Want to Understand the Tax Extenders? Here's a Few Charts.

Congress is continuing to discuss this week the tax extenders, a set of tax breaks that expired at the end of last year which could have major fiscal implications if they were extended without being paid for. Below, we describe the extenders in a series of charts.

While CBO projects our fiscal situation will continue to deteriorate in the coming years, Congress could make the situation worse by renewing a host of temporary and expired tax provisions without offsetting their cost.

While CBO projects our fiscal situation will continue to deteriorate in the coming years, Congress could make the situation worse by renewing a host of temporary and expired tax provisions without offsetting their cost.

A PDF version of our chartbook is available here. The individual charts are posted below with their descriptions. In addition, see our "Tax Break-Down" on the extenders for a much more detailed look at the history and composition of the individual provisions in the extenders package, and follow our blog posts on the tax extenders for the latest updates.

Chart 1: What Are the Tax Extenders Anyway?

Over 50 tax breaks expired at the end of 2013. These provisions are known as the "tax extenders" because Congress typically extends them for a year or two at a time. All of these provisions have expired at least once before, many of them have been continued several times, and some are nearly a permanent part of the tax code. For example, the research and experimentation tax credit has been extended at least 15 times since 1981.

The set is dominated by a few costly provisions and many smaller ones – the top four tax breaks represent over half of the cost. If the entire set were extended for a year, they would cost about $40 billion, or about $85 billion if they were extended for two years. About three-fifths of the tax breaks go to businesses, with another fifth devoted to individuals and the last fifth promoting renewable energy and efficiency, a category that also mostly goes to businesses.

Chart 2: Making Tax Extenders Permanent is Incredibly Expensive

As expensive as these tax breaks are, they would be much pricier if enacted permanently instead of one year at a time: the cost jumps from $85 billion to over $700 billion. This dramatic jump is due to several expensing provisions which become much costlier when made permanent – they encourage businesses to take deductions now instead of taking them later, which reduces federal revenue in the years it is in effect but increases revenue after they expire. One provision, bonus depreciation, was enacted as temporary stimulus to spur business investment in 2008 and is responsible for almost one-third of the total cost of the package. That provision jumps from a $3 billion cost if enacted for two years to more than $240 billion if the provision is enacted permanently. In fact, the year-by-year extensions of bonus depreciation have already cost $220 billion since 2008.

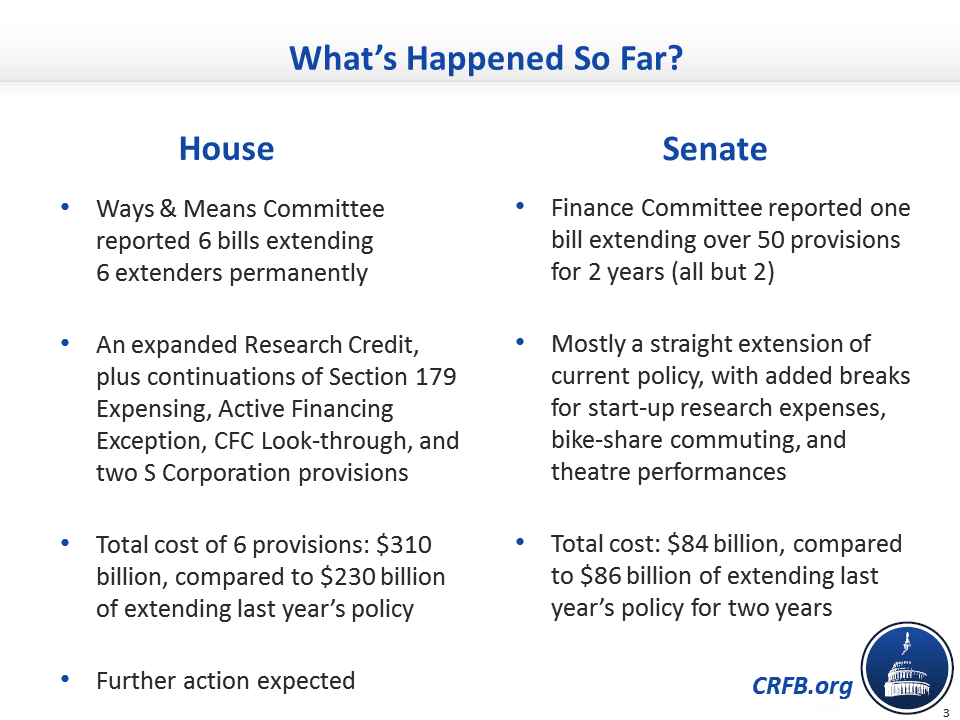

Chart 3 & 4: What's Happened So Far?

