Emerging Tax Deal Could Add $2.3 Trillion in Debt by 2035

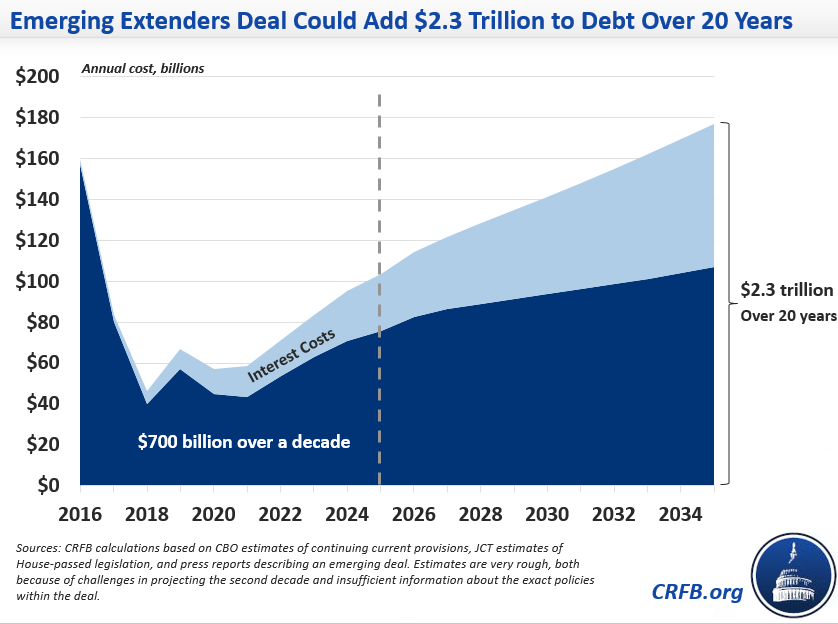

A fiscally irresponsible bipartisan deal is emerging to re-instate, make permanent, and in some cases expand many expired tax breaks known as tax extenders. According to several press reports (behind paywall), the deal could cost $700 billion over a decade. When interest is included, the emerging tax extenders deal could add nearly $850 billion to the debt this decade and $2.3 trillion by 2035.

Although details are scarce and negotiations ongoing, we have attempted to itemize our best understanding of the emerging deal. The deal would likely build on House legislation passed earlier this year to permanently continue various costly tax breaks and significantly expand one of the most expensive ones – the research and experimentation (R&E) credit. These tax breaks, which go largely to businesses, would be paired with the extension of low-income tax credit expansions scheduled to expire at the end of 2017. The deal would also reportedly include a two-year delay of the "Cadillac tax" on high-cost health insurance plans and the medical device tax.

By our estimate, this deal could increase the debt in 2025 by about $840 billion, bringing debt to GDP to 80 percent – 3 percentage points higher than currently projected.

| Policy | Ten-Year Cost |

| Extend and Expand Research Credit* | $180 billion |

| Extend Refundable Tax Credits^ | $195 billion |

| Extend Provisions for Multinational Corporations: Active Financing Exception and CFC Look-through | $100 billion |

| Extend Section 179 Small Business Expensing | $70 billion |

| Extend State & Local Sales Tax Deduction | $40 billion |

| Delay Medical Device Tax and Health Insurance Cadillac Tax for Two Years | $15 billion |

| Other Provisions | $100 billion |

| Subtotal | ~$700 billion |

| Interest Costs | ~$140 billion |

| Grand Total | ~$840 billion |

All of these numbers represent very rough estimates due to uncertainty over which provisions are in the reported deal.

Estimates based on Congressional Budget Office and Joint Committee on Taxation projections.

*Press reports aren’t clear whether the deal includes the $70 billion House expansion, but it is assumed here.

^We assume the extension of all expiring refundable credits, though press reports only definitively include two of the three: the Earned Income Tax Credit and Child Tax Credit expansions, excluding the American Opportunity Tax Credit

The costs would unfortunately continue to mount over the second decade. Our rough extrapolations suggest the emerging deal could add $2.3 trillion to the debt by 2035, a 6 percent of GDP increase.

These tax breaks do not need to be deficit-financed, but lawmakers are not willing to do the work to find offsets. As one example, we released an updated version of the PREP Plan this week, showing how lawmakers could offset two years of these tax breaks by increasing tax compliance and reducing loopholes used to avoid taxes.

Further, this emerging deal shows the dangers of abandoning budget discipline. Once negotiators decided offsets were unnecessary, it became easier to expand the legislation's costs. And costs could rise even higher if this change opens the door to more expensive ones down the road. For instance, if the two-year delay of the Cadillac and medical device taxes is a sign of a full repeal that will later be enacted, total debt will increase by more than $3 trillion by 2035.

As CRFB President Maya MacGuineas said recently in a statement,

Bipartisanship shouldn’t mean deficit-financing both parties’ priorities; it means working together to develop solutions that benefit all Americans. Congress should not close the year by rushing through budget-busting legislation that increases the debt burden on future generations.