Taking a Closer Look at the House Budget’s Reconciliation Instructions

Note (2/19/2025): The below analysis was written before the committee marked up the resolution and added a requirement for an additional $500 billion of savings; we have updated our analysis here.

The House Budget Committee is set to mark up a budget resolution for Fiscal Year (FY) 2025 that would facilitate the beginning of the budget reconciliation process to extend the expiring provisions of the Tax Cuts and Jobs Act (TCJA), increase spending on border security and defense, and enact other tax cuts and energy changes. The budget resolution’s instructions include a net $3.3 trillion in allowable deficit increases – or nearly $4 trillion including interest in additional debt by 2034.

In this piece, we explain that:

- The budget resolution includes $3.3 trillion of net allowable deficit increases – from $4.8 trillion of deficit increases somewhat offset by $1.5 trillion of required savings – that, with interest, we estimate would allow nearly $4 trillion of additional debt.

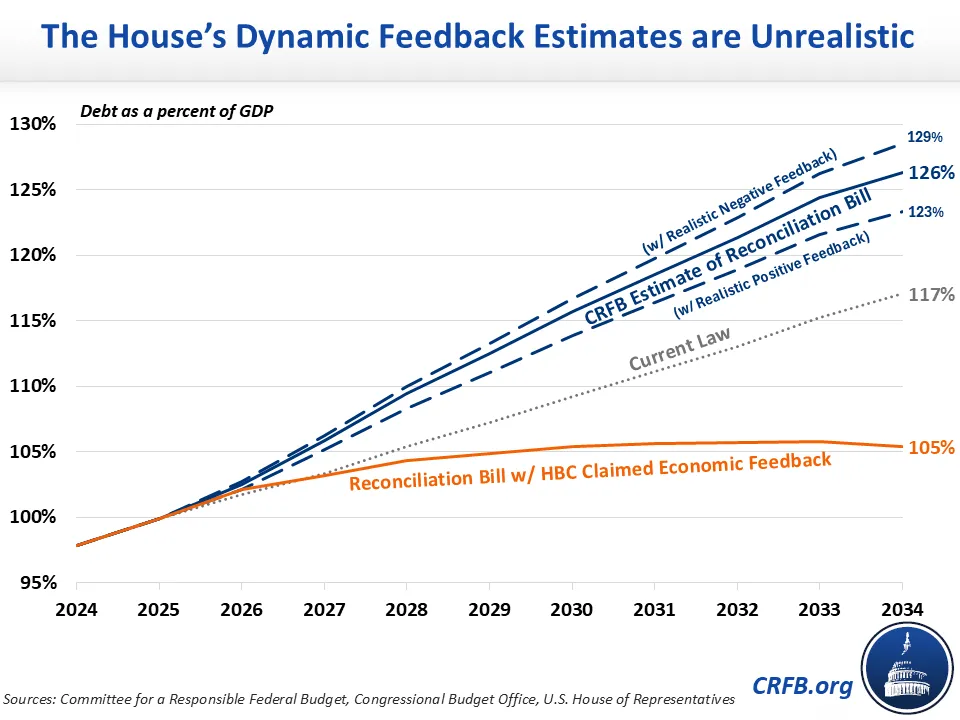

- Passing a reconciliation bill consistent with these instructions would increase debt in 2034 (the last year of the budget) to 126 percent of Gross Domestic Product (GDP) compared to 117 percent under current law.

- The budget’s economic assumptions are overly aggressive, and the ultimate direction of the economic effects is likely ambiguous; if they resulted in modestly positive economic feedback, we estimate debt would be 123 percent of GDP by 2034, or if they resulted in modestly negative feedback, we estimate debt would be 129 percent of GDP by 2034.

- The window of the budget – FY 2025 through 2034 – includes one year where the TCJA doesn’t need to be extended (2025) and one less year of extension (2035) than a 2026-2035 budget would include, which could make the $4.8 trillion of tax cuts and spending increases in this budget window translate to $5.5-$6 trillion of ten-year increases.

- The Ways and Means Committee’s instruction in particular could be substantially smaller by either paring back extensions and cuts or increasing the savings sought from the committee’s jurisdiction.

