How Ryan Gets to Balance

With the medium-term economic and budget outlook weaker than last year, House Budget Chairman Paul Ryan's (R-WI) goal of reaching a balanced budget by the end of the decade has become much more difficult. Despite this, Ryan's FY2015 budget does achieve balance in 2024, just as last year's budget did in 2023. It does so through a combination of faster phase-ins, lower war spending, larger discretionary spending cuts, and the assumption of a “fiscal dividend.” Below, we explain these changes in more detail.

Adjusted to remove one-time Hurricane Sandy relief funding, CBO’s baseline last year projected $5.9 trillion in deficits from 2014 to 2023, and over $800 billion in 2023 alone. This year, however, CBO projects $6.8 trillion over that same ten-year window ($7.2 trillion from 2015-2024), and about $975 billion in 2024. In other words, this year’s projection of 2024 deficits is about $150 billion higher than last year’s projections for 2023.

Source: CBO, CRFB calculations

Note: Extrapolated Hurricane Sandy relief spending is removed for February 2013 numbers

Although $150 billion is a large difference, it could have been worse. Luckily for Congressman Ryan, 2024 has a timing issue that makes that year's deficit appear to be $50 billion smaller: the beginning of the fiscal year falls on a weekend, so the year only includes 11 monthly payments (as opposed to 12) from mandatory programs that send out monthly payments. In addition, many policies save more money in 2024 than 2023 due simply to inflation, growth, and the passage of time.

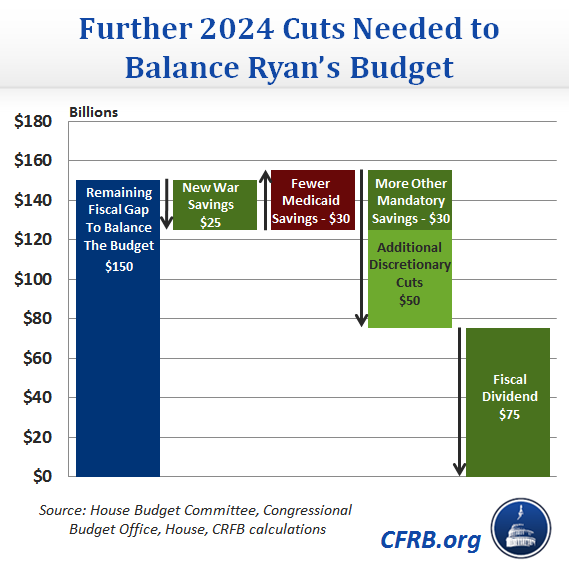

Nevertheless, the budget proposal must identify an additional $150 billion in the final year of the budget window, relative to last year’s budget, to balance the budget – and it does. That money comes mainly from three sources. First, the budget adopts President Obama’s assumption on war spending, which results in roughly $25 billion less spending in the final year than in last year's budget. Second, this year's budget assumes a “fiscal dividend” of growth-induced deficit reduction, based on CBO’s estimates of what lower deficit levels would do to the economy and debt. This generates about $75 billion of deficit reduction in 2024. Finally, the budget further reduces discretionary levels compared to last year’s budget. Including interest, this lower discretionary spending is responsible for about $50 billion of the difference in the last year of the budget window.

Other changes move in both directions. On the one hand, the budget saves less from the Medicaid program. On the other hand, it saves more in the other mandatory category. On the whole, fully half of the needed additional deficit reduction comes from the "fiscal dividend," and most of the remaining cuts come from the discretionary budget. We'll be writing more on both of these changes in the coming days.