Third Way: Both Revenue Increases and Spending Cuts Are Needed

Two new Third Way papers by David Brown, Gabe Horwitz, David Kendall together present an arguement that we have been making for a while now—that the only way to fix our deficit is with a plan that looks at both revenue increases and spending cuts. Third Way explores both relying on a revenue-only approach (specifically taxing the rich), and then a spending only approach, with the results being not so good.

The first paper "Neccessary but Not Sufficient: Why Taxing the Wealthy Can't Fix the Deficit" explores three different tax scenarios and the effect on the deficit.

- The first scenario assumes the 2001/2003/2010 tax cuts expire for the top two tax brackets (along with cuts in capital gains and dividends rates), the Buffet Rule is passed, itemized deductions and exclusions are limited for upper-income taxpayers, and the estate tax reverts to 2009 levels—but even with these tax increases the national debt would still double by 2035.

- The second scenario assumes all the changes above and raise marginal rates for the top bracket and capital gains rate by 15 percentage points, resulting in 50 and 39 percent top rates, respectively. Also, the next two brackets (the 33 and 36 percent brackets) are raised by 5 percentage points and the Social Security payroll tax cap is increased from $110,100 to $170,000.

- The third scenario raises income tax rates by 5 percentage points across the board, raises the Medicare payroll tax rate by one percentage point, raises capital gains rates by 10 percentage points, and enacts a 10 percent value-added tax (VAT).

As the graph below shows, neither of the first two scenarios are able to halt the rise in debt. In the third scenario, debt would be stabilized, but the median family's after-tax income would go down by 8 percent compared to current policy due to the tax changes.

Just as a Tax Policy Center paper earlier this year showed, there are clear limits to taxing the rich, so spending will have to be addressed or taxes will have to be raised on the non-rich.

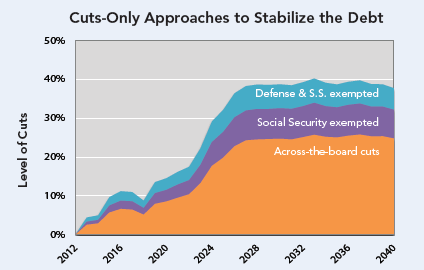

In "Death by a Thousand Cuts: Why Spending Cuts Alone Won't Fix the Deficit," the authors explore the alternative approach of trying to eliminate the deficit with only spending cuts. An across-the-board cuts approach to spending would require cuts as high as 25%, and as the graph below shows, when lawmakers beging to protect some programs the level of cuts are even higher. The real key cost driver is health care: if policymakers are able to contain health care costs, the solution becomes a bit easier but the paper, along with similiar findings from the Center for American Progress, shows that trying to tackle the deficit without any increase in revenue would be very difficult.

Both parties will have to give up something in a debt deal, whether its Republicans with more revenue or Democrats with entitlement reforms. This is not only to ensure that a bill will receive the needed bipartisan support but also due to the fact that our fiscal issues are so large, it is unreasonable to think a solution can come from only one side of the ledger. Through a comprehensive plan, we can minimize the burden for either side, whether it is using base broadening to raise more revenue or making sure changes to entitlement programs protect the most vulnerable. Policymakers will need to put everything on the table and think creatively if we are going to be able to come up with a solution.