Reconciliation Instructions Allow $4 Trillion of New Debt

Lawmakers have stated that they intend to use reconciliation to extend the expiring provisions of the TCJA, increase spending on border security and defense, and enact other tax cuts and energy policies proposed by President Trump during his presidential campaign. The budget resolution would allow committees to report a gross $4.8 trillion in deficit increases and at least a gross $1.5 trillion in deficit reductions, for a net $3.3 trillion of deficit increases. Additionally, the budget includes a policy statement explaining that the goal is to reach $2 trillion of savings and that failure to meet that goal would reduce the Ways and Means instruction by a commensurate amount. However, policy statements are not binding, meaning this could ultimately be ignored.

After accounting for the interest effect of a $3.3 trillion primary deficit increase, we estimate that debt would rise by nearly $4 trillion, reaching 126 percent of GDP by 2034, compared to 117 percent of GDP under current law. Deficits by 2034 would rise to 6.5 percent of GDP compared with 6.1 percent under current law.

Potential Debt Impact of House Budget’s Reconciliation Instructions (FY 2025-2034)

| Committee of Jurisdiction | Reconciliation Instruction (billions) |

|---|---|

| Ways and Means | $4,500 |

| Judiciary | $110 |

| Armed Services | $100 |

| Homeland Security | $90 |

| Deficit Increases | $4,800 |

| Energy and Commerce | -$880 |

| Education and Workforce | -$330 |

| Agriculture | -$230 |

| Oversight and Government Reform | -$50 |

| Transportation and Infrastructure | -$10 |

| Financial Services | -$1 |

| Natural Resources | -$1 |

| Deficit Reductions | -$1,502 |

| Subtotal | $3,298 |

| Interest | ~$700 |

| Total | ~$4,000 |

Sources: House Budget Committee, CRFB estimates.

Budget’s Economic Assumptions Are Overly Aggressive

The budget resolution assumes $2.6 trillion of macroeconomic feedback, which press reports have indicated is a result of boosting average annual growth to 2.8 percent from a projected 1.8 percent. If one were to assume the House budget’s $2.6 trillion of economic feedback from 2.8 percent average annual growth and $3.3 trillion of net deficit increases, debt would reach 105 percent of GDP by 2034 and the deficit would total 5.6 percent of GDP in 2034.

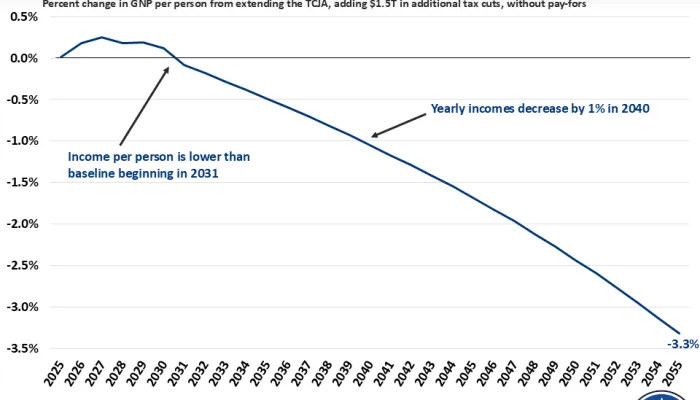

However, as we have written before, it is very unlikely that any set of policies would be able to get this magnitude of economic feedback – and certainly not through extension of the TCJA alone. To reach 2.8 percent average annual growth, the combination of policies would need to increase 2034 GDP by 10 percent and increase the average annual growth rate by around 55 percent and offset nearly 80 percent of the reconciliation bill. The range of estimates from independent estimators is that the dynamic growth would offset 1 percent to 14 percent, or $15 to $581 billion in dynamic feedback – and some estimates even imply negative feedback.

More credible economic assumptions would result in much higher debt. Using the Tax Foundation’s estimate that TCJA extension could cause real GDP to be 1 percent larger after a decade and lower the revenue loss of extension by 14 percent through dynamic feedback, we estimate that debt would be 123 percent of GDP by 2034. Deficits by 2034 would total 6.4 percent of GDP.

