The Fiscal Irresponsibility of the Tax Deal in 6 Charts

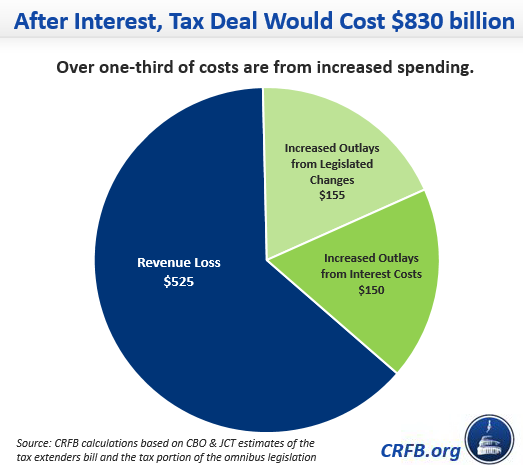

It's no surprise that a deficit-financed tax cut deal costing $830 billion after interest would be bad for the budget. We've been describing the emerging deal in various blogs over the last month, but below are the most important charts, updated for the actual numbers from the announced deal.

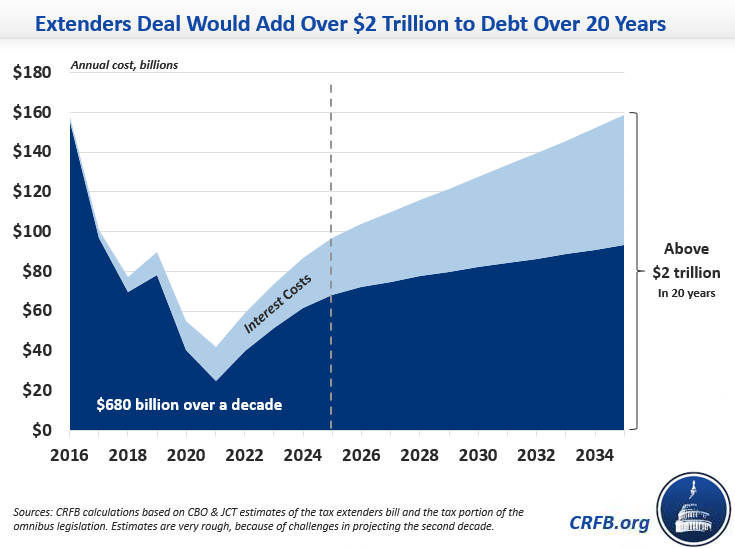

The Deal Would Add More Than $2 Trillion to the Debt Over 20 Years

The Joint Committee on Taxation has scored the deal as costing $680 billion over ten years, which would rise to $830 billion if interest costs are included. Although 20-year estimates are inherently uncertain and imprecise, we estimate that the costs grow over time to exceed $2 trillion over 20 years.

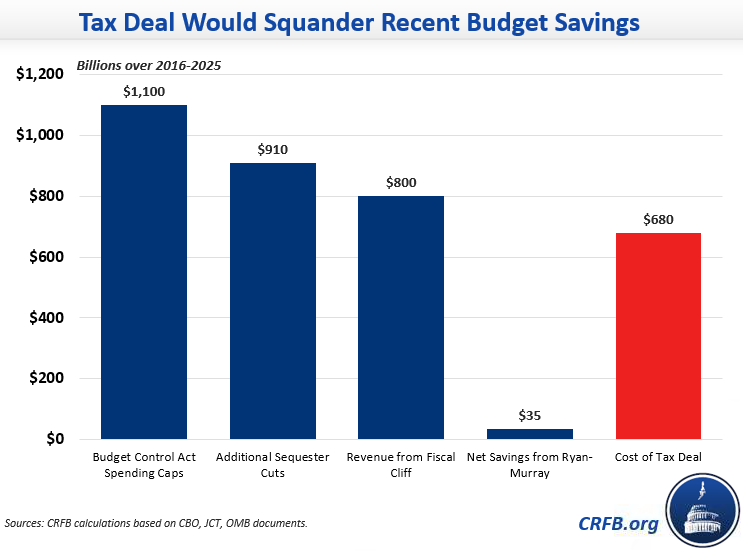

The Deal Squanders Recent Deficit Reduction

Although lawmakers have been adding to the debt repeatedly for the past few years, the $680 billion tax deal is easily the largest step backwards and is comparable in magnitude to the deficit reduction lawmakers enacted between 2011 and 2013. The deal easily swamps the net savings from the 2013 Ryan-Murray agreement, almost equals the revenue raised in the fiscal cliff agreement, amounts to three-quarters of the sequester savings, and is more than two-thirds of the savings from the Budget Control Act spending caps.

