Without Budget Discipline, a Spending Spree Ensues

Budget rules require new policies to be paid for with savings elsewhere in the budget. Policymakers must balance the new policy against the choices necessary to offset the costs, forcing them to prioritize and exercise cost restraint. Once PAYGO rules are suspended, however, legislation can be loaded up with new spending or tax breaks without the same scrutiny.

The tax bills considered by the House this year to permanently extend certain breaks are a prime example. These bills have all have been exempted from PAYGO rules which require legislation to be paid for and the budget limits established by the Ryan-Murray budget agreement. As a result, these bills have advanced new tax breaks and expanded existing tax breaks to the tune of $275 billion.

We've long called for Congress to abide by PAYGO with the tax provisions that expired at the end of 2013 known as the tax extenders. However, Congress appears to be holding themselves to a more relaxed standard where they are not required to pay for the costs of extending current policy: the tax cuts can be "extended for free." Even though this is a mistake which allows costs to disappear from the budget process, the door is opened to even greater problems once legislation is exempt from PAYGO. Without PAYGO, nothing prevents legislation from becoming a spending free-for-all of new and expanded tax breaks.

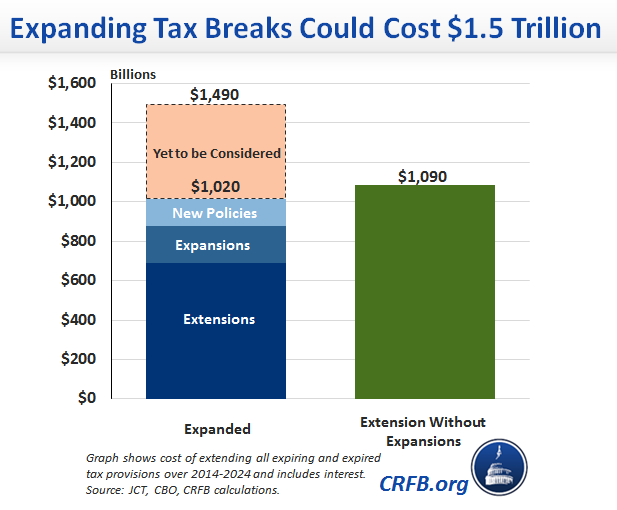

Only half of the 14 bills approved by the Ways and Means Committee even hold themselves to the more relaxed standard where extensions are free. The other half either expand current tax breaks or enact entirely new breaks, which would add about $275 billion to the debt over and above the $550 billion cost of simply extending current policies. And there are several dozen provisions that haven’t even been considered; all told with interest costs, the expansions could reach $1.5 trillion.

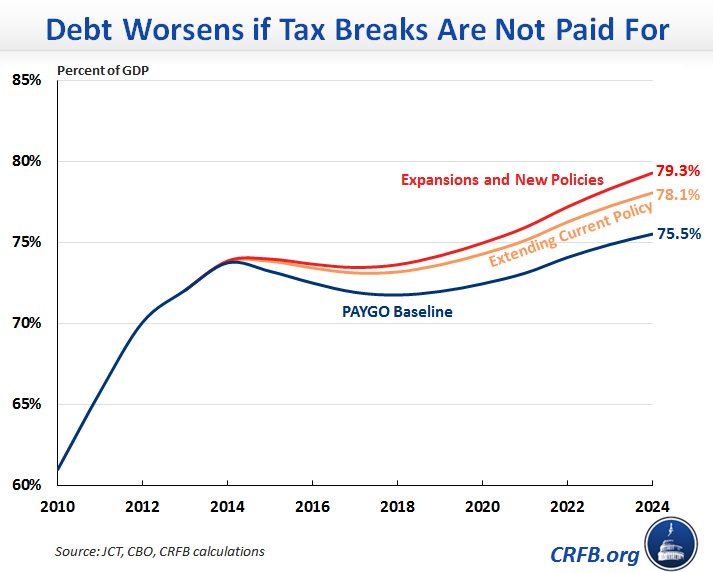

If lawmakers approve all 14 of these bills, our already unsustainable debt levels will increase even further. Debt will increase to 79.3 percent of GDP by 2024, rather than 75.5 percent if Congress followed PAYGO for all legislation.

The House is expected to vote on another package of five policies relating to the charitable deduction, three of which extend provisions that expired in December. The other two are new proposals from Chairman Dave Camp's (R-MI) tax reform discussion draft: allowing charitable deductions to be counted in the previous year and reducing the tax that certain private foundations must pay on their investment income. These new policies add another $5 billion to the $11 billion cost of extending expired tax breaks related to charitable contributions.

In total, the 14 tax bills approved by the Ways & Means Committee would cost $825 billion over the next ten years, or just over $1 trillion including interest costs. Half of them are either expansions of existing tax breaks or completely new policies. The table below lists all 14 bills and their cost (click to see the blog where we describe each one):

| Costs of Tax Provisions Approved By the Ways and Means Committee | |||

| Policy | Cost (2014-2024) | Description | House Floor Status |

| Research and Experimentation credit | $156 billion | Expansion (~$80 billion) | Approved |

| Small business expensing (Section 179) | $73 billion | Expansion (~$5 billion) | Approved |

| Two S corporation provisions | $2 billion | Extension | Approved |

| Bonus depreciation | $287 billion | Expansion (~$40 billion) | Approved |

| Allow tax-free charitable donations from retirement plans | $8 billion | Extension | Considered this week |

| Allow charitable donations to be counted in the previous year until April 15 | $3 billion | New Policy | Considered this week |

| Enhance the charitable deduction for businesses donating food | $2 billion | Extension | Considered this week |

| Reduce tax on private charitable foundations | $2 billion | New Policy | Considered this week |

| Extend more generous limits for donating conservation easements | $1 billion | Extension | Considered this week |

| Index the Child Tax Credit to inflation and expand to higher-income families | $115 billion | New Policy | Not yet considered |

| Expand the American Opportunity Tax Credit | $97 billion | Expansion (~$30 billion) | Not yet considered |

| Active financing exception | $59 billion | Extension | Not yet considered |

| Controlled foreign corporation look-through | $20 billion | Extension | Not yet considered |

| Subtotal, Cost of Tax Provisions | $825 billion | ||

| Interest Cost | $190 billion | ||

| Grand Total, Addition to the Debt | $1.02 trillion |

||

| Memorandum: Permanently extending these provisions at current levels, with interest | $690 billion | ||

Source: JCT, CBO, CRFB calculations

Related Posts: