Tax Expenditures For Higher Education Rival Spending on Pell Grants

One of the lesser known provisions of the American Taxpayer Relief Act is the extension of the refundable American Opportunity Tax Credit (AOTC) through 2017. The AOTC was created in the 2009 stimulus to replace the non-refundable Hope Credit, and provides a tax credit equal to spending on tuition, up to $2,500. A recent post by Elaine Maag on TaxVox shows the growth of education-based tax expenditures over ten years, a trend that has accelerated with the creation of the AOTC.

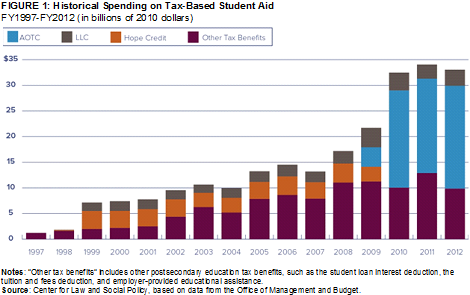

Tax expenditures for higher education aid have grown significantly in value since the Hope and Lifetime Learning Credits were created in 1997, quadrupling in value between 2000 and 2010. Tax expenditures for higher education totaled $34.2 billion in 2012, compared to the $35.6 billion in spending on Pell grants.

Maag also shows that the AOTC may be less effective in reaching low-income students. For one, the AOTC is not received until a tax return is filed, meaning the benefits often don't reach filers until well after tuition is paid. Also, the Tax Policy Center estimates that half of the benefits from the tuition and fees deduction and a quarter of the AOTC's benefits will go to families making over $100,000. This is a significant amount of foregone revenue to subsidize those who likely would have attended college without the AOTC. Many lawmakers may want to promote higher education, but it may be worth questioning if these resources can be directed in a better way.

Tax expenditures may get less scrutiny than direct government spending does, and it is worth examining some of these credits and deductions to see if they are achieving their policy goals in a cost-effective way. A report from the GAO discussed things to think about when evaluating tax expenditures. In doing so, the report suggested that there were many ways to improve or eliminate many deductions and credits, paving the way for a simpler and more efficient tax code. The GAO especially highlights the prevalence of tax windfalls, where much of a tax expenditure's value is going towards promoting behavior that would have taken place anyway. Tax-based student aid may be one of those areas the way many credits are currently designed.

About a month ago, we highlighted a report from the New America Foundation's Education Policy Program on reforming federal financial aid. Not surprisingly, tax expenditures were targeted in recommendations, and the report recommended eliminating higher education tax benefits (i.e. the American Opportunity Tax Credit) and tax advantaged education savings plans (i.e. 529 plans) and redirecting the savings to the Pell Grant program.

Lawmakers may chose to keep some tax expenditures around to achieve worthwhile policy goals, such as promoting education, homeownership, and donations to charity. But tax expenditures will also total nearly $1.3 trillion in forgone revenues, and given unsustainable debt projections, lawmakers will need to find additional revenues in addition to controlling spending growth in entitlement programs. Not all deductions and credits need be eliminated, but many will have to be reformed. Tax reform could create a more efficient and effective tax code, and that will require taking a serious look at tax expenditures.