Blog

Welcome to our blog – The Bottom Line, where you’ll find up-to-date commentary and analysis on the most important news in the fiscal world. Below is a list of our blog posts.

Fact Checking The Debates: Round III

Tonight at 9 PM on the grounds of Hofstra University is the second presidential debate and the only debate with a town hall format. This will allow...

MY VIEW: Tim Penny October 2012

Former Congressman and CRFB Board Member Tim Penny (D-MN) writes in today's The Hill that even with both parties laying out different plans this...

Changes to Income-Based Repayment for Student Loans: "Safety Net or Windfall?"

Our colleagues Jason Delisle and Alex Holt of the New America Foundation's Federal Education Budget Project have released a new paper "Safety Net or...

Social Security Adjustments Announced Today

With the release of September inflation numbers from the Bureau of Labor Statistics, the Social Security Administration also announced its cost-of...

Blahous: "The End of Social Security Self-Financing"

The Mercatus Center has released a new paper by Social Security Trustee Charles Blahous entitled "The End of Social Security Self-Financing." In the...

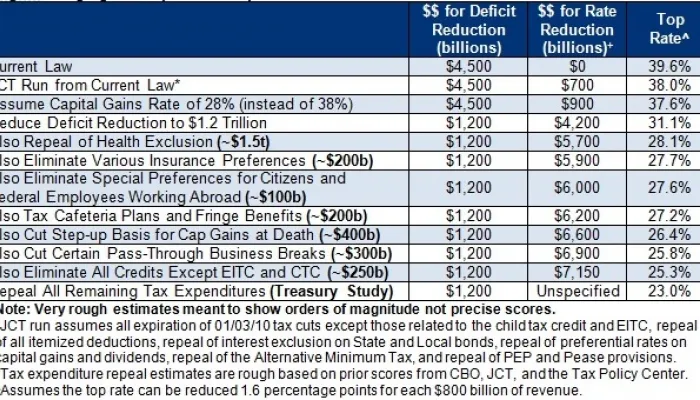

New CRFB Paper Shows Tax Reform Can Reduce Rates and Deficits

Today, CRFB released a paper on individual income tax reform, showing how comprehensive reforms could lower both deficits and tax rates. The paper...

Expanding on Our Live Fact-Checking

After live fact-checking the vice presidential debate on Twitter, we will take some time to go back and expand on some of our fact-checking and...

JCT Report Does Not Conflict With Rate-Reducing Tax Reform

Today, a report from the Joint Committee on Taxation was released that some claim to show the near-impossibility of deficit-reducing, rate-reducing...

Fact Checking the Debates: Round 2

Vice President Joe Biden and Representive Paul Ryan (R-WI) will take the stage in Kentucky tonight at 9:00 PM E.T. in the Vice Presidential Debate. In...

AIG Drives TARP Estimate Lower

The CBO has released its newest estimate of the Troubled Asset Relief Program (TARP), showing that it would cost taxpayers a total of $24 billion...

Fiscal Background for Tonight's Debate

Tonight at 9 PM in Kentucky will be the first and only vice presidential debate between Vice President Joe Biden and candidate Paul Ryan. If this...

Reducing Both Tax Rates and the Deficit Is Possible

Over the past few years, bipartisan agreement has begun to form around approaches to tax reform that take a broad approach to reducing or eliminating...