayers can only claim one of three education benefits, although the AOTC is the most generous tax benefit for people who qualify. Taxpayers can also choose the Lifetime Learning Credit (which is smaller, but available beyond the first 4 years of post-secondary school education) or the tuition and fees deduction (which is less valuable, but available to high-income taxpayers who do not qualify for the other credits).

How Much Does It Cost?

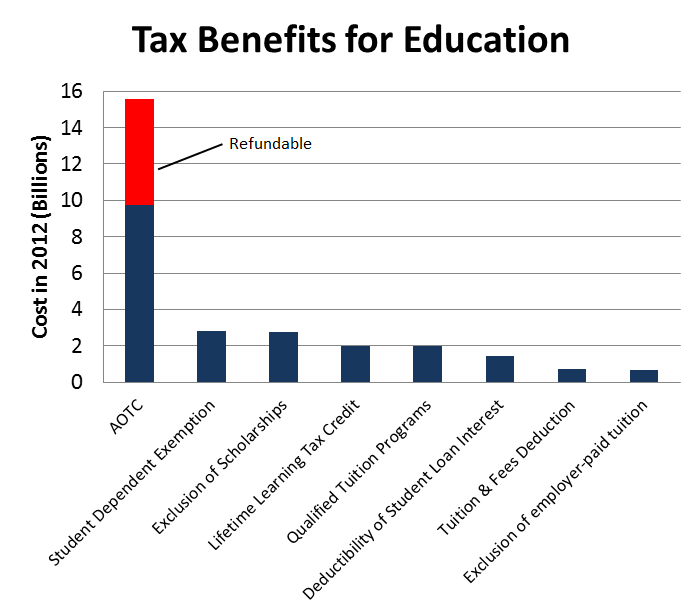

According to the Joint Committee on Taxation (JCT), all education credits combined will cost $20 billion in lost income tax revenue in 2013, or over $125 billion over the next five years. OMB provides an estimate for just the American Opportunity Tax Credit of $14 billion this year. Slightly under half of the credit’s cost is the refundable portion given to individuals with no income tax liability.

According to the Tax Foundation, repealing all education tax credits would provide enough revenue for a 0.9 percent across-the-board rate cut (the 39.6 percent rate would become 39.2 percent)

Source: Office of Management and Budget, 2013

If the current provisions were extended permanently instead of expiring in 2017, the AOTC would cost an additional $11 billion per year starting in 2018, or $58 billion through 2023, according to the President’s Budget.

Who Does It Affect?

Because the AOTC is refundable and phases out for higher income individuals, its benefits are spread relatively evenly across taxpayer income levels. By comparison, the Hope credit offered a benefit much more concentrated on middle-class taxpayers. Only about a quarter of the recipients of the AOTC have incomes over $75,000, and 16% have incomes over $100,000. The AOTC can either be based on a student’s income, or that of their parents, depending on who pays tuition and claims the credit. Students claiming the credit can create a very misleading perception of the income distribution, since young people make (and spend) less and get income from sources not often reported on tax returns, like gifts.

Source: Tax Policy Center estimates for 2011 and 2012

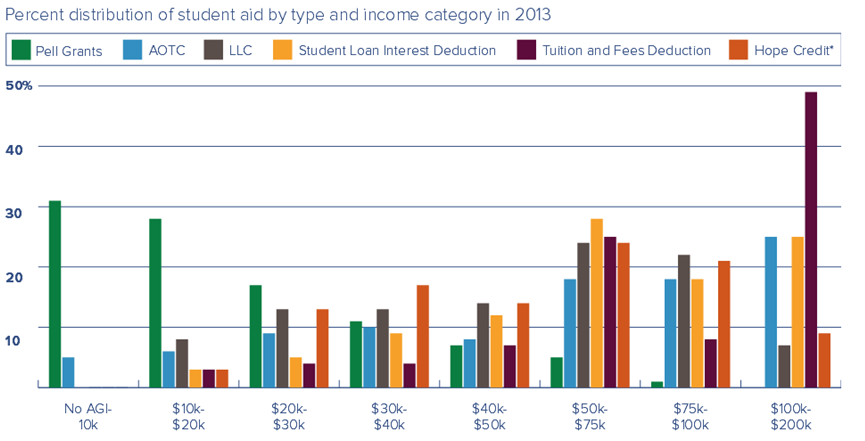

As we’ve written before, education tax preferences are nearly as large as Pell Grants, and these tax preferences comprise half of non-loan student aid. Benefits from Pell Grants are targeted to low-income households, while the tuition and fees deduction is the least progressive of these education subsidies with 50 percent going to households making over $100,000. The AOTC’s benefit also accrues more to higher-income households than Pell Grants, which can be seen clearer in the below graph that groups taxpayers by income levels, instead of lumped into larger quintiles as above.

