Tax Extenders Deal Might End Up Adding $4 Trillion to the Debt

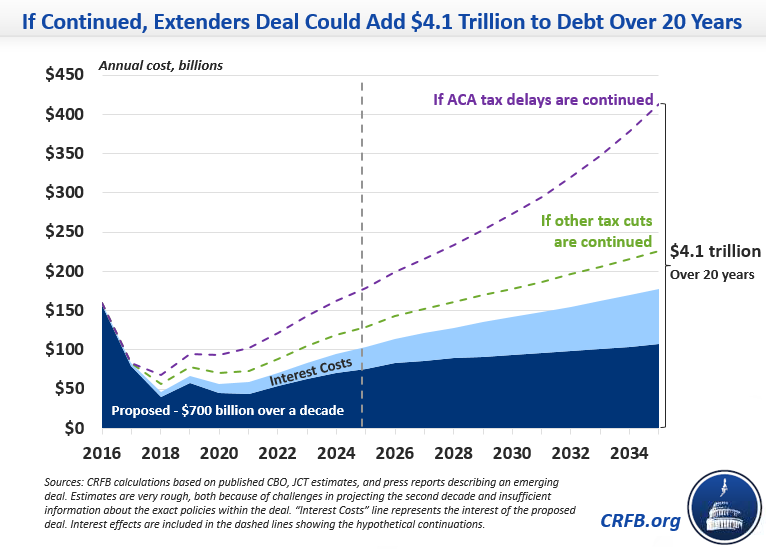

The $700 billion price tag on the rumored deal to permanently extend expired tax breaks might actually be underselling just how expensive the package could end up being. If some of the delays in the deal beget permanent tax cuts (as at least many members of Congress intend), the price tag would grow substantially.

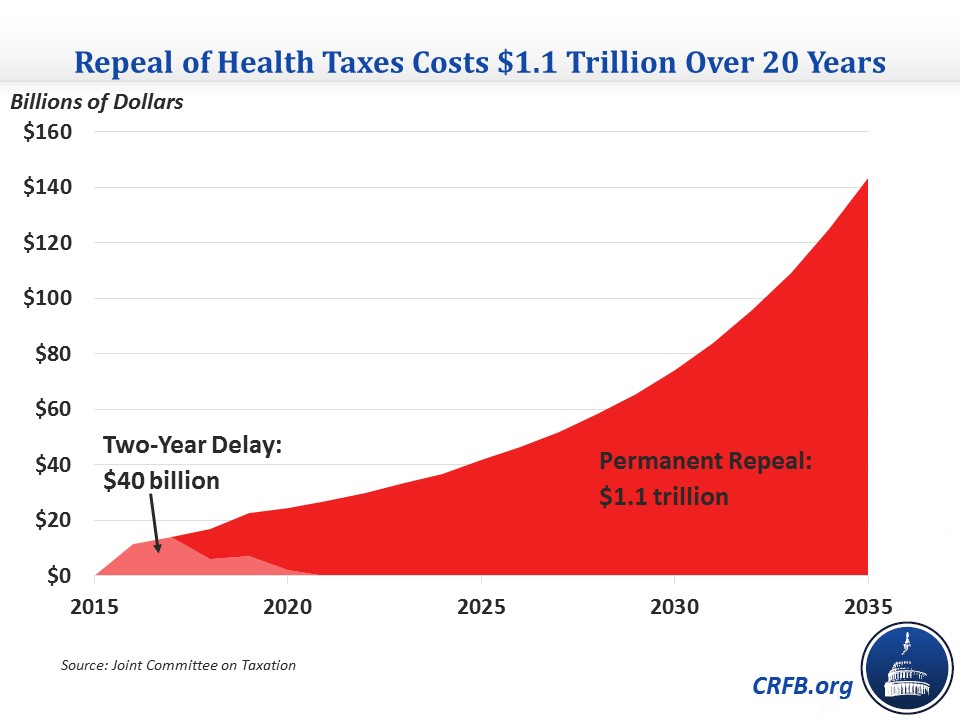

The reported package would delay three separate Affordable Care Act (ACA) taxes for two years, including one of the law's most important cost-control mechanisms. Although the two-year delays don't cost very much money on paper now, the cost of continuing to delay or completely repealing these taxes could climb over $1 trillion over the next 20 years. In a "fiscal worst case scenario," where the remaining tax extender provisions that expired after two years were also continued, the ultimate 20-year cost of this deal could be $4.1 trillion.

The three health-related delays currently rumored in the deal are the Cadillac tax, medical device tax, and the health insurer excise tax. Although our estimates are very rough and simply based on press reports about what is being considered, the two-year delays of each revenue source would cost about $40 billion over ten years. But if those delays become permanent, they would cost about $250 billion over ten years and $1.1 trillion over 20 years.

In addition, as our own Loren Adler has pointed out, rolling back these revenue sources, particularly the Cadillac tax, would undermine the Affordable Care Act on fiscal and health policy grounds. Repealing them would take away funding sources used to finance the coverage expansions that would remain in place. Repealing the Cadillac tax would also harm cost-control efforts and dampen wage growth.

Previously, we showed how the $700 billion extenders deal would cost $2.3 trillion over the next two decades. That deal, however, allows most of the tax provisions to expire after two years and only delays the ACA taxes for two years. If those delays and temporary extensions are continued, the total cost of the bill might climb to $4.1 trillion over the next 20 years.

This year-end legislative rush could turn out to be very costly for the budget and harmful to the progress that has been made in slowing the growth of health care spending.

Further Reading:

- Emerging Tax Deal Could Add $2.3 Trillion in Debt by 2035

- Tax Extenders Deal Could Undermine the ACA

- Tax Deal Goes Beyond Simple Extensions

- Seven Reasons to Pay for Tax Extenders

- Who Gets What In the Tax Extenders Deal?