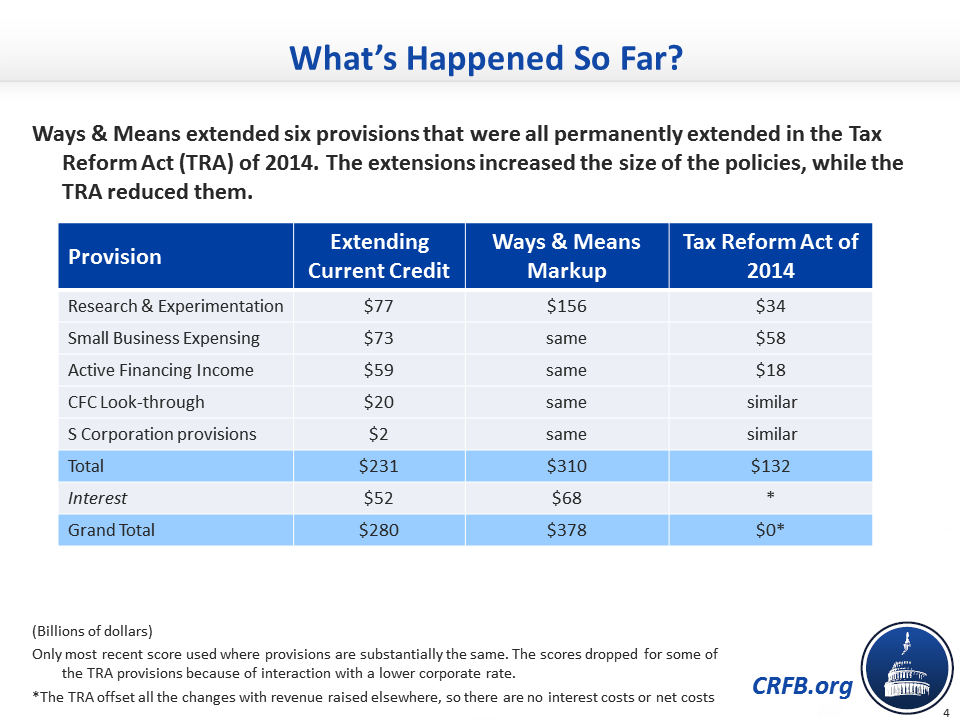

The tax extenders were allowed to expire last year, partially because both tax writing committees were drafting proposals to comprehensively reform the tax code, including these expiring provisions. With tax reform efforts stalled, both sides of Congress are now taking different approaches to renew the provisions. The Senate Finance Committee has passed legislation that would extend nearly all of them for two years, while the House Ways & Means Committee has been more selective, proposing to permanently extend certain provisions and let others expire. So far, they have passed legislation which would extend six of the provisions, but they will likely consider more.

The Ways & Means Committee, led by Chairman Dave Camp (R-MI), passed legislation that would extend six provisions the Committee identified as particularly important to job creation, even expanding the research and experimentation credit to double its cost. The Committee is moving in the opposite direction of the discussion draft that Chairman Camp released in February (the Tax Reform Act of 2014), which would have still extended these six provisions and increased the research credit, but made other reforms to reduce the cost of the provsions.

Chart 5: Debt Worsens if Tax Breaks Are Not Paid For

Unfortunately, both the House and Senate would extend these tax breaks by adding to the debt, without proposing offsetting savings. If Congress extends these breaks without offsets, the tax cuts will cost $710 billion over ten years (or $880 billion with interest). Permanently extending the traditional extenders would increase the debt to nearly 78 percent, while also extending bonus depreciation would increase the debt to 79 percent of GDP by 2024. By contrast, debt would rise to 76 percent of GDP if Congress pays for all new changes.

