Has the Deficit Been Cut in Half?

Last night, President Obama gave his State of the Union address to Congress, which mentioned fiscal policy on a several occasions. As one of the nation's accomplishments, he noted that "our deficits [have been] cut by more than half." This is not the first time the President has made reference to the recent decline in deficits. Throughout the summer, the President claimed that "our deficits are falling at the fastest rate in 60 years." These statements are factually accurate but missing important context.

Have deficits been cut in half?

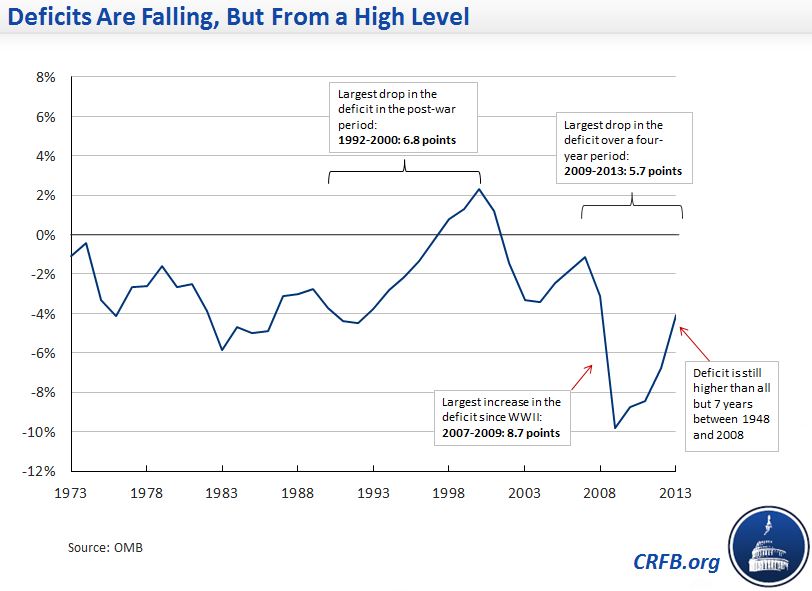

Depending on what year is chosen for comparison, this statement checks out. When measured in dollars, the $680 billion 2013 deficit is slightly less than half of the $1.4 trillion deficit recorded in 2009. When measured as a share of the economy, the deficit was 4.1 percent of GDP, compared to 9.8 percent of GDP in 2009. But the rest of the story is how high the deficit was in 2009: at 9.8 percent of GDP it was a larger figure than any year since 1945, the last year of World War II.

In fact, the deficit in 2009 was larger than any time since World War II, and was nearly twice as big as the previous post-war record of 5.9 percent of GDP, set in 1983. The high deficit levels were largely the result of the great recession – including depressed tax revenue, a surge in the cost automatic stabilizers, a drop in GDP, a large stimulus bill (the American Recovery and Reinvestment Act), the TARP program to rescue financial institutions, and the government takeover of Fannie Mae and Freddie Mac.

Though the 2013 deficit partially reflects concerted efforts to cut spending and raise revenue, it is largely the result of waning stimulus measures and continued economic recovery. While the deficit has been more than cut in half since 2009, this follows an increase in the deficit by a factor of eight between 2007 and 2009. This brings us to the 2nd claim:

Have deficits fallen faster than any other point in the last 60 years?

Obama states the decline of the deficit from 2009 to 2013, a four-year span. During that time, the deficit declined from 9.8 percent of GDP to 4.1 percent, a 5.7 point drop and the largest decline in the deficit over a four-year time period since immediately after World War II. It is not, however, the largest decline overall in the post-war era: a 4.5 percent deficit in 1992 became a 2.3 percent surplus by 2000, a 6.8 point swing over an eight-year period covering most of the Clinton Administration. And an even greater decline coincided with the World War II demobilization, when the budget balance swung from a 29.2 percent of GDP deficit to a 1.2 percent of GDP surplus. Obama's claim is factually accurate and fair given that his term started in 2009, but it is highly dependent on the period of time considered.

However, the improvement in the short-term budget outlook was also a reflection of just how bad of fiscal situation has been over the past few years. The largest decline in deficits in the post-war era follows the largest increase in deficits since that time: an 8.7 percentage point jump between 2007 and 2009. This jump is nearly double the previous post-war record, when the deficit increased to 3.3 percent of GDP in 2003 from a 1.2 percent surplus in 2001—a 4.5 point increase. Because deficits skyrocketed during the financial crisis due to a faltering economy and stimulus policies, the deficit in 2013 of 4.1 percent of GDP is still high by historical standards - larger than all but 7 years between 1947 and 2008.

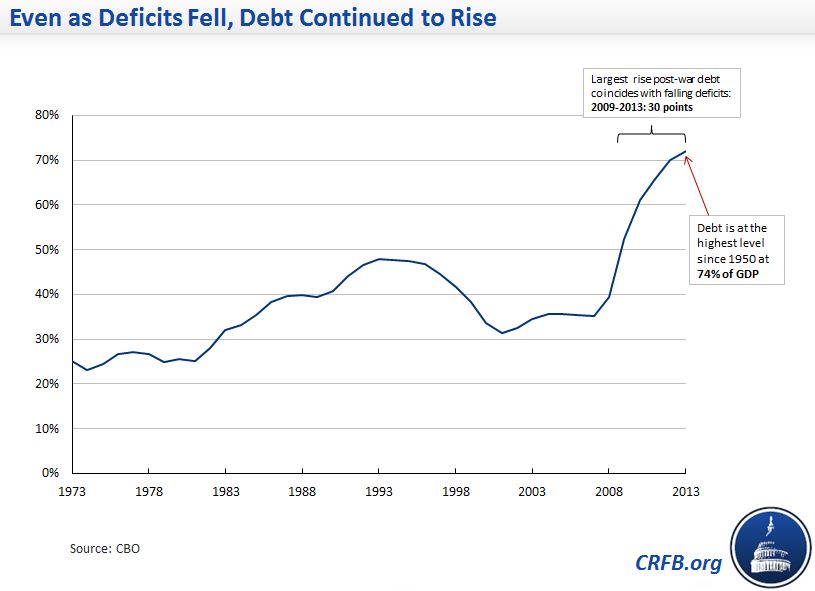

Furthermore, the focus on deficits may distract from another concern—our high levels of debt. Since 2007, the national debt has doubled to 72 percent of GDP, nearly twice our historical average and the highest it has ever been since the aftermath of World War II. Although deficits continue to come down, debt levels have continued to rise as a share of the economy.

On a positive note, the debt is projected to briefly reverse course after 2014, and modest declines in the debt-to-GDP ratio are expected through 2018 or so. However, with the long-term drivers of population aging and health care cost growth still unaddressed, debt will begin to rise thereafter and will soon grow to unsustainable levels.

*****

The President and Congress have enacted significant savings over the past few years. Those efforts, in combination with a recovering economy, have led to a significant decline in deficits over the past four years. But our long-term problems are still far from solved and the longer we wait to begin addressing our fiscal challenge, the harder it will become. Lawmakers today face a greater challenge—both starting with a far greater debt burden and needing to deal with demographic and health care cost drivers. We can both promote economic growth and get our fiscal house in order and the President should make both a priority in 2014.

Note: This blog has been updated on 1/30/2014 to correct a date.