Weakening the SALT Cap Would be a Costly Mistake

According to press reports, policymakers are considering changes to the $10,000 state and local tax (SALT) deduction cap as part of their efforts to extend the expiring parts of the Tax Cuts and Jobs Act (TCJA). Specifically, recent discussions have centered around boosting the cap from $10,000 to $20,000 for married tax filers. Although this change would reduce the “marriage penalty” associated with the current cap – which doesn’t vary by filing status – it would also further increase the deficit effect of TCJA extension, provide a windfall to higher earners in high-tax states, and undermine tax simplicity.

We’ve written numerous times about past efforts to weaken the SALT cap. In this piece, we show doubling the SALT cap for married couples would:

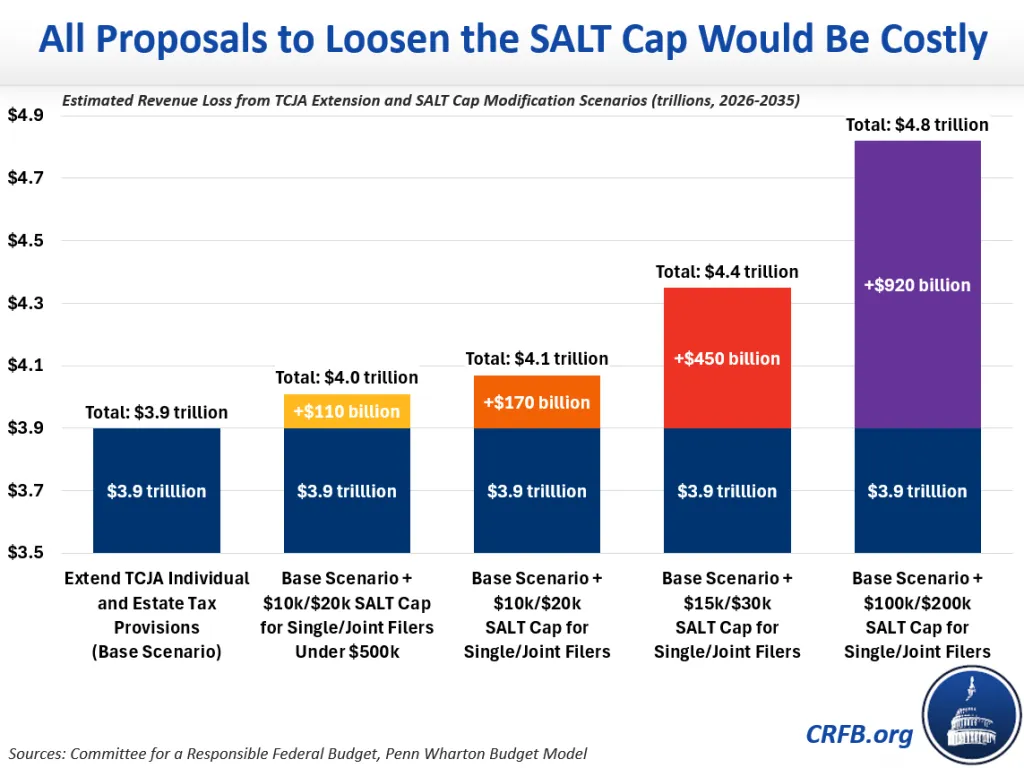

- Reduce revenue by $170 billion, on top of the $3.9 trillion deficit impact of extending the expiring individual and estate tax provisions in the TCJA as written.

- Deliver 94 percent of the benefit to households making over $200,000 per year, disproportionately in high-tax states like New York and California.

- Undermine tax simplicity by significantly reducing the number of filers taking the standard deduction.

For these and other reasons, lawmakers should avoid any efforts to weaken the SALT cap and should instead tighten the cap. At a minimum, any SALT relief should be more-than-fully offset so that, on net, SALT changes raise revenue to help cover the revenue loss of any other tax cut extensions.

SALT Relief is Expensive

Extending the expiring individual and estate tax provisions under the TCJA would reduce revenue by $3.9 trillion over the next decade, meaning lawmakers will need to include significant adjustments and/or offsets to prevent tax extensions from worsening an already unsustainable debt trajectory.