Chart 6 & 7: House and Senate Bills Would Both Reduce Revenues Below Current Law Levels

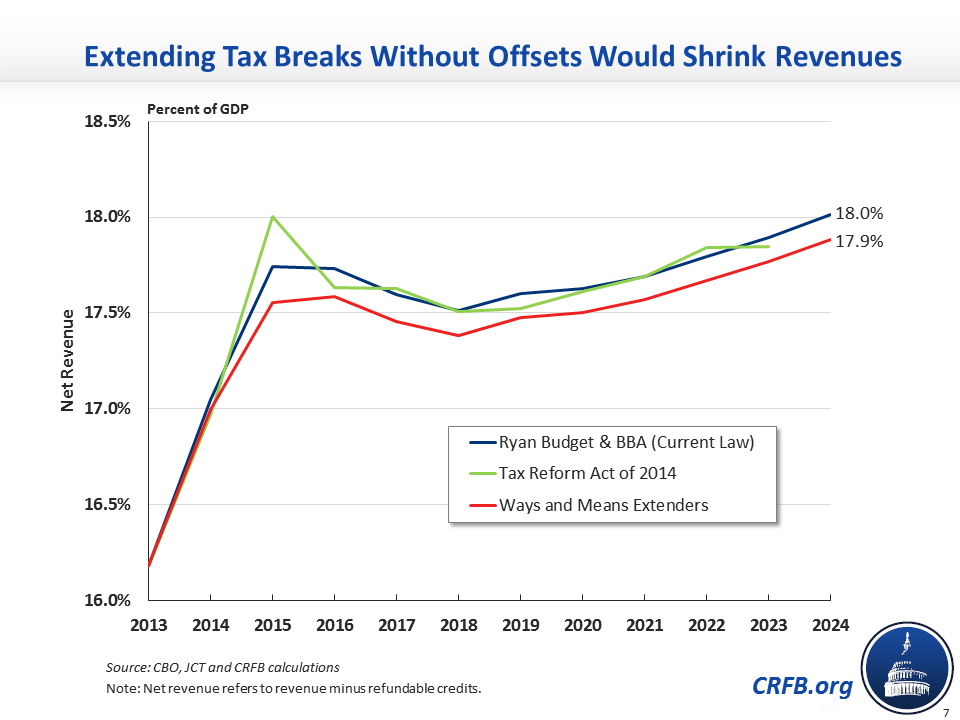

Many of the most recent deficit reduction negotiations have broken down over the question of new revenue, but the Ryan-Murray Bipartisan Budget Act called for revenues to continue at current law levels. However, this budget agreement would be violated by the bipartisan bill coming out of the Senate Finance Committee extending nearly all the provisions for two years and consequently, reducing revenues below current law levels. If the bill passed, revenues would decrease in the first few years and return to current law levels by the end of the decade. However, revenues would stay below current levels if Congress continued its recent trend of continuing these tax breaks year after year.