Source: CLASP

What are the Arguments For and Against the American Opportunity Tax Credit?

Proponents argue that the American Opportunity Tax Credit provides financial assistance for college students struggling with the rising cost of tuition. Particularly in its expanded form, the AOTC better helps students who are lower in the income distribution than the Hope credit, and was responsible for a 90 percent increase in tax incentives for education in 2009. Proponents say that expanding the credit to cover third and fourth year students will make it easier for them to stay in school. A study predating the AOTC found that federal aid creates a small persistence effect, encouraging students to stay in school.

Opponents argue that the AOTC does nothing to encourage college attendance; rather, it is a windfall to students who planned to attend college anyway. The credit may help students with college costs, but it comes with a lag of up to 15 months, and the student likely would have already taken out loans to pay for college. Further, they argue that the credit is not well-targeted, since credits given to upper-income students could be better targeted to poor families. They argue that the complicated system of three different tax credits, various deductions for tuition expenses, and tax benefits given to universities should be dramatically simplified. Finally, federal subsidies for education may drive up the cost of tuition, either at all universities or only for-profit universities.

What Are the Options For Reform?

| Revenue from Options to Reform the American Opportunity Tax Credit (billions, 2014-2023) | |||||

| Policy | Current Law | Current Policy | |||

| Extend AOTC past 2017 | - $60 | $0 | |||

| Extend the AOTC and index it for inflation | - $75 | - $15 | |||

| Repeal the AOTC, but leave the Hope credit in place | $100 | $160 | |||

| Repeal the AOTC, Hope, and Lifetime Learning credits, and gradually eliminate the interest deduction | $155 | $215 | |||

| Limit the AOTC to those below 500% of poverty, extend it, and eliminate other education tax benefits | $25 | $85 | |||

| Streamline all education benefits into a single credit, as proposed by Wyden-Gregg | $60 | $120 | |||

| Repeal all education preferences except the AOTC | $200 | $140 | |||

| Increase the AOTC’s refundability to 60% | - $10 | - $15 | |||

*All estimates are CRFB calculations based on available estimates.

What Have Other Plans Done?

President Obama’s budget and the Senate Budget Resolution would make the AOTC permanent, extending it past 2017. Numerous other proposals would reform, consolidate, or eliminate education tax credits. The New America Foundation’s plan for education reform would eliminate all tuition tax benefits and re-direct the money to Pell Grants. The Institute for College Access and Success recommends eliminating higher education tax provisions as well, instead funneling the money into Pell Grants and incentive funds.

Many plans would streamline various education credits into one provision: Senators Wyden and Coats would create a single nonrefundable credit. Sen. Rubio and Rep. Schock would eliminate other tax incentives in favor of a version of the AOTC targeted towards low- and middle- income families. Both the National Community Tax Coalition and the American Institute of CPAs propose a simplified credit. The Heritage Foundation would create a single tuition deduction, up to the value of the average cost of college.

The Center for Law and Social Policy published recommendations that would reform the AOTC and other educational credits, simplifying tax credits and front-loading refundability so students get the credit when they pay tuition instead of much later.

Both the Simpson-Bowles and Domenici-Rivlin plans did not include the American Opportunity Tax Credit on the short list of tax expenditures that they would keep, choosing to repeal it in favor of lower rates and higher revenue.

Where Can I Read More?

- Congressional Research Service - The American Opportunity Tax Credit: Overview, Analysis, and Policy Options

- Tax Policy Center – “American Opportunity” Tax Credit

- Committee for a Responsible Federal Budget – Tax Expenditures for Higher Education Rival Spending on Pell Grants

- Internal Revenue Service – Tax Benefits for Education: Information Center

- Susan Dynarski – Testimony before the Senate Finance Committee

- Scott Hodge – Are Tax Credits the Proper Tool for Making Higher Education More Affordable?

- CLASP – Reforming Student Aid: How To Simplify Tax Aid and Use Performance Metrics to Improve College Choices and Competition

- Congressional Budget Office – Higher Education Tax Credits

* * * * *

The American Opportunity Tax Credit is an expanded tax credit for undergraduate tuition expenses. It helps students and their families in most income ranges, providing up to $2,500 per student per year. However, critics complain that the AOTC does not change the number of people who go to college—it only subsidizes those who would go anyway. Some education reformers would eliminate the AOTC in favor of more funding for Pell Grants, which are targeted more heavily to low-income families and provide aid when the tuition bill comes due instead of 15 months later. Many tax reform plans have offered suggestions to consolidate and simplify the many tax preferences for higher education, in some cases incorporating features to better help students attend college without contributing to the rising cost of tuition.

Read more posts in The Tax Break-Down here.