Who Gets What in the Tax Extenders Deal?

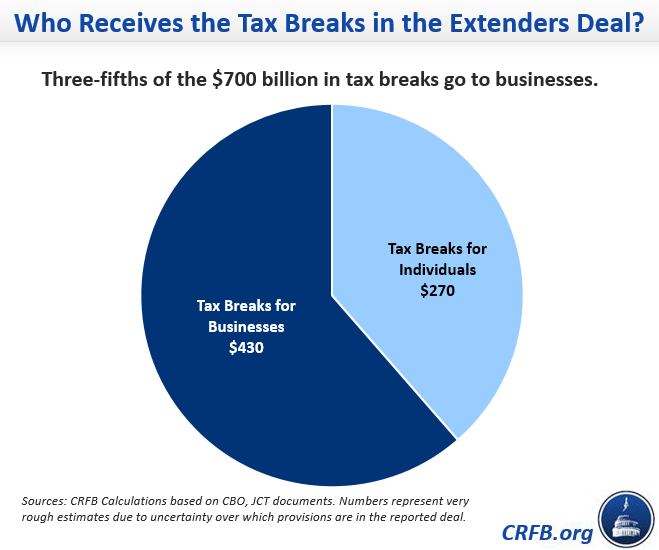

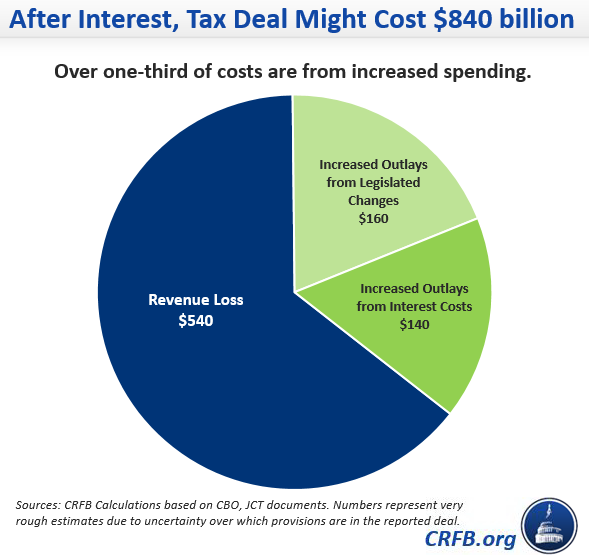

Congress is still considering a potential fiscally irresponsible deal to extend the 50-some tax breaks that expired at the end of the year, known as tax extenders. Although negotiations continue, press reports suggest an outline of an emerging deal that will cost around $700 billion, or $840 billion once interest costs are included.

Using those press reports, we have attempted to sketch our best understanding of the deal, which seems to build on House legislation passed earlier this year to permanently continue and expand various costly tax breaks. Paired with those tax breaks are extensions of tax credit expansions scheduled to expire at the end of 2017 and delays of some Affordable Care Act taxes.

If press reports reflect the actual deal, we estimate approximately three-fifths of the package will go to businesses, mostly due to an expanded research credit, provisions allowing businesses to deduct expenses more quickly, and two tax breaks for multinational corporations. The remainder would go to individuals, largely from continuing stimulus-era tax credits that expire in 2017.

Even though the deal largely extends expired tax breaks, it also contains some new and expanded policies, as we described in Tax Deal Goes Beyond Simple Extensions. And while most costs are due to tax revenue loss, the deal also contains increased spending. Outlays include the continuation of renewable tax credits that provide payments to low-income families with no tax liability, increased interest payments as a result of the deficit-financed tax bill, and payments to insurers in the health exchanges who insure higher-cost patients.

These numbers are all approximate, because they are based on our best understanding of the deal from press reports. However, as negotiations continue, the size of the deal is fluctuating between $500 and $800 billion (paywall), so there is a lot of room for these numbers to change.

Further Reading:

- Emerging Tax Deal Could Add $2.3 Trillion in Debt by 2035

- Tax Deal Goes Beyond Simple Extensions

- Seven Reasons to Pay for Tax Extenders