Not April Fool's: Senate Democrats Propose Lower Revenues than House Republicans

One of the recurring themes of recent budget debates has been partisan differences over the appropriate level of revenues, with Republicans rejecting any increased revenue proposed by Democrats in budget negotiations. But in separate releases yesterday, Senate Democrats proposed reducing revenues below the levels proposed by House Republicans. While this may seem like an April Fool’s joke, the numbers don’t lie.

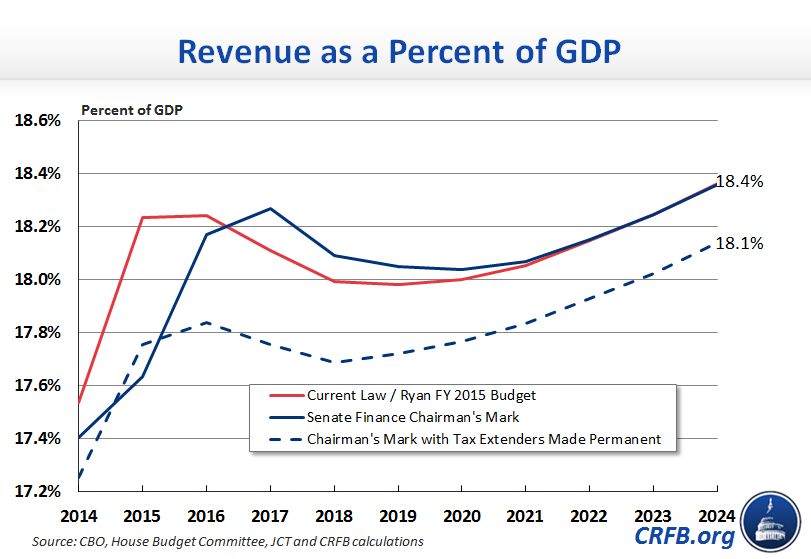

In a strange twist of timing, Senate Finance Committee Chairman Ron Wyden (D-OR) and Ranking Member Orrin Hatch (R-UT) released a chairman’s mark of legislation addressing tax extenders that would reduce revenues below current law by $108.5 billion in fiscal year 2015 and $67 billion over ten years the same day that House Budget Committee Chairman Paul Ryan (R-WI) released a budget resolution which would maintain revenues at current law levels. As a result, total revenues under the Senate Finance Committee mark would be $108.5 billion below the revenue levels proposed in Chairman Ryan’s budget resolution for fiscal year 2015.

The difference becomes even more dramatic if the tax extenders in the Senate Finance Committee legislation were extended through the end of the decade. In that case, revenues under the Senate Finance Committee policies would be $679 billion lower than the revenue levels in the budget resolution put forward by Chairman Ryan.

We should note that Senate Democrats are not solely responsible for the Senate Finance Committee's proposal; the chairman's mark has the support of Hatch, the Committee's ranking Republican. And lawmakers of both parties have already offered up numerous amendments that would increase the final cost of the Senate proposal.

It is true that Chairman Wyden has said that this is the last tax extenders package he intends to enact, and that he plans on dealing with extenders as part of tax reform. But how Congress deals with tax extenders now will affect the baseline used to score tax reform proposals. Passing tax extenders without offsets could lead to a much lower revenue baseline as the starting point for tax reform. For that reason, it is essential that policymakers offset the costs of a temporary extension of expiring provisions and permanently address tax extenders as part of comprehensive tax reform. If not, the joke will be on the American people in the form of higher debt.