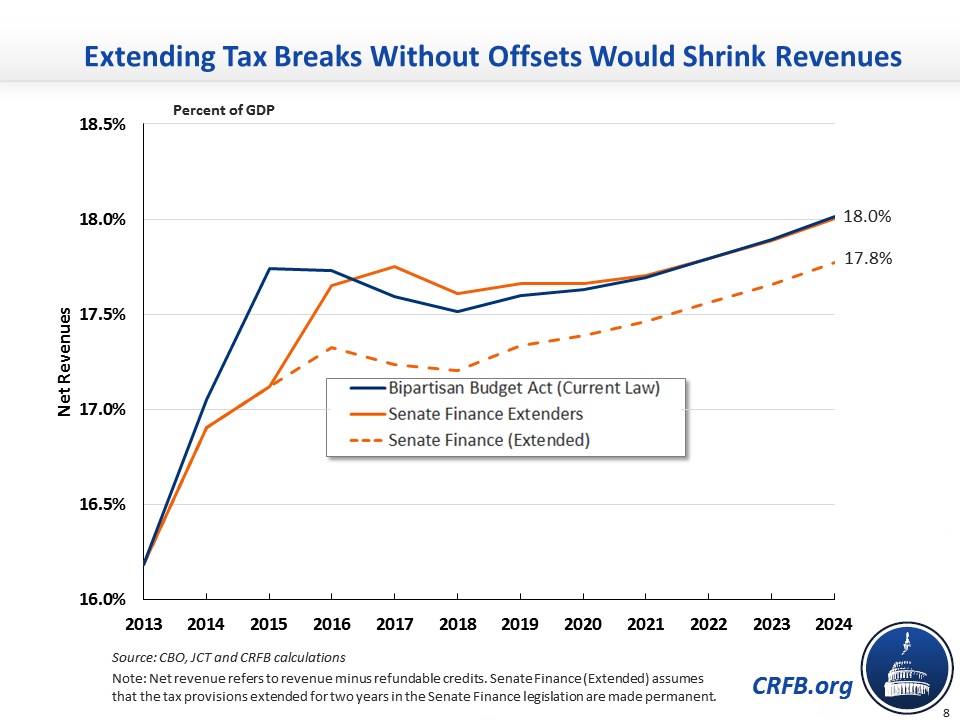

The bill proposed by the House Ways & Means Committee would similarly reduce revenues below the current law levels called for in Ryan-Murray and the House-passed budget. Although Camp's discussion draft to reform the tax code, the Tax Reform Act of 2014, would keep revenues at current-law levels, the bills passed by the Committee last week would permanently reduce them.

Chart 8: Extending the Tax Breaks Would Squander Fiscal Cliff Revenue

The fiscal cliff deal at the beginning of 2013 raised some revenue from the top 1 percent of earners by allowing some of the 2001/2003 tax cuts to expire, setting aside some revenue for deficit reduction and helping to reduce record-high deficits. However, if Congress extends these tax breaks, it will give away nearly all of this revenue, largely for business tax breaks. The 2013 extension of these tax breaks, along with a future bill that extended them all permanently, would cost almost $1 trillion, nearly exactly the same amount scheduled to be raised from high-earners between 2013 and 2024.

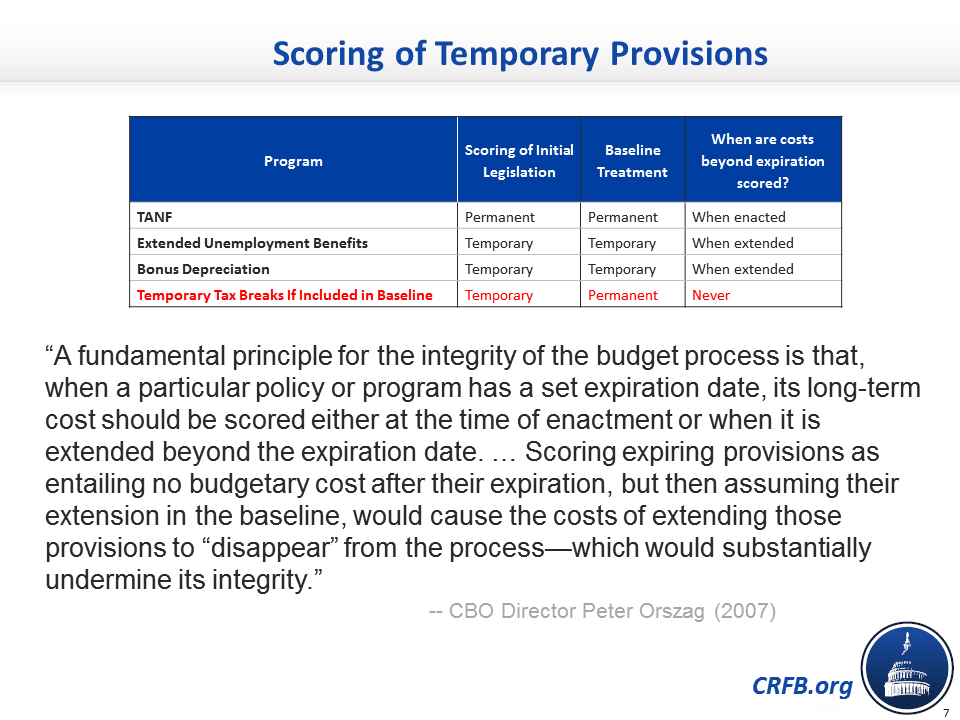

Chart 9: Extending Tax Breaks Without Offsets is Inconsistent with Budget Practice

Budget rules generally require the costs of a new program or tax provision to be considered either when it is first enacted or when it is extended. If the provision is scored as permanent, the entire cost of the program is considered when it is first enacted. If the provision is scored as temporary, the legislation will have a smaller initial cost but additional costs must be accounted for when the program is extended.

