Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

What Works and What Doesn't for Deficit Reduction

The IMF's most recent World Economic Outlook has a very helpful chapter looking at six case studies on countries who have dealt with a high debt...

Taxpayers for Common Sense's $2 Trillion Plan to Avoid the Sequester

Yesterday the group Taxpayers for Common Sense released a report with over $2 trillion in deficit reduction. The report, "Sliding Past the Sequester,"...

Event Recap: The Imperative of Entitlement Reform and Health Care Cost Control

In the fourth and final event in the series Strengthening of America, "The Imperative of Entitlement and Health Care Cost Growth," former Members of...

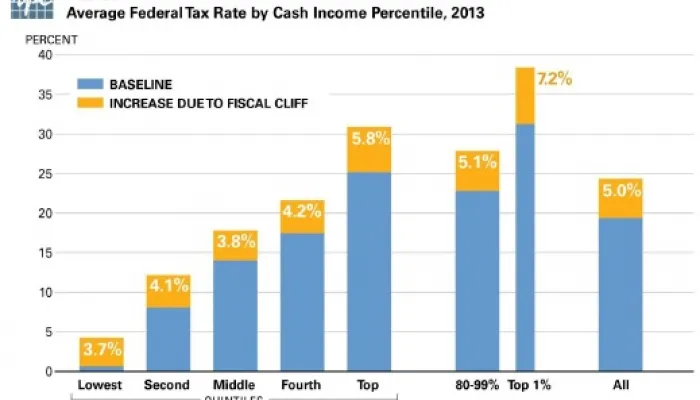

How the Fiscal Cliff Will Affect Taxpayers

UPDATE: Tax Policy Center also has a video in which TPC director Donald Marron walks through their findings. It is no secret that the fiscal cliff...

Feldstein: Capping Tax Expenditures Is the Way to Raise Revenue

In a Project Syndicate piece, former Chairman of President Reagan's Council of Economic Advisors Martin Feldstein reminds us about another idea to...

Happy Fiscal New Year!

Today, October 1, marks the first day of FY 2013, with FY 2012 now in the history books. Over the past year we have seen some setbacks, like the...

Going Beyond Tax Expenditures

When we talk about tax reform which lowers the rate and broadens the base, the base-broadening portion of the equation usally focuses on tax...

Third Way: Both Revenue Increases and Spending Cuts Are Needed

Two new Third Way papers by David Brown, Gabe Horwitz, David Kendall together present an arguement that we have been making for a while now—that the...

Millennials Weigh in on Simpson-Bowles

Fix the Debt co-founders and Fiscal Commission co-chairs Al Simpson and Erskine Bowles have been busy traveling around the country speaking with...

Event Recap: The Challenge of Pro-Growth Tax Reform

Today, the third forum of the "Strengthening of America—Our Children's Future" series was held in New York City on " The Challenges of Pro-Growth Tax...

CRS: Carbon Tax Would Take a Chunk Out of the Deficit

Efforts to curb greenhouse gas emissions have fallen out of favor since the attempted passage of a cap-and-trade program in 2009 and 2010. Still, the...

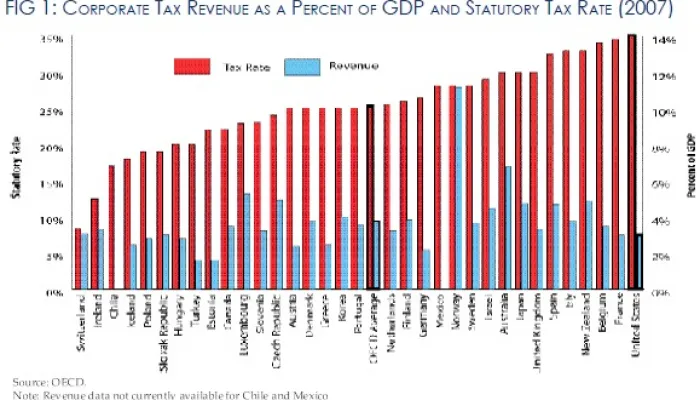

How Does Our Corporate Code Compare to Other Countries?

In our newest paper, " Reforming the Corporate Tax Code," CRFB makes the case for why the U.S. needs to reform the corporate tax code, discussing its...