However, the mix of tax cuts and extensions with immigration policy that results in a smaller labor force could actually result in real GDP per capita being larger or smaller but real GDP itself being smaller. In a scenario where the combined effect of these policies results in GDP that is 1 percent smaller after a decade, we estimate that debt would be 129 percent of GDP by 2034 and deficits would be 6.9 percent of GDP in 2034.

Budget Window Could Be Hiding $5.5-$6 Trillion of Ten-Year Debt

Because lawmakers are using the budget resolution for the current fiscal year – FY 2025 – to facilitate this reconciliation process, the relevant budget window for legislation is FY 2025 through 2034. As a result, the largest policy that lawmakers have mentioned wanting to address – TCJA extension – could only be extended through FY 2034, or nine years past its expiration date, and would largely not have any deficit impact in the first year of the budget window (2025). However, even nine years is likely an overstatement because tax policy is typically enacted on a calendar year basis, so it is likely that the reconciliation bill would need to have TCJA extension expire by the end of calendar year 2033. This would translate to an eight-year extension.

Extending the entirety of the TCJA through FY 2034 – including both the individual and estate tax provisions expiring at the end of 2025 and the business provisions that have been expiring over the last few years – would increase deficits by $4.2 trillion through 2034, or by about $4 trillion through the end of calendar year 2033. Thus, given the Ways and Means Committee’s $4.5 trillion instruction, lawmakers would be able to add another $500 billion of temporary tax cuts on top of TCJA extension and still comply with its instruction. Assuming the intention is for all of these tax cuts to be permanent and lawmakers will want to extend them when they expire – just as with TCJA now – the $4.5 trillion instruction could be significantly understating the ten-year impact of the policies being considered. This could mean $5.5 to $6 trillion of ten-year debt hidden within this eight-and-a-half year timeframe.

Ways and Means Committee’s Instructions Could Be Lowered Substantially

The budget resolution gives the Ways and Means Committee – which has jurisdiction over not only taxes but also Medicare, trade, Inflation Reduction Act credits, and several safety net programs – instructions that allow it to report legislation increasing deficits by up to $4.5 trillion through FY 2034. Given our current unsustainable fiscal situation and the trillions of dollars of potential savings available in these programs, the allowed deficit increase could easily be much smaller.

Instead, lawmakers could reduce the committee’s instruction to ensure that its allowable deficit increase is no larger than the total amount of deficit reduction instructions given to other committees. Even better, the instruction could be to reduce deficits, which would require lawmakers to fully pay for any tax cuts by either paring back costs or coming up with other savings from within the committee’s jurisdiction, resulting in a reconciliation bill that would reduce deficits overall instead of increase them.

Some examples of other savings or offsets that the Ways and Means Committee could consider, largely accounted for in our Offsets Bank, include:

- $200 billion or more from changes to Affordable Care Act subsidies.

- $400 billion or more from lowering Medicare costs.

- $200 billion or more from repealing or modifying the clean energy credits in the Inflation Reduction Act.

- $100 billion from ending the Employee Retention Credit and enacting other tax compliance measures.

- $50 billion or more from changes to TANF, the Social Services Block Grant, and inflation indexing.

- $500 billion or more from restricting SALT cap workarounds and extending the SALT cap to corporations.

- $300 billion from ending the Head of Household tax filing status.

- $100 billion from phasing the mortgage deduction cap down from $750,000 to $500,000.

- Over $600 billion from closing other tax loopholes and cutting tax breaks.

While we do not endorse any of these options specifically, the magnitude of their potential savings goes to show that the Ways and Means Committee’s instruction could be substantially smaller by requiring more savings from within the committee’s jurisdiction.

***

The House budget resolution would allow lawmakers to increase borrowing by nearly $4 trillion over the next decade. With the national debt headed toward record levels in just four years, interest costs on the national debt surging, and the impending insolvency of several federal trust funds, it would be a mistake to make our fiscal situation worse. Policymakers should ensure that any deficit increases are fully offset with savings – of which there are numerous options – and they should reduce, not increase, the debt.