Many of the expiring tax provisions were initially enacted temporarily to limit their cost and therefore are not included in the baseline. Some critics of paying for the extenders would like to shift the budgetary treatment to avoid accounting for costs either time. They would first pass the provisions as temporary, then suddenly treat them as permanent to avoid accounting for the full cost of the provisions. This would create a huge loophole that would encourage more programs and provisions to be enacted temporarily to hide their true costs. (Read a more detailed explanation here).

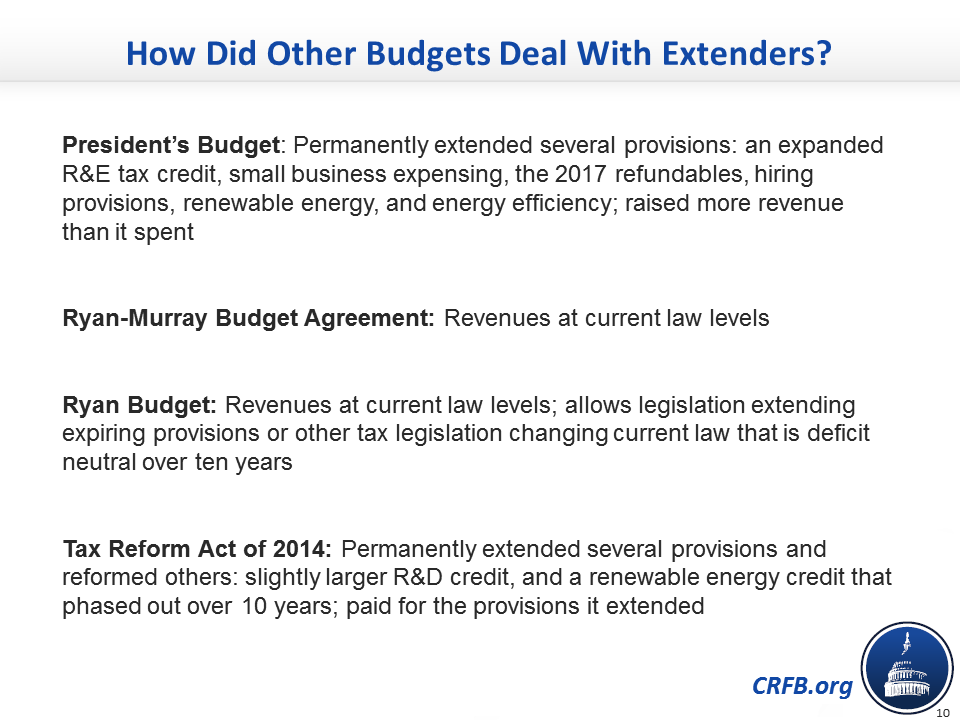

Chart 10: How Did Other Budgets Deal With Extenders?

Failing to pay for the tax extenders and reducing revenues below current law would run contrary to every budget plan published this year, which all called for revenues at current law levels or higher. The President's Budget extended some of the provisions but raised more than enough revenue to pay for the ones it continued. The Ryan-Murray Bipartisan Budget Act (serving as this year's functional budget) called for revenues at current law levels, as did the House Republican budget.