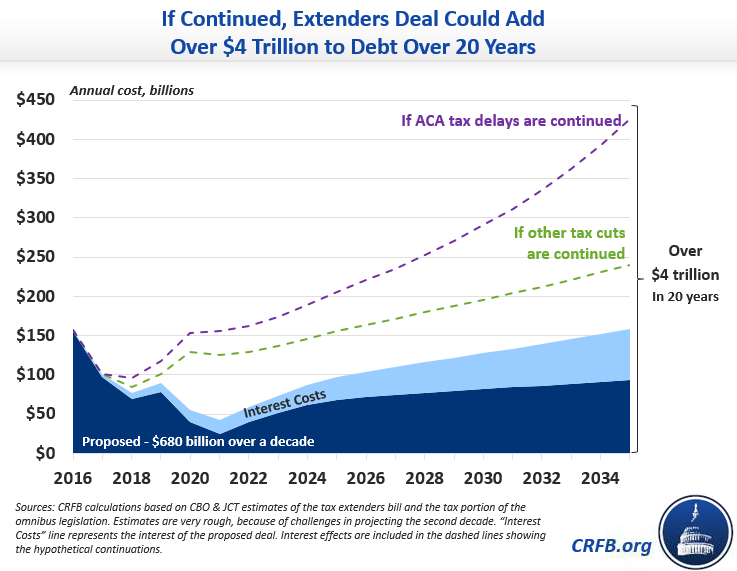

The Deal Could End Up Costing Far More

Although the tax package makes many provisions permanent, several other tax extenders only get two- or five-year extensions, and the delays in the Affordable Care Act taxes are only for one or two years. If these policies were made permanent, the package would end up costing well over $4 trillion over 20 years, twice as much as the current deal.

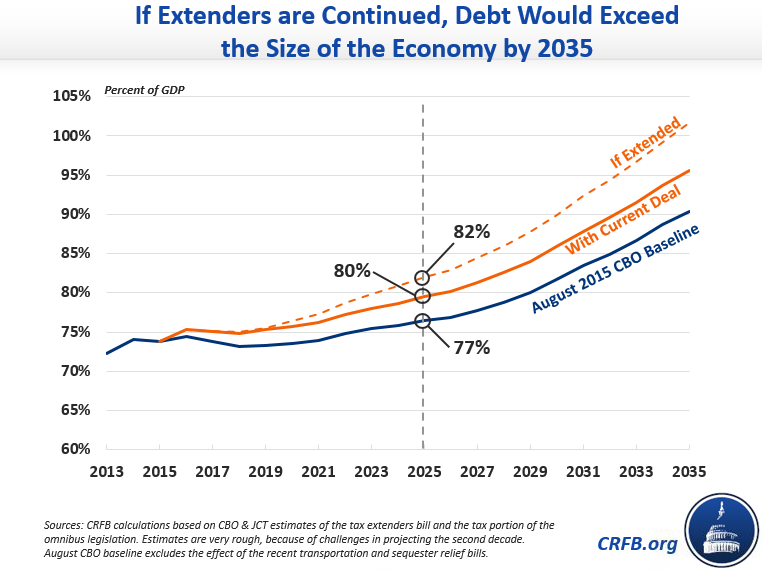

The Deal Could Push Debt to over 100 Percent of GDP by 2035

Debt is already projected to reach about 90 percent of Gross Domestic Product (GDP) by 2035. If the tax package is enacted, debt would increase to about 96 percent by that year. If the temporary tax and health policies in the deal are continued, debt would exceed 100 percent in that year, about five years sooner than under current law projections.

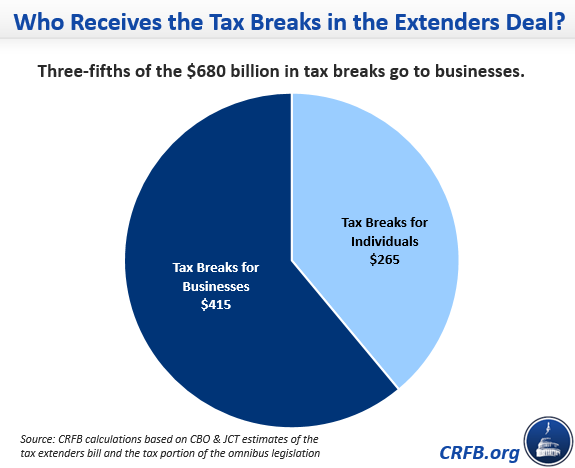

Package Contains Business and Individual Tax Breaks

The tax deal includes a wide variety of tax breaks and three-fifths of them are for businesses. The largest business tax breaks include the Research & Experimentation (R&E) tax credit, small business expensing, and the active financing income exception that allows multinational corporation to defer tax. The largest individual tax breaks include several expansions for refundable tax credits and the state and local sales tax deduction.

The Deal Both Lowers Revenue and Increases Spending

Although it is considered a tax deal, the package also increases spending. Of the $830 billion cost of the deal (including interest), about $525 billion comes from revenue losses and the rest comes from increased spending on interest and refundable credits to low-income individuals with no tax liability.

Also Read

- Negotiated Tax Deal Would Cost $680 Billion, with a detailed breakdown of the provisions in the bill.

Similar Blogs Written About a Hypothetical $700 Billion Deal (numbers differ slightly):

- Emerging Tax Deal Could Add $2.3 Trillion in Debt by 2035

- Tax Extenders Deal Might End Up Adding $4 Trillion to the Debt

- Are Tax Extenders Worth The Cost?

- Who Gets What in the Tax Extenders Deal?

- Seven Reasons to Pay for Tax Extenders