An Irresponsible "Tax Extender" Package

Senate Democratic leadership is reportedly considering a last minute effort to extend 55 expiring tax provisions for another year, including a large number of so-called “tax extenders” as well as the supposedly-temporary bonus depreciation. This package could cost $40 to $50 billion and includes no offsets.

As CRFB, the Center on Budget and Policy Priorities, and others have said numerous times, lawmakers should fully pay for any extensions to expiring tax provisions. CRFB recently highlighted the importance of PAYGO, and we believe it should apply to anything Congress choses to continue or waive, including sequester relief, unemployment insurance, and the doc fix, as well as the tax extenders. Ideally, lawmakers would address expiring tax provisions within the context of comprehensive tax reform. But short of that, lawmakers should carefully review the extenders, decide which ones are worth keeping, and fully pay for the cost of doing so.

CRFB recently analyzed the package of tax extenders Congress is currently considering, and found that the one-year extension of the provisions could cost between $40 and $50 billion through 2023. That's a cost of roughly twice the savings that the Bipartisan Budget Act was able to put in place this week. That may not seem like a lot, but its worth considering that deficit financing the extensions year after year would cost over $500 billion if bonus depreciation expires, or roughly $800 billion if it is continued as well (which totals up to $970 billion when including interest costs). The Center on Budget and Policy Priorities recently measured the long-term implications of deficit-financing extenders. As they wrote:

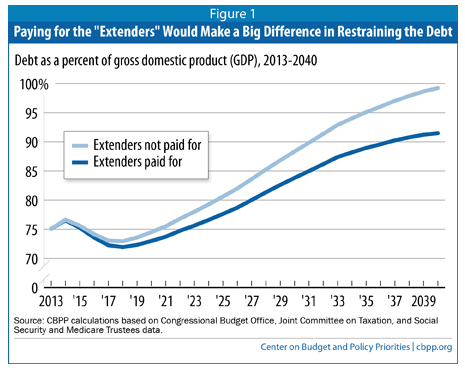

If the tax extenders are made permanent but not paid for (and no other changes in current policy are made), the debt as a percent of GDP will rise about 24 percentage points between 2013 and 2040, from 75 percent of GDP to 99 percent. We project that if the cost of continuing the extenders is offset, however, the debt ratio will rise about 16 percentage points over that period, to 91 percent of GDP. The resulting debt ratio will still be too high, and deficit-reduction action will be needed on a variety of other fronts. Nevertheless, this would represent a significant contribution. Simply paying for the tax extenders would erase about one-third of the expected climb in the debt-to-GDP ratio between now and 2040.

We couldn't agree more with CBPP on this point. Senate Democrats should take note, as should the rest of Congress if this package gains any traction. Lawmakers need to either fully offsets the costs of any tax extenders this decade with other changes to the tax code or spending programs or else let the provisions expire.

It is extremely disappointing that one day after the Senate passed a budget agreement that made a very modest step in reducing the deficit Senate Majority Leader Reid is attempting to pass a tax extenders package without offsetting the cost. If lawmakers cannot agree on a comprehensive plan to reform the tax code, strengthen entitlement programs and put the debt on a downward path, they should follow the example of the Ryan-Murray budget compromise which established the principle that the costs of short-term fixes should be fully offset while also having additional savings for deficit reduction. It would be encouraging if lawmakers were to continue this principle going forward in order to keep making incremental progress on controlling long-term federal debt.

At absolute minimum, they must not make the deficit worse.