New Proposal to Reform Federal Student Aid

In a report released today, the New America Foundation’s Education Policy Program offers a proposal to overhaul the federal financial aid system with over 30 specific policy options. The authors argue that the current poorly targeted and complicated system, combined with rising tuition costs, is no longer meeting today’s demand. These recommendations aim to more efficiently spend federal dollars and better align incentives for students and institutions of higher education. These include:

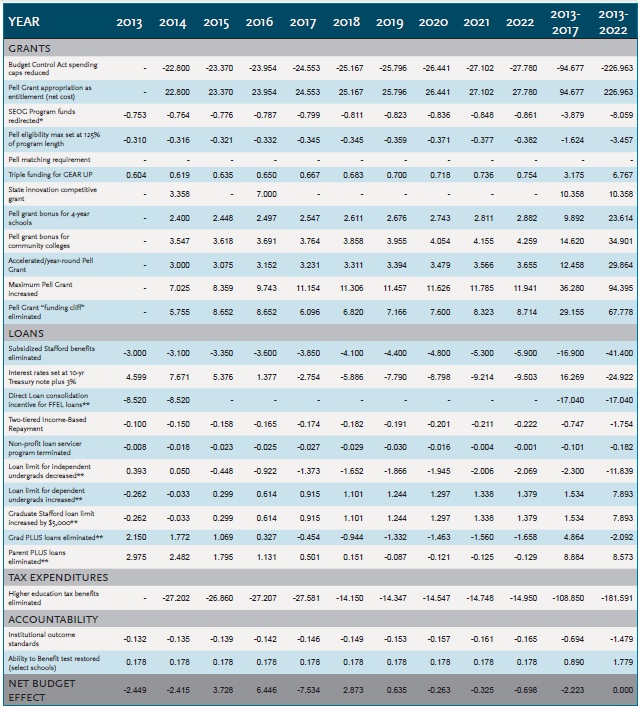

- Reform Pell Grants: The report recommends permanent elimination of the Pell Grant funding cliff and shifting future Pell funding to the mandatory side of the budget (making it into an entitlement program). It proposes increasing the maximum Pell Grant and providing Pell bonuses to public and private non-profit colleges that serve a larger share of low-income students. Additionally, it recommends requiring schools that enroll a small share of low-income students but charge them high net prices to match a portion of the Pell Grant funds they receive.

- Make the Pell Grant Program Mandatory and Fully Fund ($68 billion cost)

- Increase the Maximum Pell Grant Level ($94 billion cost)

- Enact Further Pell Grant Reforms ($94 billion net cost)

- Simplify Student Loans: The report recommends eliminating the in-school interest subsidy for subsidized Stafford student loans, which ensures that interest doesn't accrue while the borrower is in school. It would also allow borrowers to repay their loans based on a percentage of their earnings after graduation, thereby reducing the dangers of default. Other options which would reduce spending include the creation of a new fixed formula for setting student loan interest rates that adjusts annually according to market conditions (specifically, ten-year Treasury bond rates plus three percent) along with incentives for borrowers with older loans to switch to the direct loan program.

- Eliminate in-school interest subsidies ($41 billion savings)

- Set student loan interest rates based on market rates ($25 billion savings)

- Enact other student loan reforms ($9 billion net savings)

- Eliminate Certain Education Tax Expenditures: The report recommends eliminating higher education tax benefits (i.e. the American Opportunity Tax Credit) and tax advantaged savings plans (i.e. 529 plans). They argue that the benefits are poorly targeted, poorly timed (since benefits are often received long after tuition is paid), and complex to navigate. (savings $182 billion)

- Improve Accountability, Transparency, and Reform: Other recommendations in their report would create new incentives to use existing federal aid more effectively with greater accountability and data collection measures. (<$1 billion net cost)

Click image to enlarge.

While together these recommendations are budget neutral through 2022 according to their estimates, individually some policies (such as increasing the Pell grant program) would be deficit increasing whereas others (such as eliminating interest-free subsidized Stafford loans) would be savers. Importantly, the report reminds us that there are opportunities in all areas of the budget to reduce, reform, and more efficiently use federal spending to achieve policy goals.