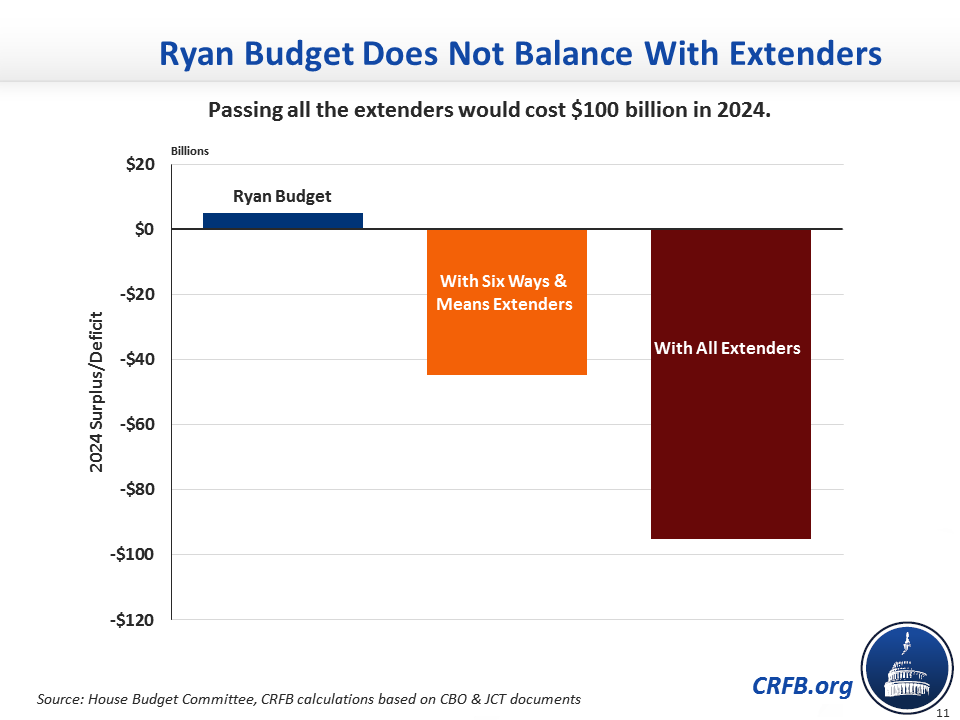

Chart 11: Ryan Budget Does Not Balance With Extenders

One of the main features of the House Republican budget proposed by Paul Ryan was a balanced budget within ten years, with a small surplus in 2024. However, by relying on current law levels of revenue, the Ryan budget implicitly called for extenders to either be allowed to expire or offset with other revenue. Extending all the extenders and failing to offset them would cost $100 billion in 2024 alone, causing the budget to fall short of its balanced budget goal.

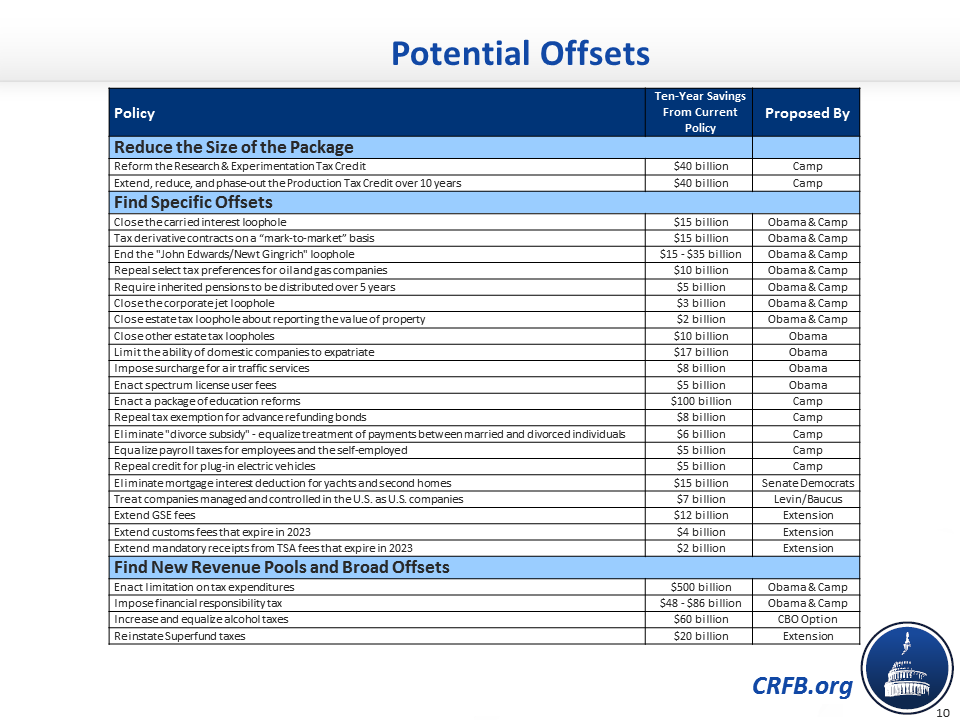

Chart 12: Congress Could Pay For the Extenders if they Wanted

Ideally, these tax provisions should be dealt with in a fiscally-responsible, comprehensive tax reform plan that evaluates each tax break and makes permanent the ones that are worth keeping. Short of that, however, any short- or long-term extension should abide by pay-as-you-go rules to offset the cost of any tax cuts with reduced spending or increased revenue elsewhere in the budget. If Congress wanted to find ways to pay for the extenders, there are many to consider. We compiled a sampling below (and another here) of revenue proposals largely drawn from the President's budget and Camp's Tax Reform Act of 2014. If a proposal was included in both documents, it starts with some bipartisan support.