Cost of Ways & Means Tax Cuts Passes the Trillion Dollar Mark

The Ways & Means Committee today marked up new and extended tax breaks costing more than $210 billion of lost revenue and increased outlays over the next decade, plus another $35 billion in interest payments. We've warned before about adding to the deficit by not paying for new tax cuts or spending increases, yet Congress continues down this path. Over the past three hearings, the Ways & Means Committee has approved $825 billion worth of tax cuts. Since none of the cuts are paid for with other savings, the bills would add over $1 trillion to the debt once interest is included.

The latest markup included two pieces of legislation. The first started as bipartisan legislation to reform and extend the American Opportunity Tax Credit (AOTC) for college tuition. Unfortunately, the committee kept the cost-increasing parts of the reform while removing the cost-saving measures. The result is nearly $100 billion of new costs, about one-third more than simply extending the current tax credit, which expires after 2017. The second bill would expand the Child Tax Credit at a cost of $115 billion. Importantly, this is not an extension of current policy. The bill would index the credit to inflation and make it available to families with incomes between $150,000 and $205,000, but leave the credit's 2017 expiration in place when it will become much less generous to low-income families.

The table below shows the cost of the provisions approved by the Ways and Means Committee in its recent hearings. We've written several times about the eight reasons that lawmakers should not increase deficits to pay for these provisions.

| Costs of Tax Provisions Approved By the Ways and Means Committee | ||

| Policy | Primary Cost (2014-2024) | With Interest |

| Extend and Expand the American Opportunity Tax Credit | $97 billion | ~$110 billion |

| Index the Child Tax Credit to Inflation and Expand Its Availability | $115 billion | ~$135 billion |

| Subtotal, provisions approved at June 24 hearing | $211 billion | ~$245 billion |

| Six provisions approved at the April 29 hearing | $310 billion | ~$380 billion |

| Six provisions approved at the May 29 hearing | $303 billion | ~$395 billion |

| Grand Total, Addition to the Debt | $825 billion | ~$1.02 trillion |

Source: JCT, CRFB calculations

At the markup, Budget Committee Chairman Paul Ryan (R-WI) argued that extending the AOTC is exempt from PAYGO requirements. However, this is incorrect for a number of reasons. First, AOTC was never among those tax breaks with a PAYGO exemption. Secondly, the exemptions that did exist were temporary – only for changes made before 2012. And finally, the exemptions would have only applied to a pure extension, whereas the Ways & Means bill would expand the AOTC and increase its cost by about $30 billion.

When the AOTC was extended on a temporary basis, only that temporary cost was accounted for – we have never accounted for the permanent cost in the budget. And indeed, Chairman Ryan's own budget assumes the AOTC either expires as scheduled or is paid for.

In addition to violating PAYGO, extending and expanding tax breaks would violate the Congressional Budget Act by reducing revenues below levels approved in the Ryan-Murray budget agreement and subsequently adopted by the House. In fact, these additional tax cuts would reduce revenue to levels below Ryan's House Republican budget and if they were in place the budget would not balance by the end of the decade.

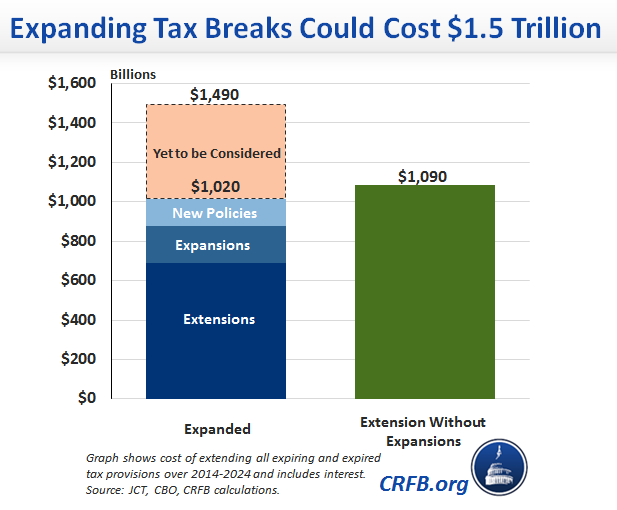

As we've explained before, the absolute least Congress can do to avoid rising debt levels is abide by PAYGO. Allowing current policy to be extended as exempt from PAYGO could make the debt situation far worse – but it also opens the door to an even greater lack of budget discipline. This is illustrated by the fact that the House bills to extend various tax breaks have actually increased their cost by about 50 percent.

When the first of these tax breaks was considered by the entire House, White House advisors recommended a presidential veto, citing the cost of extending these tax provisions without offsets. We hope the White House will maintain the same principle, recommending a veto of these or any other unoffset provisions if they are considered on the floor.

Lawmakers should be paying for all these provisions to avoid adding to an already unsustainable federal debt.