Raising the SALT cap to $20,000 for joint filers would increase that revenue loss by $170 billion, to $4.1 trillion. Covering that additional revenue loss would require the equivalent of a 1 percentage point increase in the top individual income tax rate. Limiting the cap increase to those earning less than $500,000 would mitigate some revenue loss but would still result in more than $110 billion in lost revenue. Further increasing the SALT cap to $15,000 for individuals and $30,000 for couples would reduce revenue by roughly $450 billion. Some reports have even suggested policymakers are considering increasing the SALT cap to $100,000 for single filers and $200,000 for joint filers, which would reduce revenue by an additional $920 billion.1

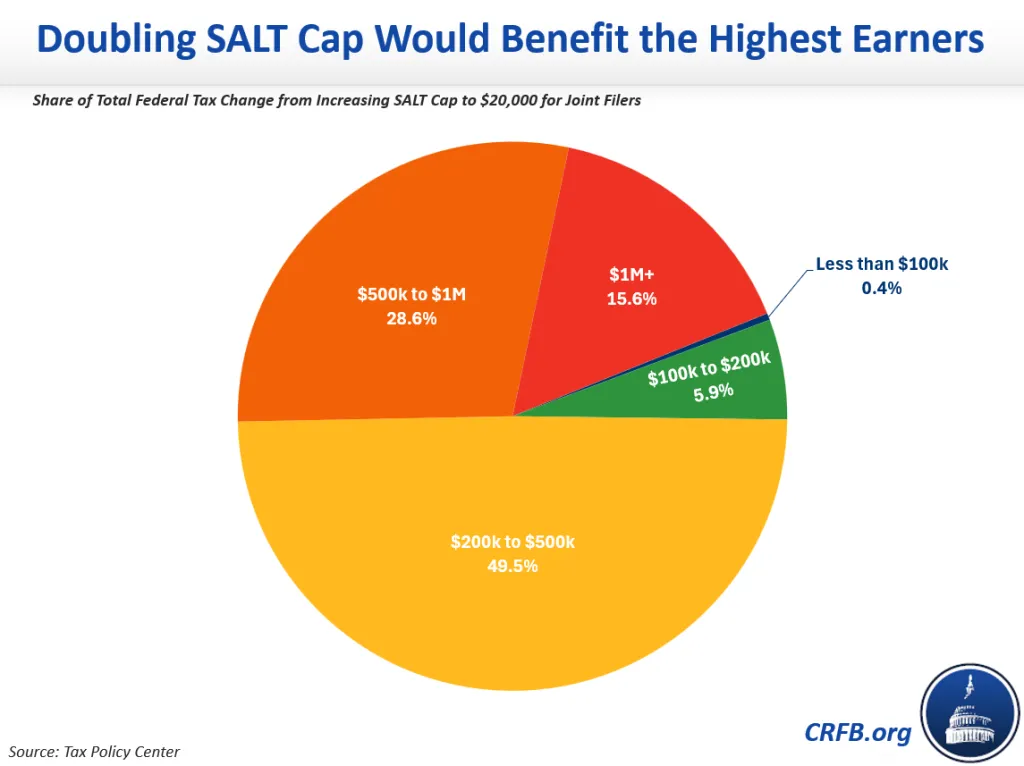

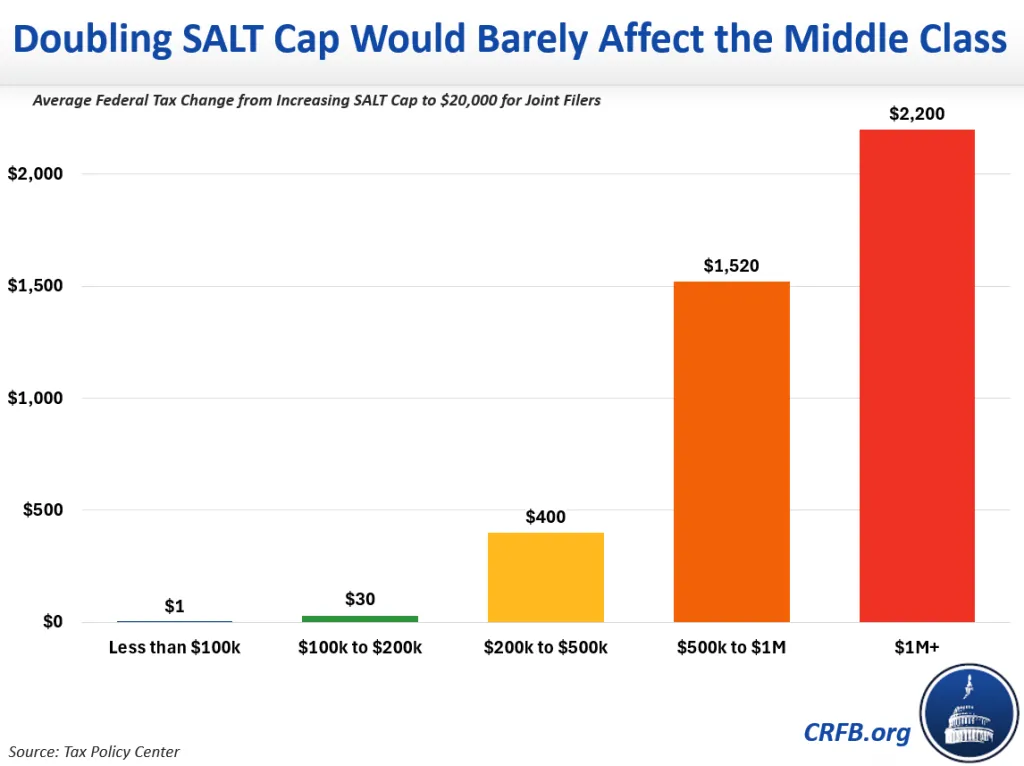

SALT Relief is Regressive

Although often described as middle-class tax relief, the benefits from loosening the SALT cap would flow almost exclusively to the highest-income households, especially to those in high-tax states like New York, New Jersey, Connecticut, and California.

Indeed, according to the Tax Policy Center, approximately 0.4 percent of the benefit of doubling the SALT deduction for married couples would go to households making less than $100,000 per year, while nearly 94 percent would go to households making over $200,000 per year.

The average tax cut would be less than $1 per year for those making under $100,000, about $30 per year for those making between $100,000 and $200,000, $400 per year for those making between $200,000 and $500,000, $1,520 per year for those making between $500,000 and $1,000,000, and $2,200 per year for those making over $1,000,000. If the cap were increased to $100,000 for single filers and $200,000 for joint filers, the average tax cuts would be exponentially larger across the board but especially for those in the highest tax bracket. As we’ve shown before, further loosening of the SALT cap would skew benefits even more toward the highest earners.

SALT Relief Would Worsen Tax Complexity

One of the best benefits of the TCJA was that it simplified the tax code; it reduced the number of households itemizing their deductions from nearly 50 million to only 15 million. This was accomplished mainly by boosting the standard deduction while also capping the SALT deduction. In 2025, for example, the combination of a $10,000 SALT cap and a $30,100 standard deduction for married couples means that a given household that paid more than $10,000 of state and local taxes would not need to itemize unless it had over $20,000 of mortgage interest payments, charitable deductions, and/or other deductible expenses.

Doubling the SALT deduction for couples would greatly increase the number of households who itemize. Instead of needing over $20,000 in deductible expenses, as in the above scenario, any household with more than $10,000 of deductible expenses would need to itemize, which would increase the number of itemizing households by roughly 4.1 million, according to the American Enterprise Institute. A further increase in the SALT deduction could mean up to 7.1 million more itemizers. This would significantly reduce tax simplicity and increase the cost of tax compliance in terms of hours and money spent on tax preparers. The larger the increase in the SALT cap, the more taxpayers would need to itemize.

SALT Changes Should Reduce Revenue Loss from TCJA Extension, not Increase It

Rather than weakening the SALT cap, lawmakers should strengthen it. Concern over the marriage penalty could be addressed by reducing the SALT cap to $5,000 for single filers or setting a new revenue-neutral cap – for example at about $6,000 for singles and $12,000 for couples.2

Other options to help finance any marriage penalty relief and other TCJA extensions include:

- Phasing out the SALT cap for higher earners

- Closing the SALT cap “pass-through workaround”

- Applying the SALT cap to corporate taxes

- Partially reviving the Alternative Minimum Tax (under which SALT is non-deductible)

- Repealing the SALT deduction

Given the $3.9 trillion deficit impact of a straight extension of the TCJA, as well as our mounting federal debt, policymakers should be pursuing options to reduce rather than expand the revenue loss from any tax cut extensions.

Note: this blog was originally published with an incorrect graphic. It has since been substituted with the correct graphic.

1 Based on estimates from Penn Wharton Budget Model and the Tax Foundation.

2 Based on estimates from the Bipartisan Policy Center.